Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2023

By Zoe Sagalow and David Hayes

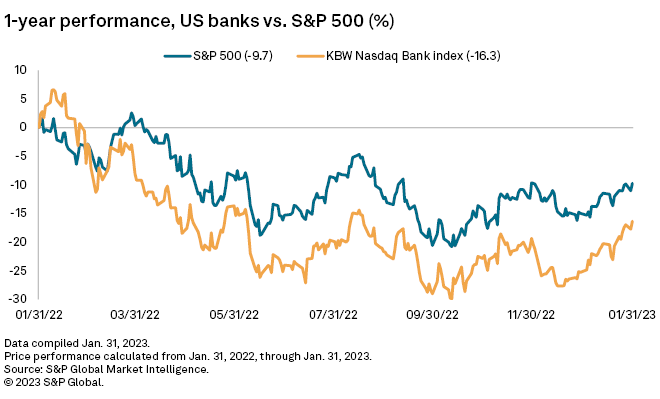

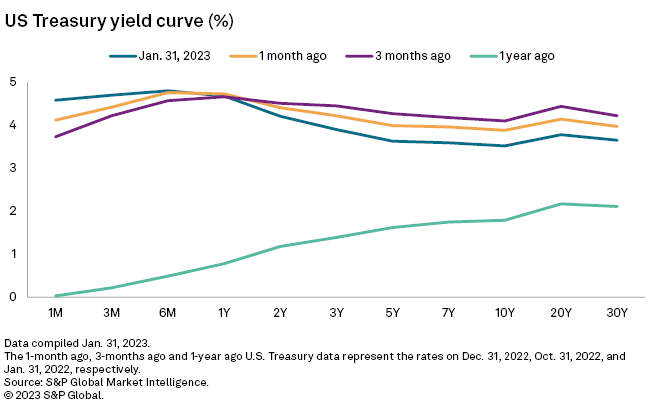

U.S. bank stocks moved up after the Federal Reserve said it would raise the federal funds rate by 25 basis points, bringing it to a range of 4.5% to 4.75%, and gave plans for further rate hikes as it continues its effort to tame inflation.

It was the smallest hike since March 2022, when the central bank began its battle against rising inflation after two years of near-zero rates. The committee also said it will keep reducing Treasury securities, agency debt and agency mortgage-backed securities as planned.

After the Fed's announcement, the KBW Nasdaq Bank Index was up about 0.6% at 3:50 p.m. ET on Feb. 1, while the S&P 500 was up about 1.1%. At market close, the bank index was up 0.56%, and the S&P 500 was up 1.05%.

"Restoring price stability will likely require maintaining a restrictive stance for some time," Fed Chair Jerome Powell said during the post-meeting press conference. "Although inflation has moderated recently, it remains too high. The longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched."

The Fed has hiked rates by 450 basis points since March 2022, including four 75-bps increases. After the Fed's November 2022 meeting, Powell indicated that the pace of increases would likely slow, and the central bank followed through with a 50-bps hike in December.

"Shifting to a slower pace will better allow the committee to assess the economy's progress toward our goals as we determine the extent of future increases that will be required to attain a sufficiently restrictive stance," Powell said.

Powell described openness to change based on economic conditions.

"This is not a standard business cycle where you can look at the last 10 times there was a global pandemic, and we shut the economy down, and Congress did what it did," he said. "It's unique, so I think certainty is just not appropriate here."

The Federal Open Market Committee also unanimously reaffirmed its consensus statement called the "Statement on Longer-Run Goals and Monetary Policy Strategy." The rate-setting committee first adopted this version in August 2020.

Among bank stocks, the biggest movers at market close included SVB Financial Group, up about 3.62%, KeyCorp, up about 3.18%, and Webster Financial Corp., up about 2.17%.

Inflation continued to cool in December 2022, an indication that the Federal Reserve's aggressive interest rate hike push is working as intended.

The consumer price index, the market's preferred inflation measure, rose 6.5% year over year on a non-seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported. It was the sixth consecutive month of lower annual growth since index readings peaked in June 2022 at 9.1%.

There were six straight months of annual declines for the consumer price index after it reached the highest levels in more than 40 years.