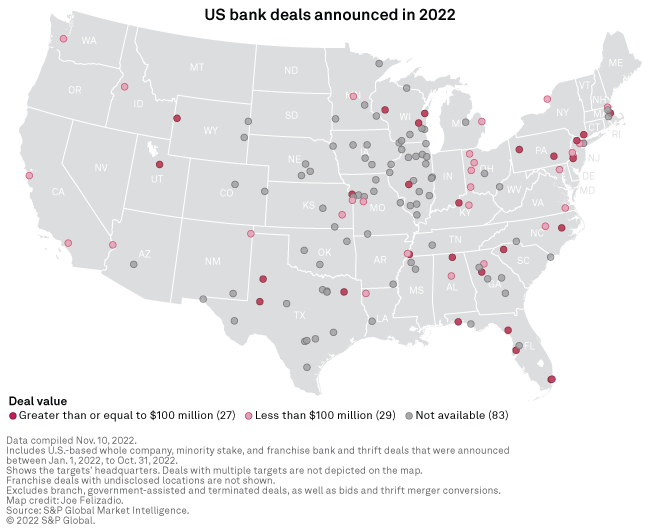

Thirteen M&A deals were announced in the U.S. banking sector in October, bringing 2022's total deal count to 139, down from 176 over the same period in 2021.

Aggregate deal value last month was $1.01 billion, down from September's $1.50 billion, according to S&P Global Market Intelligence data.

* Access a list of pending and completed M&A deals announced since Jan. 1, 2012.

* Access the S&P Capital IQ Pro M&A summary page for U.S. financial institutions.

* Read more M&A news.

Valuations rising

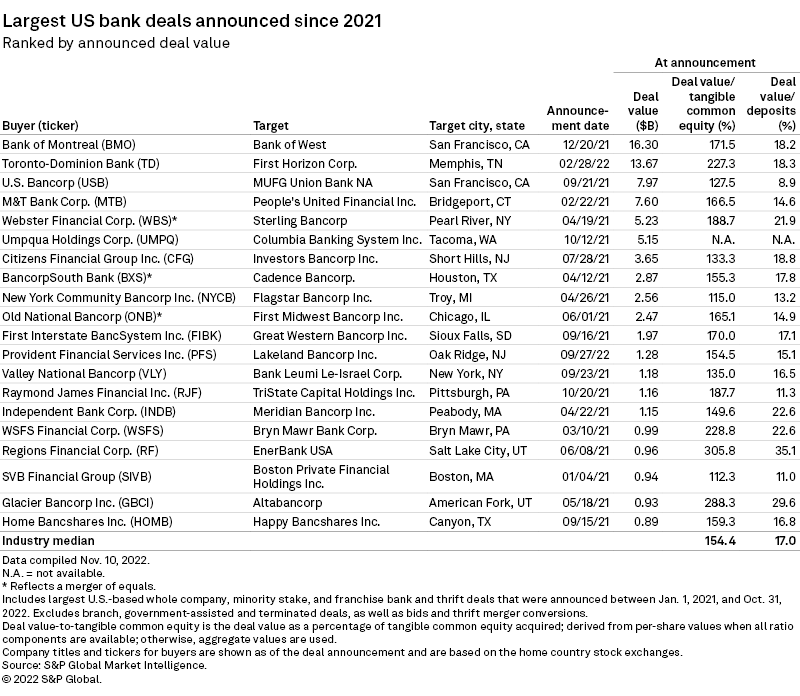

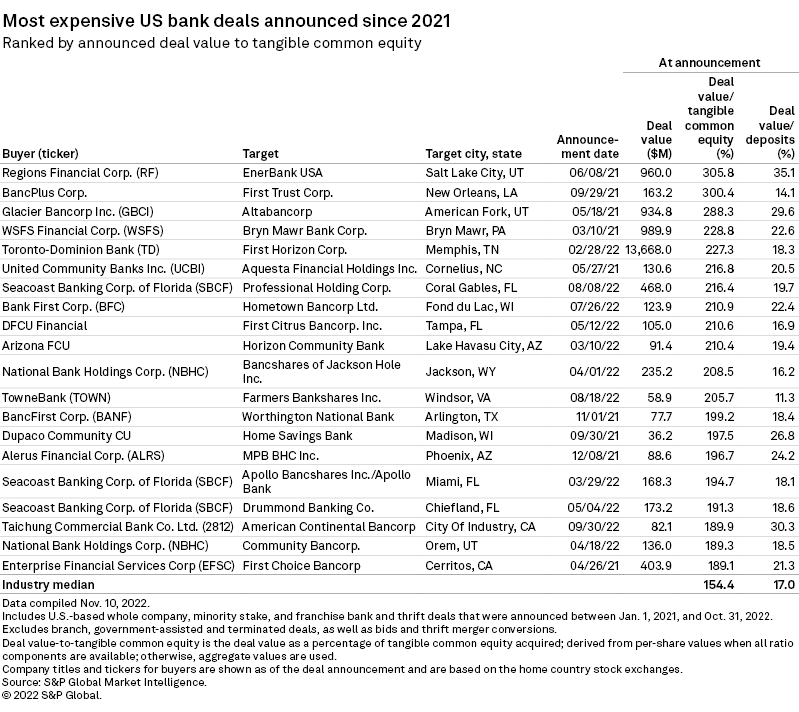

Over the first 10 months of 2022, the median deal value-to-tangible common equity ratio for announced deals was 155.2%, higher than 2021's 152.5% and 2020's 135.3% but just below 2019's 156.5%.

Texas remains popular

Bank M&A activity remains hot in the Lone Star State. Three of October's announced targets are headquartered in Texas, pushing the state's total deal count to 14 in 2022, the second-highest in any state after Illinois.

On Oct. 11, Houston-based Prosperity Bancshares Inc. announced two acquisitions in Texas: a $338.2 million deal for Midland-based First Bancshares of Texas Inc. and a $226.4 million deal for Lubbock-based Lone Star State Bancshares Inc. at 160.9% and 187.0% of tangible common equity, respectively.

Banks shift M&A strategy amid credit uncertainty, pricing dynamics

So far, only two transactions announced in 2022 are among the 20 largest by deal value since 2021, as a slide in bank stocks made valuations more difficult.

On an Oct. 26 earnings call, Wheeling, W.Va.-based WesBanco Inc. President and CEO Todd Clossin said the company was hesitant to strike a deal due to a murky credit quality outlook and pricing dynamics. Between 2014 and 2019, WesBanco announced and closed five whole-bank deals.