With more U.S. oil and gas producers likely headed for bankruptcy, midstream firms are bracing for a wave of upstream customers trying to get out of gathering, processing and pipeline contracts. The terms of those contracts, as well as how courts handle them, will determine how protected the midstream operators are.

The outlook from executives and credit analysts is dire across the board. Kinder Morgan Inc. CEO Steven Kean said in May that 2020 will be "worse" for exploration and production company bankruptcies than the last oil price rout in in 2015 and 2016. Moody's, meanwhile, recently downgraded the global pipeline sector's outlook to negative from stable for the first time in part because U.S. drillers filing for Chapter 11 protection will more aggressively target their pipeline contracts than during the previous crisis.

Attorneys with expertise in energy sector bankruptcies are also expecting the number of those disputes to balloon.

"I think we're going to continue to see this issue arise just because it can be such a key component of a producer's operations," Haynes and Boone LLP restructuring attorney Eli Columbus said in an interview. "We're in a little bit of an unprecedented time in the market."

Running with the land: When agreements tie to property

How a midstream agreement is set up can have major implications for how it is treated during a bankruptcy, according to Foley & Lardner LLP's John Melko. The agreements and their legal precedents may prove crucial for midstream operators as bankruptcy grows more prevalent among their producer customers.

For example, midstream gathering and processing agreements are often written as real property interests, as opposed to executory contracts. A real property interest, which is tied to the property, cannot be rejected in bankruptcy, unlike an executory contract, which obligates the debtor and or another party to fulfill its terms at a later date.

Some covenants, or legal contracts, can "run with the land," meaning that rights or limitations apply to not only current landowners but also to future ones. "It doesn't give the gathering company an interest in the minerals themselves ... but it does give them this covenant — sort of like an easement — that attaches itself to the mineral interest, such that when the oil and gas is produced, it's committed ... to flow through that gathering system," Melko said in an interview.

The devil is often in the details with these types of covenants. Midstream operators have had to grapple with whether they could satisfy "touch and concern" requirements, which involve demonstrating that their covenants impact how the land is used or valued, and whether covenants running with the land have been formally conveyed, or transferred. If done correctly, Melko noted, covenants running with the land are also legally recorded to back up ownership claims.

Those legal principles were tested during the last oil price downturn when shale producer Sabine Oil & Gas LLC filed for Chapter 11 protection in July 2015 and asked to nullify its contracts with midstream firms Nordheim Eagle Ford Gathering and HPIP Gonzales Holdings LLC just a few months later. Nordheim and HPIP argued the contracts could not be rejected because they involved property rights that, under Texas state law, run with the land.

But a judge for the U.S. Bankruptcy Court for the Southern District of New York in 2016 ruled that Sabine could reject them.

As Nordheim pursued appeals through the courts, it argued that it did not have to show "horizontal privity," which requires that the original parties to the covenant have a mutual interest in the land at the time the covenant was executed. The U.S. District Court for the Southern District of New York and the U.S. Court of Appeals for the 2nd Circuit upheld the 2016 decision. The federal court of appeals in 2018 ruled in favor of Sabine because "there is no benefit to real property of Nordheim. ... It is Nordheim as an entity — not its real property — that is benefited by the agreement."

The courts reached a different conclusion, however, when Utah-based Badlands Energy LLC filed for Chapter 11 in 2017. Badlands sold assets to Wapiti Utah LLC that had gas gathering and processing agreement with Monarch Midstream LLC — but because Badlands rejected the Monarch contract in the course of the bankruptcy, the agreement did not initially transfer to Wapiti. Monarch challenged, and even though Utah state law's touch and concern statute does not require formal real property conveyance, the U.S. Bankruptcy Court for the District of Colorado in September 2019 still concluded that the contracts were covenants running with the land. Wapiti had to honor the covenants.

|

Precedent amid pandemic pains

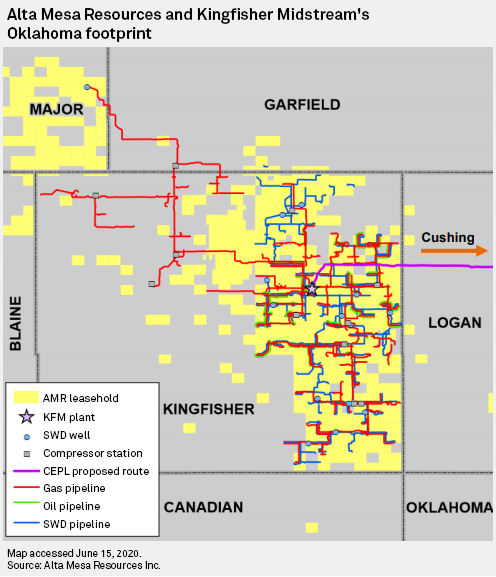

The most recent decision that could come into play in midstream-upstream contract struggles is a Texas bankruptcy judge's December 2019 ruling that pure-play STACK operator Alta Mesa Resources Inc. and subsidiary Alta Mesa Holdings LP cannot use Chapter 11 proceedings to reject oil and gas gathering contracts with Kingfisher Midstream LLC.

"[W]hile Alta Mesa retained the right to determine whether and when to capture its mineral reserves, it surrendered the right to determine what happens to the reserves once it drills," Judge Marvin Isgur of the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division wrote.

Turning to the present day, Whiting Petroleum Corp. became the first big shale producer to file for Chapter 11 protection amid the oil price collapse and novel coronavirus pandemic. Whiting is getting out in front of any potential contract disputes by reassuring its midstream providers that operations will proceed as usual.

"Whiting has significant liquidity, which will allow us to operate our business in the normal course and maintain productive commercial relationships with the company's partners and counterparties," according to the driller's website. "This announcement is not expected to impact operations and normal commercial relationships are expected to continue with minimal disruption."

But if an upstream customer filing for bankruptcy now contests a gathering or processing contract's real property interest, pipeline industry veterans such as Williams Cos. Inc. President and CEO Alan Armstrong are confident that a court would side with the midstream operator. He said in December 2019 — when a surge of potential producer defaults was already on the horizon — that he has never seen one of Williams' gathering contracts get rejected by a customer going through bankruptcy.

At the same time, though, Armstrong has "seen plenty of long-haul pipelines that have gotten stiffed" as well as "processing contracts where we don't own the hardware back to the wellhead."

Getting to the negotiating table

Many pipelines and producers will likely opt to settle instead of continuing down the long and expensive road of litigation, Haynes and Boone's Columbus said, pointing to the commercial resolution recently reached by Sanchez Energy Corp. and subsidiaries of its midstream arm Sanchez Midstream Partners LP.

The agreement between the bankrupt driller and Carnero Processing LLC and Catarina Midstream LLC reduces costs and concedes certain minimum volume commitments, or MVCs. Sanchez Midstream's intrastate Seco natural gas pipeline will also "enter into two new transportation agreements with [the] debtors," but the details were not disclosed.

"Simply put, the debtors cannot operate successfully without the assistance of midstream service providers that gather, transport, process and market their oil and gas," attorneys for Sanchez Energy said in a document filed with the U.S. Bankruptcy for the Southern District of Texas, Houston Division on June 6. "Considerable time and expense would be expended by the debtors to prepare for litigation of these issues with risk that the debtors would not prevail."

According to Foley & Lardner's Melko, asking bankruptcy courts to reject midstream contracts itself is really just a tactic to bring pipeline companies to the negotiating table.

"The debtor uses the threat of trying to reject the contract and challenging whether the covenant's valid as a price renegotiation," Melko said. "If that gathering system was built when oil prices were significantly higher, the field economics can be pretty tough."

Bankruptcy courts and FERC

Firm transportation agreements for long-haul gas pipelines, on the other hand, are more similar to executory contracts — those that are focused on the duties the parties are expected to fulfill — and "virtually never backed up with a covenant running with the land," according to Melko. But while executory contracts can be rejected in bankruptcy courts, interstate pipeline operators such as Rockies Express Pipeline LLC and Stagecoach Pipeline and Storage Co. LLC are asking the Federal Energy Regulatory Commission to exercise its Natural Gas Act authority to review any such attempts by producer customers.

In the case of Rockies Express, shipper Ultra Petroleum Corp. requested a stay from a federal bankruptcy court in Houston to keep FERC from stepping in as the driller tries to nullify $27 million of annual pipeline obligation. Even though courts have generally ruled that jurisdiction over green-lighting contract rejections lies with bankruptcy courts, pipelines still want FERC involved in the event that those decisions impact how much other shippers must pay.

"They have an argument that if a debtor rejects a transportation contract, that rejection in and of itself might cause the price that the other shippers on the line have to bear to go up," Melko said. "But I have not yet seen a case where bankruptcy court has agreed where debtor rejection of contract is in effect going to force a price adjustment to other, non-debtor shippers."

As shale gas giant Chesapeake Energy Corp. lurches toward a Chapter 11 filing, Stagecoach Pipeline in June became the latest operator to request "expedited action so that the commission's authority is clarified prior to, or as soon as possible after the filing of, any bankruptcy proceeding." Stagecoach argued that the commission's concurrent jurisdiction with bankruptcy courts under the Federal Power Act applies equally under the Natural Gas Act, and the rejection of contracts in bankruptcy does not alter regulatory obligations under the natural gas law.