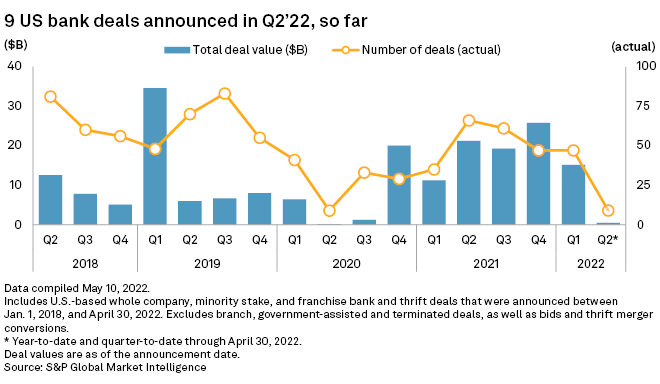

Nine U.S. bank M&A deals were announced in April, the lowest monthly tally since July 2020 when seven deals were announced, according to S&P Global Market Intelligence data.

There was also one unsolicited bid: Fort Lee, N.J.-based Nmb Financial Corp.'s $29.4 million offer for Pennsylvania-based Noah Bank, which was announced April 13.

Valuation slips

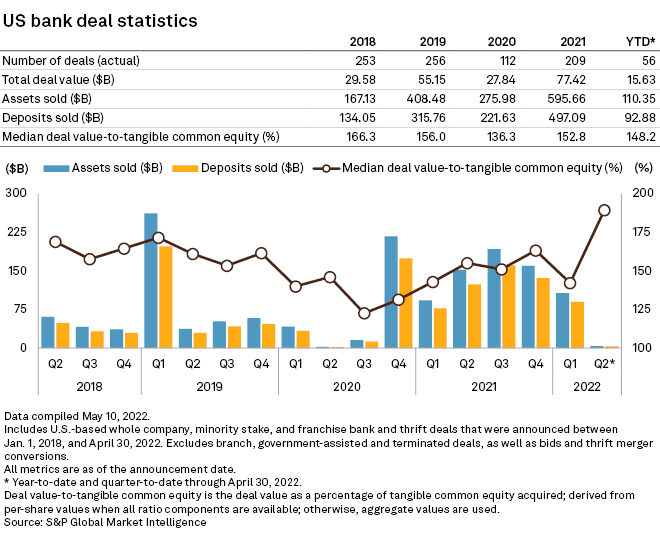

The median deal value-to-tangible common equity ratio for deals announced in 2022 was 148.2%, below full year 2021's 152.8%.

Total deal values drop

Total deal value year to date through April was $15.63 billion, down from $25.19 billion over the same period in 2021.

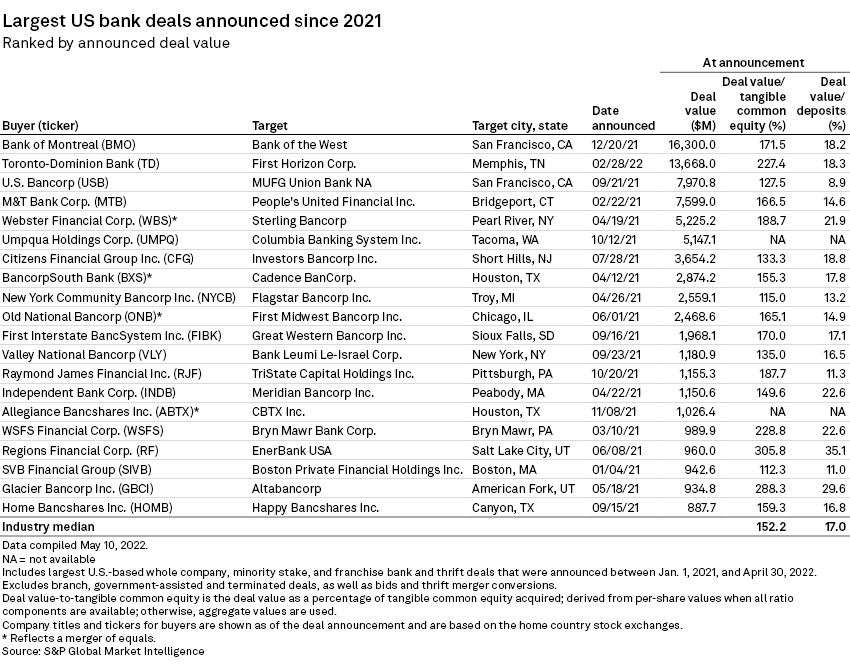

2 April deals among most expensive announced since the beginning of 2021

After announcing no deals in almost five years, Greenwood Village, Colo.-based National Bank Holdings Corp. announced a pair of deals within three weeks. On April 18, the bank announced its acquisition of Orem, Utah-based Community Bancorp. for $136.0 million at a deal value-to-tangible common equity ratio of 189.3%, making it the 12th-most expensive bank deal announced since the start of 2021.

Earlier, on April 1, National Bank Holdings announced it would buy Jackson, Wyo.-based Bancshares of Jackson Hole Inc. for $230.2 million at a deal value-to-tangible common equity ratio of 203.2%, making it the eighth-most expensive deal since Jan. 1, 2021.

National Bank Holdings' two deals were also the largest bank M&A announcements in April by deal value.

Megadeals dry up

Toronto-Dominion Bank's $13.67 billion deal for First Horizon Corp., announced Feb. 28, was the only deal worth more than $350 million announced during the first four months of 2022.

M&A outlook dims

With the Federal Reserve hiking interest rates and equities selling off, sellers are holding out for larger premiums, which is impacting buyer appetite for M&A deals.

Click here for a list of pending and completed M&A deals announced since Jan. 1, 2012.