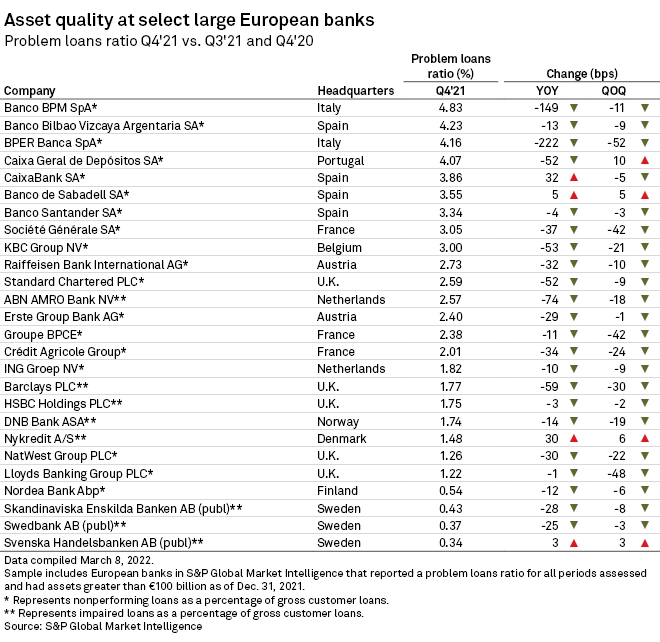

A majority of European banks with more than €100 billion in assets saw declines in their problem loans ratios on both a yearly and a quarterly basis in the fourth quarter of 2021, while two of the region's five largest lenders posted increases in the levels of bad loans, S&P Global Market Intelligence data shows.

Yearly change

The problem loans ratios of Italian lenders BPER Banca SpA and Banco BPM SpA declined 222 basis points to 4.16% and 149 bps to 4.83%, respectively, on a yearly basis, marking the steepest fall among the 26 banks in the sample. Still, BPER Banca and Banco BPM placed first and third in the ranking of banks by problem loans ratio.

Spain's Banco Bilbao Vizcaya Argentaria SA and CaixaBank SA and Portugal-based Caixa Geral de Depósitos SA completed the top five with ratios of 4.23%, 3.86% and 4.07%, respectively, while Swedish lenders Svenska Handelsbanken AB (publ), Swedbank AB (publ) and Skandinaviska Enskilda Banken AB (publ) continued to report the lowest ratios among banks in the sample.

Q4'21 vs Q3'21

BPER Banca also saw the steepest decline of 52 bps in its problem loans ratio on a quarterly basis, followed by U.K. lender Lloyds Banking Group PLC and France's Groupe BPCE, respectively. Caixa Geral de Depósitos, which reported a 52-bps year-over-year decline in its problem loans ratio, posted the largest quarter-over-quarter increase of 9.70 bps.

Denmark-based Nykredit A/S, Spain-based Banco de Sabadell SA and Sweden-based Svenska Handelsbanken AB (publ) also posted increases in their ratios on a quarterly basis, while all the remaining banks in the sample saw decreases.

Problem loan levels

Meanwhile, the levels of problem loans at two of Europe's largest banks by assets — Banco Santander SA and HSBC Holdings PLC — rose year over year to €33.23 billion from €31.77 billion and to €16.53 billion from €15.61 billion, respectively, according to Market Intelligence data. Santander had the highest level of problem loans in the period among the five banks.

France-based BNP Paribas SA and Crédit Agricole Group and U.K.-based Barclays PLC all posted declines in the levels of their problem loans to €27.82 billion from €30.07 billion, to €21.64 billion from €23.33 billion and to €8.61 billion from €10.04 billion, respectively. Barclays held the lowest level of problem loans.