Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Apr, 2021

By Zia Khan and Francis Garrido

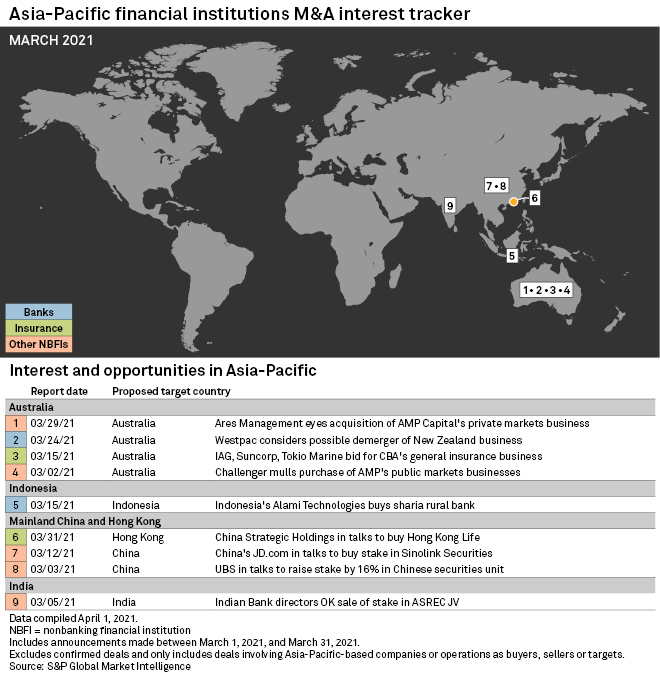

This tracker covers possible deals reported by media across Asia-Pacific over a certain period. The information is gathered from various news sources, excludes confirmed deals and is limited to potential acquisitions or sales involving companies or operations in the region. Click here to read the previous month's report.

Australia and New Zealand emerged as bright spots for potential deals in Asia-Pacific's financial sector in March, as Westpac Banking Corp. kicked off a review of its New Zealand business and suitors lined up for the potential purchase of Commonwealth Bank of Australia's general insurance business.

Westpac, Australia's third-largest bank by assets, said it was considering a possible demerger of its New Zealand business as part of its review concerning an appropriate structure for the business. The bank's March 24 announcement came after the New Zealand central bank flagged concerns over Westpac New Zealand Ltd.'s risk governance processes and required it to commission two independent reports to address the issue.

Westpac said it was in the very early stages of its review and that it has made no decisions yet.

Below is a snapshot of March reports of possible deals compiled by S&P Global Market Intelligence

On the insurance side in Australia, Insurance Australia Group Ltd. and Suncorp Group Ltd. are said to be leading the race among shortlisted suitors for CBA's general insurance business, Insurance Business NZ reported, citing a report from The Australian. Japan's Tokio Marine Holdings Inc. is also among the shortlisted suitors. Final bids are due in April. The report also cited, with less certainty, QBE Insurance Group Ltd. as a shortlisted bidder.

Separately, Australia's AMP Ltd. garnered deal-related headlines during the month. U.S.-based Ares Management Corp. expressed interest in acquiring 100% of AMP Capital's private business markets business after the end of the company's 30-day exclusivity period with AMP. The March 29 announcement came after Ares in late February agreed to buy 60% of the private markets businesses of AMP Capital for A$1.35 billion. It also followed The Australian Financial Review's report that Challenger Ltd. was considering buying AMP Capital's public markets businesses.

Meanwhile, owners of Hong Kong Life Insurance Ltd. are said to be making their third attempt to find a buyer for the business. Hong Kong Life has attracted potential suitors, and Bloomberg News cited unnamed sources as saying China Strategic Holdings Ltd. was in talks to buy the business, which could be valued between $400 million to $500 million. The discussions were said to be ongoing and no final decision had been made.

In China, JD.com Inc. was said to be in early-stage discussions to acquire a portion or all of Yongjin Group's 27% stake in Sinolink Securities Co. Ltd. A 27% stake in Sinolink was worth around 10 billion yuan, based on the brokerage's market value of 39 billion yuan on March 11.

In Southeast Asia, where potential deal activity remained relatively muted in March, Indonesian peer-to-peer lender PT Alami Fintek Sharia, or Alami Technologies, reportedly acquired Sharia-compliant rural bank PT BPRS Cempaka Al-Amin in a transaction valued at less than $10 million, DealStreetAsia reported.

Further articles about other deal possibilities

UBS in talks to raise stake by 16% in Chinese securities unit

Indian Bank directors OK sale of stake in ASREC JV