The recent tumult in the banking sector and uncertainty about the Federal Reserve's near-term policy plans have been a boon for many of the mega-cap technology stocks that struggled last year.

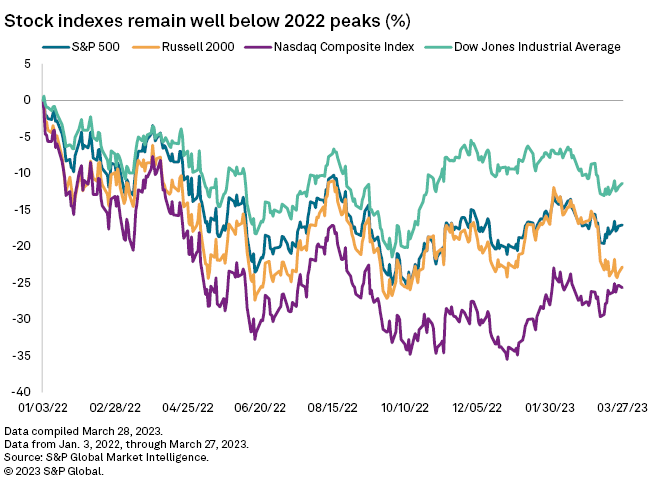

The tech-heavy Nasdaq Composite Index has risen 13.3% since the start of 2023 after falling 33% in 2022. The Nasdaq 100, made up of the broader index's largest 100 companies, has risen 16.7% so far this year, after also falling about 33% in 2022. Meanwhile, the S&P 500 has risen about 4% in 2023, after tumbling about 19.4% in 2022.

"Investors are retreating into mega-cap stocks because of banking turmoil, and many of those bigger companies with wider financial moats are large technology companies," said Callie Cox, a US investment analyst at eToro.

Some of the strength in the tech sector may be rooted in expectations that the Fed could decide to lower rates in response to the banking upheaval. The Fed has increased its benchmark federal funds rate by 475 basis points since March 2022, the most aggressive hiking cycle in its history.

"The rally is being fueled by investors who are hesitant to pull money out of the market," said Michael O'Rourke, chief market strategist at JonesTrading. "Instead, they have rotated from the banks and other value-type sectors into tech, media and telecom."

The S&P 500's information technology sector has risen nearly 17.7% this year, one of only three sectors to gain ground. The S&P 500's financials sector is down more than 8.5% on the year.

"Given big tech is outperforming by such a wide margin, this looks more like a defensive market driven more by anxiety than hope," Cox with eToro said.

Quality flight

The ongoing tech rally looks to be a "flight to quality stocks," such as Apple Inc. and Microsoft Corp., which have strong cash flow and make up large portions of equity indexes, said Sonu Varghese, a global macro strategist with Carson Group.

Apple has gained nearly 26.6% in 2023 and Microsoft nearly 15.4%.

Other mega-cap tech stocks that had dismal years in 2022, including Meta Platforms Inc. and Tesla Inc., have also seen significant gains this year.

"We believe this is a temporary move, as investors hide in 'quality' names," Varghese said.

The ongoing rally is likely not a "defensive, crisis-like flight," Varghese said. If it were, investors would likely be driven toward more defensive sectors, particularly consumer staples, healthcare, and utilities, which are all negative so far this year.

Instead, O'Rourke with JonesTrading said the banking tumult has driven investors to these tech stocks since they have strong cash flows and tend to rely on bank lending less than other businesses.

"There is investor comfort in the monopoly or near monopoly positions the mega-caps have," O'Rourke said.