Amid historically strong base and precious metal prices, global exploration projects continued to draw investor attention in the second quarter on the back of drilling results.

S&P Global Market Intelligence recently revised its 2021 copper price up to $9,094 per tonne. Market Intelligence analyst Christopher Galbraith noted drilling activity continued to climb in July, and the number of projects with reported drilling totaled 387, compared to a previous peak of 383 projects in February.

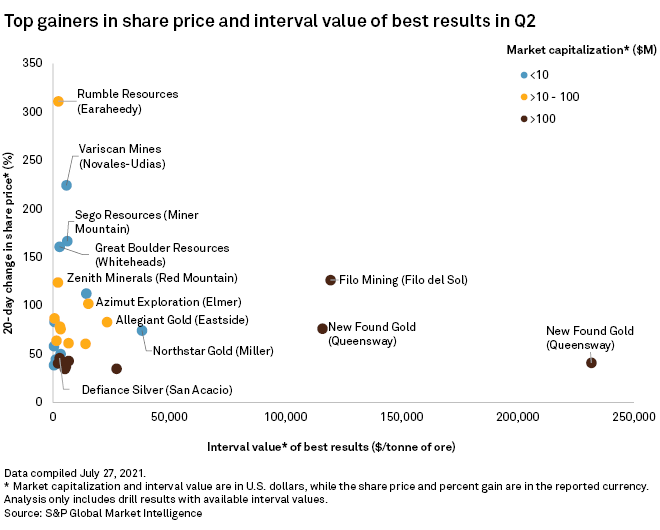

The largest share-price movements, as measured 20 days after June-quarter assay announcements, are listed below. Companies are split into three groups based on their market capitalization: very small companies under US$10 million, small companies between US$10 million and US$100 million and large companies greater than US$100 million. This grouping recognizes that smaller companies are more likely to register significant appreciation in their share price as a result of assay announcements.

Among companies with very small market caps that jumped the most, the share prices of ASX-listed Variscan Mines Ltd., TSX Venture Exchange-listed Sego Resources Inc. and ASX-listed Great Boulder Resources Ltd. climbed 224.3%, 166.7% and 160.9%, respectively.

Variscan's share price surged following the release of assays in late May from its Novales-Udias zinc-lead project in Cantabria, Spain. The exploration company said it discovered a new zone of mineralization in the Central Zone of the San Jose deposit, with drill hits including 16.9 meters grading 12.5% zinc and 2.0% lead and 15.6 meters grading 3.2% zinc and 0.3% lead. Variscan cast the drilling as pointing to the expansion potential of the deposit.

Likewise, Sego Resources' share price climbed after it announced drilling results from the Southern Gold zone of its Miner Mountain copper-gold project in British Columbia, Canada. In late May, the company highlighted drill intercepts of 59.1 meters grading 1.03 g/t gold and 88.1 meters grading 1.08 g/t gold.

Great Boulder Resources' share price surged after it announced assays from the Whiteheads gold project in Western Australia in late April. Great Boulder hit shallow gold mineralization over a few hundred meters of strike length at the Blue Poles zone, with better intercepts including 40 meters grading 1.18 g/t gold and 36 meters grading 1.09 g/t gold.

Turning to companies with small market caps, ASX-listed Rumble Resources Ltd.'s shares jumped the most during the period, up 311.1% after it outlined exploration results from its Earaheedy manganese-zinc-lead project in Western Australia in mid-April. Highlights from Earaheedy included 34 meters grading 4.22% combined zinc and lead and 21 meters grading 4.31% zinc-lead.

On the back of the drilling, Rumble Resources planned a 30,000-meter drill program at Earaheedy using a mix of diamond and reverse circulation drill rigs. The company later announced follow-up drill intercepts that included 23 meters grading 4.1% combined zinc and lead and 18 meters grading 3.06% zinc-lead.

Among the companies with larger market caps, TSX Venture-listed Filo Mining Corp. shares climbed 126.4% on the back of drilling at its Filo del Sol copper project in San Juan, Argentina. Drilling intercepts reported in mid-May included 858 meters grading 0.86% copper, 0.70 g/t gold and 48.1 g/t silver. The drill hit included a higher-grade 163-meter interval grading 2.31% copper, 2.07 g/t gold and 183.0 g/t silver.

Drilling at Filo del Sol is targeting the deeper portions of the main deposit, which hosts probable reserves of 259.1 million tonnes grading 0.39% copper, 0.33 g/t gold and 15.1 g/t silver. A 2019 pre-feasibility study estimated the net present value of the project at $1.28 billion, after taxes and discounted at 8%, with a 23% internal rate of return.