Asian banks' recent foray into digital assets backed by blockchain may require a concerted regulatory approach to protect lenders and their customers from the opacity and volatility of crypto products, experts say.

Singapore's DBS Group Holdings Ltd. recently established a digital exchange and launched an initial offering of tokenized digital securities. South Korea's Woori Bank, Shinhan Bank, NongHyup Bank and KB Kookmin Bank are also reportedly building crypto-asset custodial services.

Consistent regulations across the region would allow customers in different markets to have access to the same asset class and similar trading mechanisms, which will improve liquidity, said Andrew Gilder, Asia-Pacific banking and capital markets leader at Ernst & Young. "If you've got more liquidity, you've got better trust, price, transparency, less volatility. It makes the market a bit more stable," Gilder said.

Crypto-assets are issued and transferred using blockchain or distributed ledger technology, their best-known manifestation being cryptocurrencies such as bitcoin. But they can also take the form of a token that represents underlying assets that are not crypto in nature.

Cautious regulators

Many regulators, and also banks, have been cautious about endorsing crypto-assets as the market often equates them with cryptocurrency and its volatile, opaque nature. Fears surrounding cryptocurrencies include extreme price swings, higher default risk and even money laundering. For example, HSBC Holdings PLC said it has no plans to offer cryptocurrencies as an asset class to its customers. On the other hand, rising demand from clients and the broad application of blockchain technology in financial services have led several global banks such as JPMorgan Chase & Co. and The Goldman Sachs Group Inc. to announce products based on cryptocurrencies.

Although geographic diversities in Asia-Pacific make regulatory regimes fragmented, the region could take cues from the European Union, which is seeking to address the volatility of cryptocurrencies by bringing markets together to create larger pools of liquidity. In September 2020, the EU announced plans for rules to allow faster and cheaper cross-border payments through blockchain and crypto-assets by 2024. The potential systemic risks due to the exposure to crypto-assets prompted the Basel Committee on Banking Supervision on June 10 to propose new capital rules to ensure that lenders have a sufficient buffer against losses.

"Banks don't necessarily want to hold crypto on their balance sheet ... they just want to make crypto offerings available to their clients, but [the Basel Committee's rules proposal] still underscores this narrative that crypto is a very risky product, it needs to be treated with caution," Gilder said.

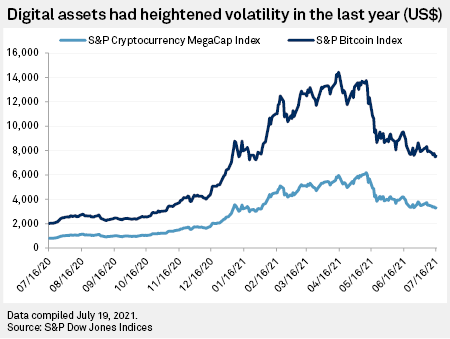

The price of bitcoin slid 48.44% over the last the months, but was up nearly 250% from a year ago as of July 16, according to the S&P Bitcoin Index. The S&P Cryptocurrency MegaCap Index, which covers the two most popular cryptocurrencies — bitcoin and ethereum network's ether, has also demonstrated volatility that is beyond what most banks may be comfortable with.

Early birds

Still, early moves into the crypto-asset

Regulators' endorsement of crypto-products could also bring virtual assets into the institutional fold, Rooke said.

Singapore Exchange Ltd. took a 10% stake in the DBS Group's digital exchange. The bank priced a S$15 million digital bond security token offering on May 31 through its digital asset exchange and has reported S$80 million in digital assets under custody, with trading volumes of S$30 million to S$40 million daily.

Standard Chartered PLC said recently that it has partnered with a blockchain-based asset company to establish a virtual asset brokerage and exchange platform. The lender's digital asset plans are subject to being able to create a safe and compliant infrastructure to support the "inevitable and increasing adoption" of digital assets from institutional investors, said Alex Manson, who heads the lender's Singapore-based innovation and fintech investments unit SC Ventures.

"It is clear to us that ignoring this space is not the way forward for us," Manson said. "It's all about clients' needs. We want to capitalize on accelerating institutional adoption for the asset class ... where we think the bulk of initial demand will emanate from."

For these banks, profitability may not be the main objective for setting up their crypto-asset frameworks just yet, said Mriganka Pattnaik, CEO and co-founder of Singapore-based Merkle Science, a blockchain monitoring and investigative platform. "For banks, setting up digital asset infrastructure is really the first step to creating innovative ways to deliver new products," Pattnaik said.

Although DBS and StanChart have limited their crypto-asset services to institutional and accredited investors, it is "safe to say" that every bank is evaluating how to provide their clients a degree of crypto-asset exposure that is in line with lenders' risk tolerance, Pattnaik said.