Commercial real estate lenders are broadly confident they are prepared for the fall out from higher interest rates, having built up loss cushions in anticipation of borrowers struggling to service increasingly expensive debt.

Concerns about future defaults center on office buildings, which have been affected by home working trends. Some banks moved their loss coverage ratios for office loans into the high-single-digit percentages. PNC Financial Services Group Inc., for example, said its 7.4% allowance means it is "reserved for whatever happens."

"Our goal is to be early on this and work with as many borrowers as we can," Truist Financial Corp. Chief Risk Officer Clarke Starnes said on an earnings call, "And hopefully, the market will improve and will have good success."

|

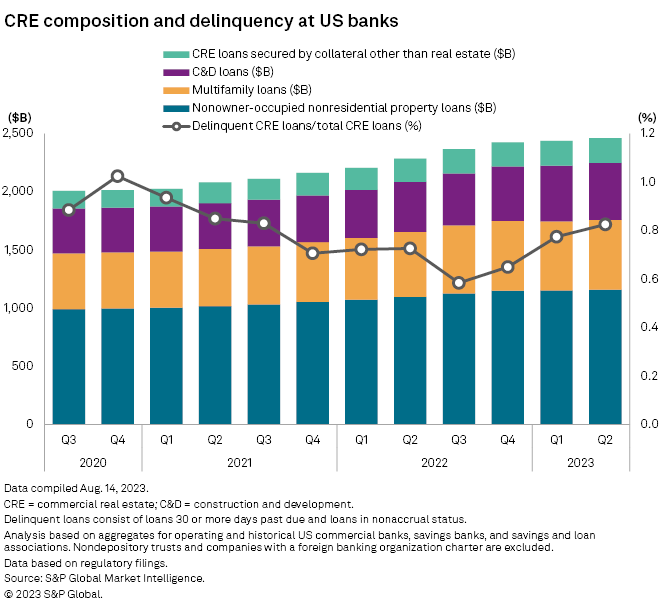

The ratio of overdue to total commercial real estate (CRE) loans among US banks increased a further 5 basis points sequentially to 82 basis points in the second quarter, S&P Global Market Intelligence data shows. This compares with a quarterly average of 57 basis points between 2017 and 2019, and a pandemic peak in the 2020 fourth quarter of 102 basis points.

Click here for a spreadsheet with data used in this article.

Lending slowdown

Tightening standards indicate banks' concerns over CRE.

While bank CRE loans rose by 0.9% to $2.459 trillion sequentially in the second quarter, the year on year rate of growth declined to 7.7%. Some of the growth reflects carryover from previous activity as banks look to rein in pipelines.

Comerica Inc.'s sequential CRE loan growth was over $520 million in the second quarter, "driven largely by construction of multifamily and industrial projects originated over the last two years in addition to the slower pace of payoffs," CFO James Herzog said in July. "Recent origination activity and pipeline have significantly declined."

Banks including Capital One Financial Corp. and Synovus Financial Corp. moved to cut exposure through portfolio sales, though such transactions are being held up over uncertainty about pricing.

CRE sales slumped 53% year on year in the first quarter and mortgage originations slid 56% in tandem, Mortgage Bankers Association (MBA) data shows. The MBA forecast that originations will fall 38% overall in 2023 before starting to rebound in 2024, while CRE prices will drop 27% peak-to-trough before recovering to peak levels toward the end of 2025.

Originations have historically tracked property values, the MBA said, noting that its forecast is highly sensitive to macroeconomic assumptions. If 10-year Treasury rates stay high for longer and end 2025 at 3.4% instead of at 2.5% as assumed in its forecast, its model predicts property values would remain 17% below the 2022 peak at the end of 2025 and maintain downward pressure on originations.

10-year Treasury rates increased 49 basis points from the end of the second quarter to 4.30% as of Aug. 17, reflecting strong economic performance.

|

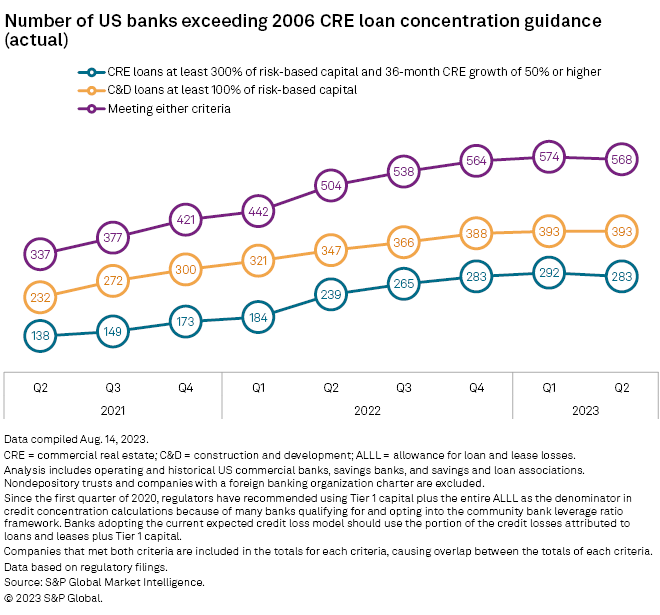

Managing concentration

Six fewer banks exceeded regulatory guidance for CRE concentration in the second quarter than in the previous three months. Regulators monitor banks where CRE loans exceed 300% of capital, where CRE loan growth has been rapid, or where construction and development loans exceed 100% of capital.

PacWest Bancorp and Pacific Premier Bancorp Inc. both dropped out of the tally between the first and second quarters.

PacWest has jettisoned loans, including from its national construction portfolio, after severe deposit outflows in the aftermath of the bank failures in March. It agreed to merge with Banc of California Inc. in July.

Pacific Premier's CRE-heavy loan portfolio has been shrinking for the past year, reflecting lower borrower demand and deliberate tightening of standards and pricing. Slower paydowns and payoffs, "probably owing to some of the other lenders out there finally beginning to tighten up a bit," would help stabilize loan levels going forward, Chairman, President and CEO Steven Gardner said on an earnings call, but it is unclear whether the bank would post loan growth in the second half of the year.

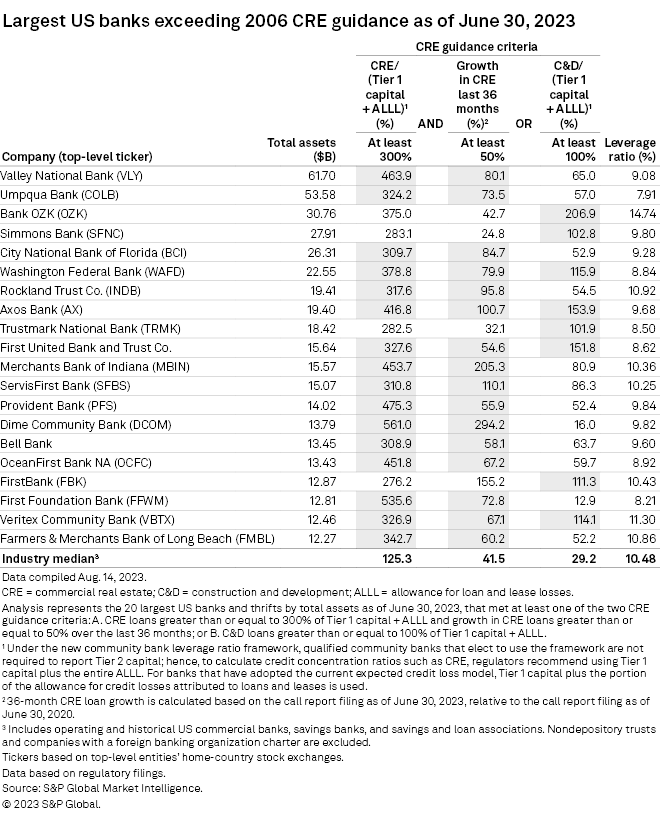

Simmons Bank, a subsidiary of Simmons First National Corp., crept above the threshold for construction and development loans to capital at 102.8% in the second quarter as its construction loans increased 5.4% to $2.92 billion.

Higher rates are restraining demand, President and CFO James Brogdon said, and the company reported that its commercial pipeline fell from $3.02 billion a year earlier to $689 million, a range at which the bank expects it to level off. Brogdon said that some borrowers are more willing to put more cash equity into deals and the volume entering the pipeline is attractive, reflecting Simmons' strong underwriting and pricing standards.

"It's certainly not our strategy to operate at above 100% for sustained periods of time," he said on an earnings call. "At the same time, we've got a lot of expertise in those areas of production and within our business. We're not afraid to go over 100% for a period of time."

|