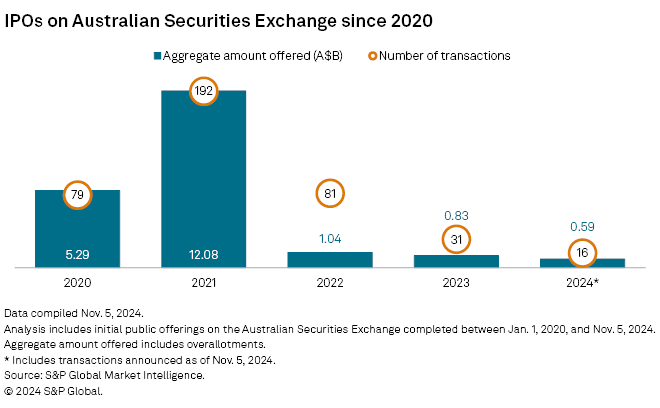

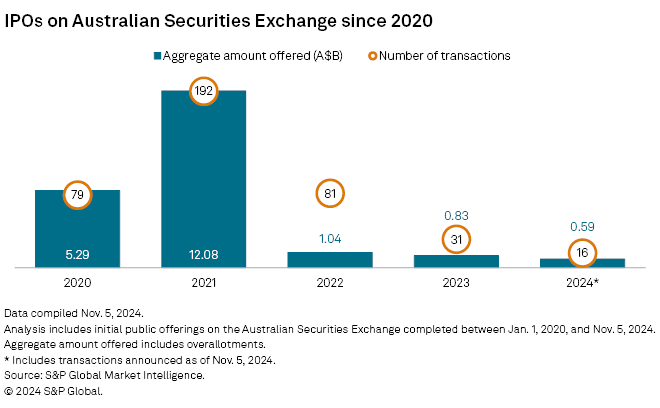

Australia's market for IPOs is likely to remain muted for a while longer, as 2024 is set to record a decline in new listings for the third consecutive year, and the pipeline remains thin.

The Australian Securities Exchange (ASX) hosted 16 IPOs up to Nov. 5 in 2024, compared with 31 in 2023 and 81 in 2022, according to data compiled by S&P Global Market Intelligence. The aggregate amount offered fell to A$590 million over the period, compared with A$830 million in 2023, the data showed.

"The IPO market at the moment is a question of timing," Corporate & Audit Services Partner Marcus Ohm of advisory and accounting firm HLB Mann Judd, told Market Intelligence in an interview. Ohm noted that economic and geopolitical factors are hindering IPOs and those barriers need to disappear or reduce in intensity before there could be a more fluid market for IPOs.

"There's a little bit of hang back and let's see what happens in early 2025," Ohm said, adding that listing is an expensive form of fund raising.

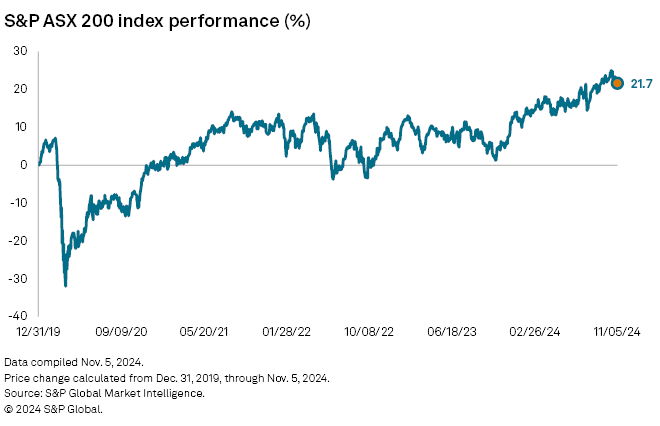

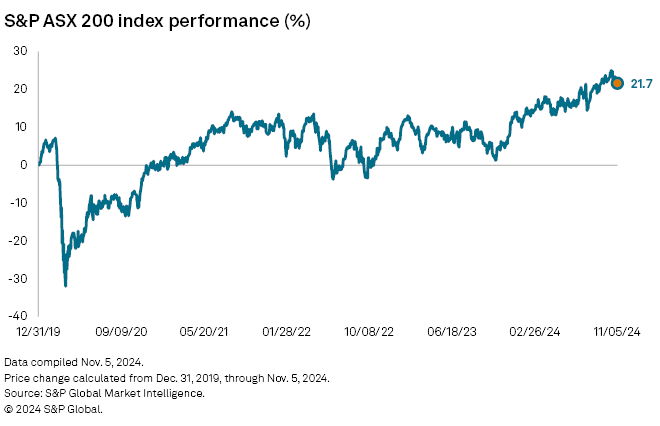

Australia's central bank has kept interest rates elevated as it stays focused on controlling inflation even as the US Federal Reserve and the European Central Bank pivoted toward lower rates in the second half. Australia's benchmark S&P ASX 200 Index has gained more than 20% this year, but the stock market's outperformance has failed to entice more companies to list.

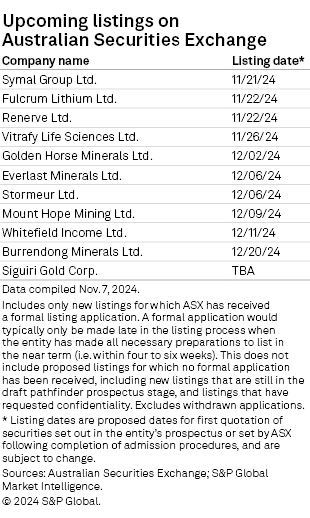

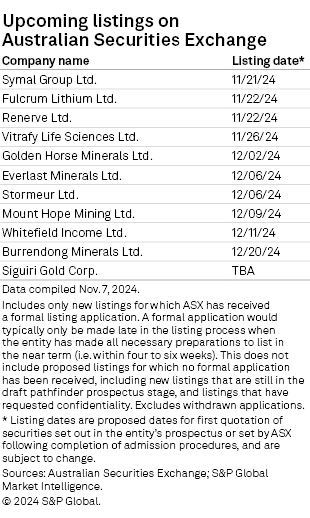

Only 11 more companies have lined up IPOs for the remainder of the year. Two companies, CleanTeach Lithium PLC and Tungsten Metals Group Ltd., have withdrawn their proposed listings, according to the ASX.

Investor sentiment was muted as investors waited out an uncertain macroeconomic outlook.

"We think the sentiment was largely driven by macroeconomic factors including the stubborn inflation and interest rate outlook, the global sentiment in the tech sector and lower valuations driven by slower growth and higher cost of capital," Paul Murphy, capital markets, built environment and resources leader for EY Oceania, told Market Intelligence in an email.

"At the start of the year, it was expected that declining inflation and interest rates would abate much sooner, but it has not turned out to be the case," Murphy said.

With underlying inflation still high, the Reserve Bank of Australia kept the cash rate unchanged at 4.35% in its Nov. 5 monetary policy meeting. The central bank noted that while inflation has fallen since its peak in 2022, underlying inflation was 3.5% to the September quarter, still some way from the 2.5% midpoint of the inflation target. The central bank does not see inflation returning sustainably to the midpoint of the target until 2026.

"We do expect to see investor sentiment improve, subject to the geopolitical situation, and better macroeconomic conditions with lower inflation and potentially the beginning of easing of monetary policy, which should create the right conditions for business growth, consumer demand and stable cost inflation. This will perhaps benefit a number of sectors and IPOs of smaller businesses," Murphy said.

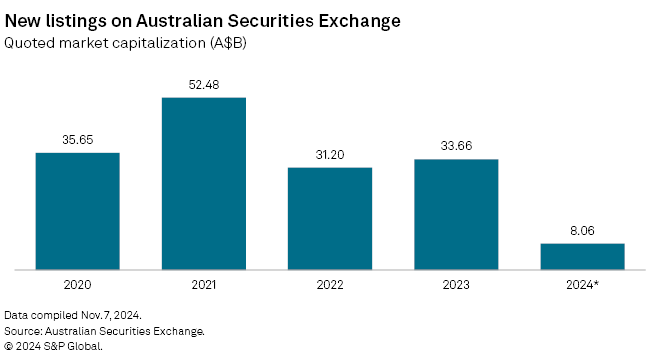

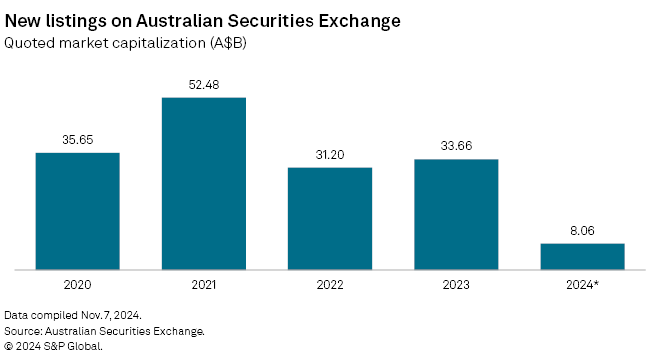

The combined market capitalization of the companies that listed in 2024 stood at A$8.06 billion as of Nov. 7, compared with A$33.66 billion for companies that listed in 2023, according to ASX data. Companies that listed in 2021 are collectively valued at A$52.48 billion.