More banks are taking the "if you can't beat them, join them" approach to buy now, pay later.

Banks of all sizes are turning to a new cottage industry of financial technology software providers who build BNPL platforms for bank clients. The effort gives banks a shot to take market share in the space from the fintech giants like Square Inc. and PayPal Holdings Inc. that are spending billions of dollars in M&A to acquire BNPL lenders.

Such outsourcing helps banks accelerate the technology development and bring BNPL products to the market faster. The speed to make BNPL products available is especially key in the current marketplace, as fintech BNPL specialists such as Affirm Holdings Inc. are rapidly expanding their product suites into more financial services arenas. Meanwhile, merchants have shown strong interest in deploying this point-of-sale financing product, which allows consumers to split the purchase price at checkout, typically into four equal payments over a period of weeks or months.

Midwest regional First National Bank of Omaha is one such bank offering installment financing at the point of sale. The bank began "getting very serious" about developing BNPL products about a year ago and will go live with its first merchant, sporting goods store Scheels, in October, said Jerry O'Flanagan, executive vice president of the bank's partner customer segment. It developed the financing product in six months in tandem with digital transformation company EXL and fintech vendor Skeps.

"I felt a sense of urgency that we needed to bring a product into the marketplace quickly, and it really would have been difficult to do if we relied solely on our internal capacity," O'Flanagan said in an interview.

First National Bank of Omaha wanted to make the loans itself and control the customer experience from start to finish, to avoid potential reputational and financial risk, O'Flanagan said. In the past, banks have functioned as partners for the fintech BNPL lenders such as Affirm, Klarna Holding AB (publ) and Afterpay Ltd. by purchasing loans they make. That gives the banks a boost to their loan totals, while the BNPL firm manages the relationship with the merchant and builds rapport with consumers.

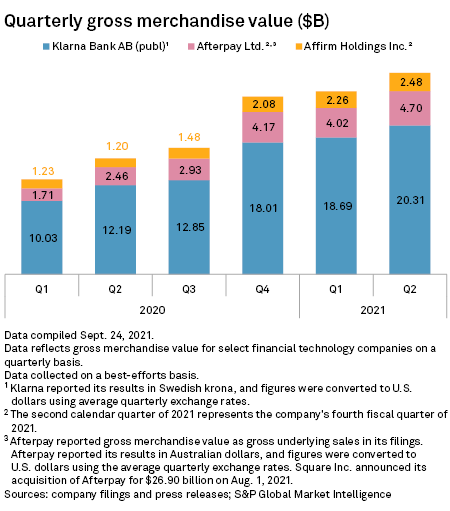

Major fintech BNPL lenders have seen rapid growth during the pandemic driven by the e-commerce boom and merchants' demand to engage with consumers in digital manners. Affirm, Klarna and Afterpay have all more than doubled the gross merchandise value over an 18-month period between January 2020 and June 2021, according to data compiled by S&P Global Market Intelligence. The fintech firms use gross merchandise value to measure the value of goods and services their loans have purchased.

As the industry collects more data and anecdotes, large credit card-issuing banks — including JPMorgan Chase & Co. and Capital One Financial Corp. — are coming around to the idea that BNPL can coexist with other consumer credit options and could be a complementary product line to grow loans, rather than a threat to their existing credit card offerings. Community banks that lack the scale to run credit card businesses of their own see BNPL as a viable way to build a consumer lending product and acquire new customers.

Big banks enter the ring

But even national-scale banks are turning to "BNPL-as-a-service" fintech firms. The Toronto-Dominion Bank went live with a BNPL deployment in May 2020 by working with Chicago-based banking software firm Amount Inc. In April, the U.S. consumer banking division of Barclays PLC said it selected Amount to launch a BNPL product and the fintech is close to announcing another large bank partner in October, Amount CEO Adam Hughes said in an interview.

While Amount also offers other retail banking solutions, half of its new sales leads are tied to BNPL, Hughes said. BNPL technology providers say they can launch the financing offering faster and cheaper than a bank's internal IT department. Big banks' existing software systems can grow unwieldy over time as the company acquires companies and adds products or apps developed in-house. Vendors offer a fully developed user interface and design already integrated with payment processing and loan underwriting, which lets the bank plug in the service and turn it on.

"The speed to market advantage is our biggest selling point, and again we view ourselves as significantly cheaper because of how flexible our platform is, versus the bank using their internal IT team to develop themselves," Hughes said.

"With these big corporations and banks, merchants, you have IT teams focusing on 10 different things. For us, we live and breathe buy now, pay later," said Neha Mittal, interim CEO of Divido Financial Services Ltd. The London-based BNPL technology provider serves large European lenders including Nordea Bank Abp and BNP Paribas SA. It secured a $30 million series B funding round in June from investors including HSBC Holdings PLC, as well as the corporate investment arms of American Express Co. and ING Groep NV.

In another example, Columbus, Ohio-based Jifiti.com Inc. helps plug a BNPL feature into Citizens Pay, the mobile payments app of Citizens Financial Group Inc.

BNPL risks

As banks lean in to BNPL adoption, they also raise their exposure to what is still a largely unregulated lending category.

The U.K. finance ministry said in February it would introduce rules to regulate BNPL loans, asking lenders to check consumers' ability to repay before offering credit. In the U.S., regulators including the Consumer Financial Protection Bureau and the Federal Reserve Bank of Atlanta have published blogs to inform the public of potential downsides such as late fees, but as the Atlanta Fed put it in March, "for those products with four or fewer payments, the product is largely unregulated."

FNBO expects that the credit risk of BNPL loans will be slightly higher than for credit cards, because many consumers using BNPL tend not to have established credit profiles. But the credit risk is projected to be manageable, O'Flanagan said. As the bank starts to originate loans and learn from the practice, "it becomes a management science in and of itself," he said.

Barclays, whose U.S. consumer bank is working with Amount, will apply the same standards and processes to manage both credit and regulatory risk, including credit checks, affordability checks and compliance with obligations of disclosure and fair treatment, a company spokesperson said.

"We're approaching it as a regulated bank with regulations and credit risk standards at the core of what we're going to offer," he said.

Fintech lenders have been willing to take the credit risk in making the loans, and the business model has not drawn major complaints in the U.S. from merchants or consumers, said Stanton Koppel, of counsel at Bryan Cave Leighton Paisner. Koppel has worked with merchants to form agreements with BNPL lenders.

"Regulation is always reactive in the sense that they're going to focus on things that are causing complaints," Koppel said.