Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jul, 2021

By Zach Fox and Tayyeba Irum

U.S. banks, mired in anemic loan growth, are finding new opportunities in Small Business Administration programs as they capitalize on systems put in place to support the pandemic Paycheck Protection Program.

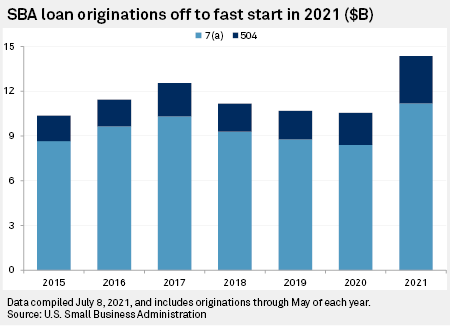

Through May, lenders have generated a 36% year-over-year increase in SBA 7(a) and 504 loans, two of the agency's most popular programs. The $14.34 billion in originations of the government-guaranteed loans is notably higher than any of the previous five years through the same period.

Third-party vendors of banking solutions said they see increase in SBA loans because borrowers have become more familiar with the agency due to pandemic support while banks are eager to cement relationships with small businesses that became clients via Paycheck Protection Program, or PPP. Lenders originated $1.08 trillion of PPP loans, including many deals that would have been otherwise too small for them to chase.

"The overall brand of SBA became more famous through this," said Rohit Arora, CEO of Biz2Credit, a lending platform that focuses on small businesses. "All of a sudden, the SBA loan programs have become very attractive."

From lenders' perspective, the PPP forced companies to develop technology capable of processing and originating small SBA loans. And with many banks reporting significant PPP demand among new clients, lenders are eager to retain the borrowers and develop full-fledged client relationships. At the same time, banks are reporting weak overall lending growth as PPP loans expire.

"PPP brought technology to SBA that hadn't been there and by leveraging that, we think there is opportunity," said Luke LaHaie, president and chief investment officer of ACAP GP, a nonbank servicer that has partnered with The Loan Source LLC to buy PPP loans.

As of June, Loan Source and ACAP had purchased $11.2 billion of PPP loans, and they utilize the Federal Reserve's PPP liquidity facility to fund the purchases. With that facility expiring at the end of July, ACAP is looking to reposition itself as a servicer of SBA loans.

LaHaie said the company has received interest from small community banks up to $30 billion-asset regional banks in the SBA's programs. LaHaie said there could be significant opportunity from small businesses seeking loans for less than $100,000. "That's always been an underserved or hard-to-serve market because for banks it takes as much time as underwriting larger loans," he said.

Other vendors are also reporting interest from banks looking to develop SBA programs, which include the 7(a) loans that offer government guaranteed financing for a wide variety of purposes and the longer-term 504 loans for major fixed assets such as real estate.

"I absolutely think there will be more community banks and nonbanks getting into SBA lending, a lot of whom never did it before," said Joe Ehrhardt, CEO of Teslar Software, which offers portfolio management systems to track banks' loans and deposits. Ehrhardt added that the PPP experience showed community banks the need to offer SBA lending to serve small businesses in their footprints.

Ehrhardt said the PPP program similarly made borrowers more aware of SBA programs, which can offer borrowers attractive interest rates for very small loans that might be difficult to secure without the government-backed guarantee.

That federal backstop is also encouraging participation among banks that may otherwise be reluctant to make loans in an uncertain economy, said Brian Geary, president of Linear Financial Technologies, which offers digital account origination technology.

"Banks' credit policies are opening back up, but they're not yet back to where they were prior to the pandemic," Geary said. He added that SBA loan volume should continue to increase in second half of the year as the economy recovers and more small businesses find themselves in need of additional funding.

ACAP's LaHaie and Teslar's Ehrhardt both said their ability to deliver a fully digital experience for banks looking to originate has been key to gaining ground in the SBA space. Many banks have reported that the COVID-19 pandemic encouraged their clients to use digital offerings since bank branches were shuttered in an effort to limit the pandemic's spread. Now, a fully digital experience has become the norm for clients looking for bank products.

Further, community banks have faced competition from both megabanks building national brands and a crop of fintech upstarts looking to gain deposit share through slick technological interfaces. The increased uptake of digital and the heightened level of competition has accelerated consolidation in the industry as community banks rush to gain scale to remain relevant.

"The future of lending for community banks is not just doing 'ABC,'" Ehrhardt said. "They have to offer an array of services. And some of that is government-guaranteed loans to help small business get off the ground, and PPP is what showed them the light."