If the ongoing turmoil in the banking sector worsens, the Federal Reserve will no longer need to hike rates, as tighter credit conditions will bring inflation down toward its 2% target, Fed Chair Jerome Powell said.

"We're thinking about that as effectively doing the same thing that rate hikes do," Powell said during his March 22 press conference. "So, in a way, that substitutes for rate hikes."

Last hike

On March 22, the Fed hiked its benchmark federal funds rate by another 25 basis points, the latest in its aggressive push to bring inflation down through tighter monetary policy.

The Fed has hiked rates now 475 bps since March 2022, its fastest pace of hiking in history, but the effort has yet to fully tame inflation, and unemployment remains near the lowest level in decades.

"I think that the Fed wants this to be the last rate hike," said Patrick Leary, a senior trader with Loop Capital Markets. "But it all depends on what happens with the banking sector, what happens with inflation and what happens with the labor market."

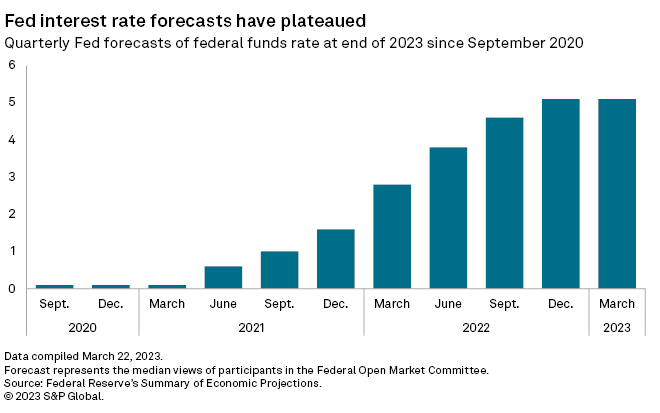

Fed officials still see the benchmark federal funds rate at 5.1% at the end of 2023, according to the quarterly Summary of Economic Projections, which were released after this week's meeting. The median view among Fed officials suggests at least one more rate hike before the end of the year.

"We think they will go 25 bps on May 3, and then that's it," said Jay Bryson, chief economist at Wells Fargo.

Banking concerns

Just two weeks earlier, Powell indicated that the Fed could accelerate its policy tightening, possibly with a 50-bps hike. But the collapse of Silicon Valley Bank and further stress throughout the sector ended that consideration, and Powell said the Fed even considered pausing its rate-hike push.

The latest emergency in the banking sector caused the Fed to alter its forward guidance from its February meeting where it said it was considering "ongoing increases" to rates to a new statement after the latest meeting stating that "some additional policy firming may be appropriate."

While Powell did not define "policy firming," it was likely an attempt to express to the market that the rate-hike path forward would be flexible due to the ongoing issues in the banking sector.

"The Fed is essentially telling investors that it's willing to tweak policy based on what happens with bank funding issues," said Callie Cox, a U.S. investment analyst at eToro.

Powell said it was too early to determine the extent of the stress in the banking system. But if it became a severe and sustained crisis, the Fed could abandon its plans to hike rates further, analysts said.

"The Fed has no idea what the impact is going to be," said Matthew Tuttle, CEO and CIO of Tuttle Capital Management. "But if this banking crisis turns into something bad then we've probably seen the last increase because the banking crisis will take us down to 2% [inflation]."

Credit tightening will boost the probability of a recession and cause inflation to recede, even if the Fed does not hike again, said Bryson with Wells Fargo.

"Not all the way back to 2%, at least not initially, but enough progress to give the Fed the ability to ease significantly in 2024," Bryson said.

Inflation views

The personal consumption expenditures index excluding food and energy, or core PCE, grew 4.7% from January 2022 to January 2023. Core PCE is the Fed's preferred inflation gauge. February PCE data is due at the end of March.

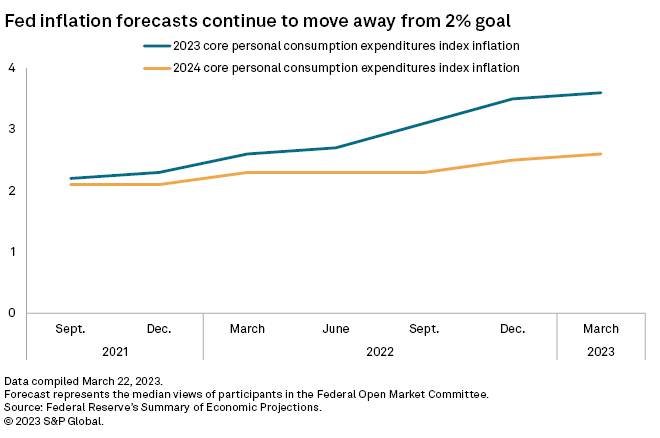

Fed officials see core PCE holding steady at 3.6% by the end of 2023, according to the latest quarterly forecast. When the central bank began hiking rates in March 2022, Fed officials expected core PCE to be 2.6% at the end of 2023.

Officials now see core PCE dropping to 2.6% at the end of 2024, suggesting that most Fed officials believe the 2% goal cannot be hit until 2025 at the earliest.

Powell has repeatedly stated the Fed remains committed to bringing inflation down to 2%, and he has brushed off suggestions that the central bank could move that goal upward, to 3%, for example, due to how ineffective rate hikes have been so far in bringing prices down.

"Inflation remains too high," Powell said March 22.

But the Fed could find that sticking to the higher-rate strategy is more challenging if it fuels bank failures and pushes the economy into a recession.

"My gut feeling is that they're not going to have the stomach for it," said Tuttle with Tuttle Capital Management.