Aviva PLC's proposal to buy fellow UK insurer Direct Line Insurance Group PLC at 275 pence per share, if it goes ahead, would be positive for both companies, according to analysts.

In a joint statement Dec. 6, the two insurers said they had reached a preliminary agreement for Aviva to acquire Direct Line for 129.7 pence per Direct Line share in cash, 0.2867 Aviva share for each Direct Line share and a 5 pence-per-share dividend. Direct Line shareholders will own around 12.5% of the combined group.

Before the agreement, Direct Line had staunchly defended its independence, knocking back two bid proposals from Belgian insurance group Ageas in February and March, and a 250 pence-per-share proposal from Aviva at the end of November.

Direct Line had said the previous offers were opportunistic and undervalued the group, as it was undergoing restructuring to restore profitability under new CEO Adam Winslow.

Direct Line said in the Dec. 6 statement that while it remained confident in its stand-alone prospects, Aviva's latest proposal was "an attractive headline value per share" and an acquisition would "provide the opportunity to deliver significant synergies, creating substantial additional value for both sets of shareholders." The insurer said it would be minded to recommend a firm offer on Aviva's proposed terms, if one is made.

Analysts agree that the acquisition would benefit both insurers. "We think the revised offer is good for both sets of shareholders — Aviva has not overpaid and DLG shareholders crystalize an attractive return," Abid Hussain, analyst at Panmure Liberum, wrote in a research note.

The offer would be at a similar multiple to other deals in the insurance industry "and allay Direct Line Group's shareholders' concerns that the current earnings base is depressed whilst it undertakes a turnaround strategy," Hussain wrote.

"We see 275p as a good offer, likely be accepted by shareholders," Rhea Shah, analyst at Deutsche Bank, said in a note.

The agreement "represents a swift conclusion to the situation at a fair price, which we see as the best possible outcome, as it avoids the need for Aviva to pursue a hostile bid," Jefferies analyst Philip Kett wrote in a research note.

After Direct Line rejected Aviva's initial proposal of 250 pence per share, Aviva reached out to Direct Line's shareholders directly, indicating the potential for a hostile takeover, the Financial Times reported Nov. 28.

In the run-up to the Dec. 6 agreement, analysts were saying that Aviva would need to offer at least 270 pence per share to bring Direct Line to the table.

The revised proposal would result in a return on investment and internal rate of return for Aviva of 15%, UBS analyst Nasib Ahmed wrote in a research note, which would be in line with previous deals the insurer has struck. Aviva has made a series of bolt-on acquisitions in recent years, including Lloyd's insurer Probitas and AIG's UK life insurance business, both of which completed in 2024.

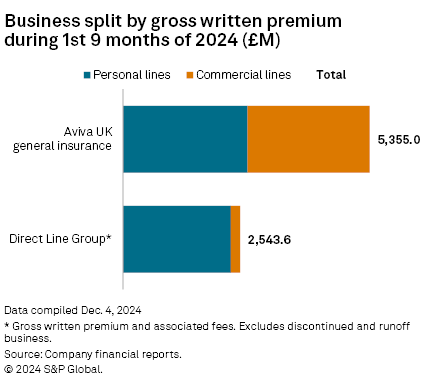

The Direct Line deal, if completed, would boost Aviva's standing in UK personal lines. Personal lines accounted for the bulk of Direct Line's gross written premium in the first nine months of 2024, while Aviva's UK general insurance business is more evenly split between personal and commercial lines.

The combination would boost Aviva's earnings from capital-light business to two thirds of divisional profit in 2026, Deutsche Bank's Shah wrote, "which improves earnings and capital diversification."

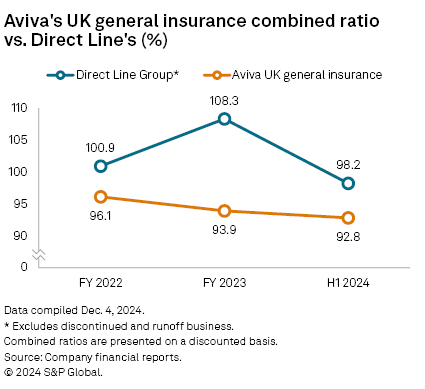

After a difficult 2023, Direct Line's performance improved in the first half of 2024, with a combined ratio of 98.2%. A combined ratio below 100% indicates an underwriting profit. However, Winslow said on the company's first-half earnings call that efforts to restore profitability were not yet fully visible in results.

Direct Line's shares were up 7% to 252.6 pence as of 11:21 a.m. UK time, while Aviva's were down 0.4% to 487.20 pence.