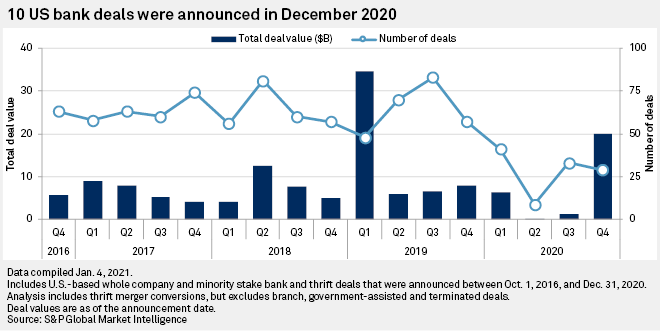

U.S. banks and thrifts announced 10 deals in December 2020 as deal activity continued to rebound from single-digit monthly tallies following the initial outbreak of the coronavirus pandemic. At least 10 deals were announced per month in four of the last five months of 2020.

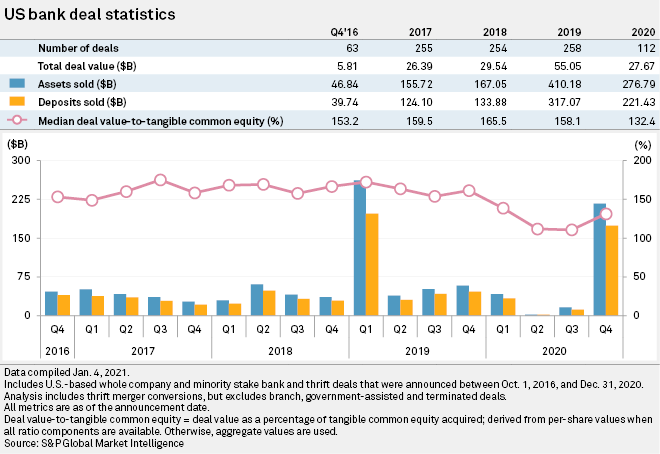

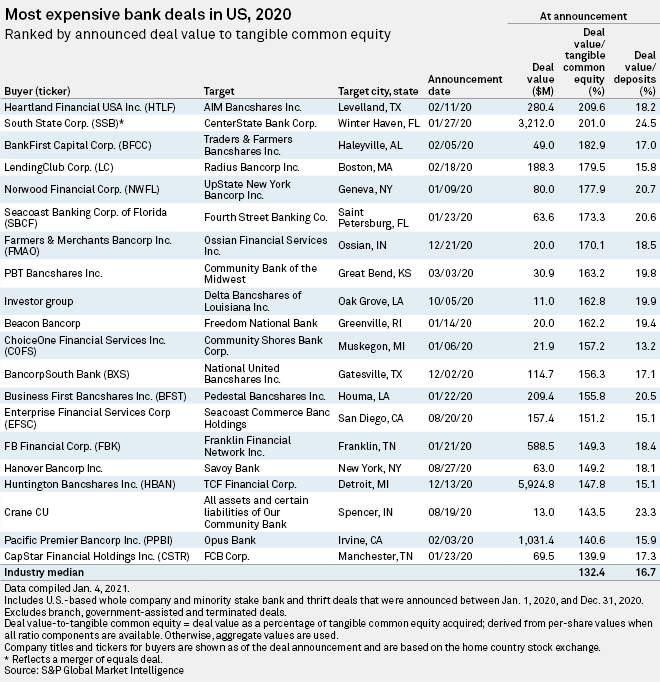

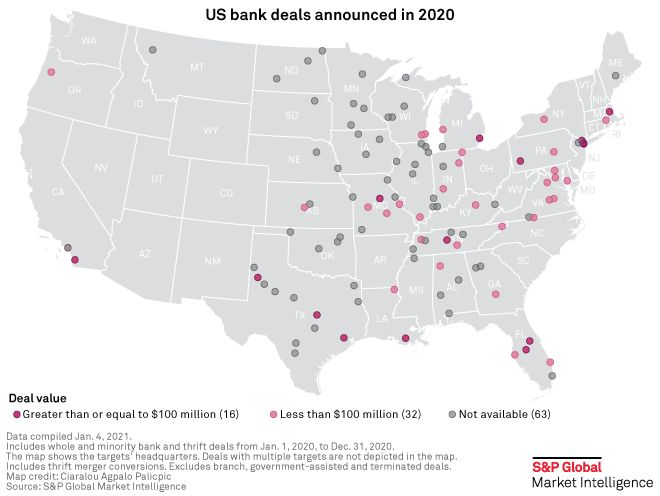

During 2020, only 112 deals were announced for an aggregate $27.67 billion, compared with 258 deals worth $55.05 billion in 2019. The median deal value to tangible common equity ratio for deals announced in 2020 was 132.4%, down from 158.1% in 2019.

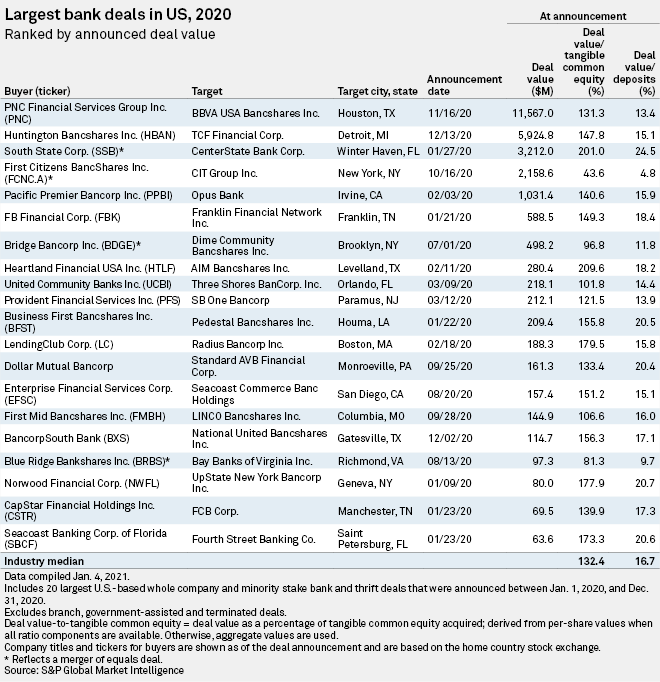

In December 2020, Columbus, Ohio-based Huntington Bancshares Inc. announced that it agreed to acquire Detroit-based TCF Financial Corp. for $5.92 billion at a deal value to tangible common equity ratio of 147.8%. This was the second largest deal of the year, following PNC Financial Services Group Inc.'s announced acquisition of BBVA USA Bancshares Inc. for $11.57 billion in November 2020.

Click here for a list of pending and completed M&A deals announced since Jan. 1, 2010.

READ MORE: