Amazon.com Inc. is expected to post strong third-quarter growth in its advertising and cloud-computing segments that should help offset slowing e-commerce sales as more shoppers returned to retail stores.

The change in consumer behavior led to a miss in Amazon's second-quarter results, and while Wall Street predicts year-over-year revenue growth in the third quarter, tough comparisons and e-commerce uncertainties put more pressure on the company's other segments to outperform.

The future of cloud

Amazon's cloud-computer unit Amazon Web Services Inc., or AWS, posted $14.81 billion in sales during the second quarter, up 37% from the year-ago period.

A pandemic-driven acceleration of cloud computing adoption across sectors helped to fuel steady double-digit growth for AWS over the past year, and the trend is expected to continue for some time.

A 451 Research Voice of the Enterprise survey fielded in the first quarter found that about one-third of represented organizations used public cloud services as their primary workload destinations in 2021, up from 26% in 2020. Survey respondents indicated that by 2023, about 57% of the represented organizations were expected to rely on public cloud environments. The survey included responses from 450 IT end-user decisions makers representing small, medium and large enterprises in public and private sectors.

Scott Kessler, global sector lead for technology, media and telecommunications at Third Bridge, said AWS has an opportunity to capitalize on client needs for an array of services, including management tools and enterprise applications, that can be customized for specific companies.

"Historically, people thought of AWS as computing and storage," Kessler said. "It's become so much more than that."

AWS ranks as Amazon's third-largest reporting segment by net sales, after the company's online store sales and third-party seller services. Those two categories reported net sales of $53.16 billion and $25.09 billion, respectively, in the second quarter.

Advertising breaks out

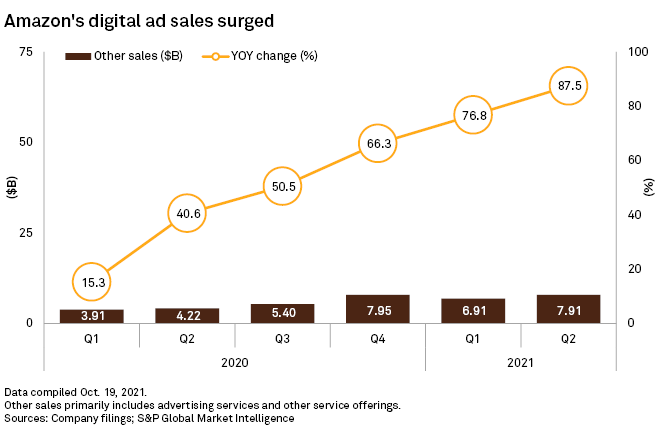

Amazon's advertising business has seen explosive growth over the last year and a half as more consumers searched for products on its e-commerce platform and companies increasingly turned to digital advertising.

Amazon's "other" sales category, which is mostly comprised of advertising services, reported growth of 87.5% year over year in the second quarter, to $7.91 billion. That puts the segment on par with the revenue generated by Amazon's subscription services, which reported sales of $7.92 billion, up about 32% year over year.

Amazon's ad business could see another big boost once the company closes on its $8.45 billion acquisition of film and television company MGM Holdings Inc., which will arm the company with the rights to an array of film content, noted Tom Forte, managing director with D.A. Davidson.

Amazon's advertising services include online display ads, video ads that appear on connected TVs, and audio ads on Alexa-enabled devices.

E-commerce headwinds

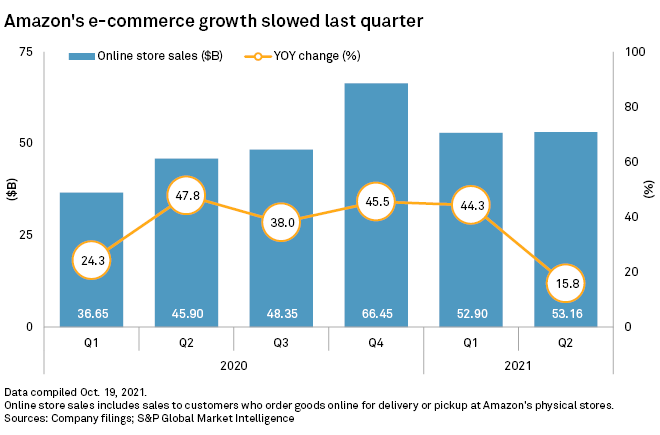

The company's core e-commerce growth slowed significantly in recent months as consumers spent more offline, with online store sales up 15.8% year over year in the second quarter, compared to 44.3% growth in the first quarter. A key question is to what extent some shoppers continued to return to brick-and-mortar retail stores this summer as COVID-19 case rates fluctuated. Slowing e-commerce sales negatively impacted Amazon's second-quarter revenue of $113.08 billion, which missed Wall Street's expectations.

"We're passed the turbo-charged levels of online sales that we already saw from the pandemic," said Tuna Amobi, entertainment analyst with CFRA. That said, retail sales were up in September, which offers some reassurance that the consumer is still spending at healthy levels, the analyst noted.

Wall Street expects Amazon's third-quarter revenue to grow 16% to $111.66 billion, on the higher end of Amazon's projected range, according to S&P Capital IQ consensus estimates as of Oct. 25.

"It's difficult to determine the e-commerce sales performance in the September quarter for Amazon given the big unpleasant surprise in the second quarter," Forte said.