Lloyds Banking Group PLC is set to continue its push into wealth management and insurance following the forthcoming departure of its leadership team, but the coronavirus pandemic may curtail its immediate ambitions.

Lloyds' chairman, Norman Blackwell, will be replaced by Robin Budenberg, the London chairman of banking advisory firm Centerview Partners LLC, in early 2021. Lloyds also said long-standing CEO António Horta-Osório will step down at the end of June 2021 after more than a decade in charge.

Under Horta-Osório the bank has built up its insurance and wealth management operations, which operate mainly under its Scottish Widows brand. It formed a joint venture with Schroders for wealth management, aiming to become a top three financial planning firm by 2023, and acquired Zurich Insurance Group AG's £19 billion workplace pensions business in 2018. The bank's insurance and wealth arm reported a £1.1 billion underlying profit in 2019, up 19% over the previous year.

Horta-Osório said before the pandemic hit that the bank would begin work on a new strategy over the summer as it comes to the end of its latest three-year plan, which included the expansion of Scottish Widows. Lloyds said the timing of the succession "will allow a new CEO to work with the new chair in the next stage of the group's development and transformation."

Pandemic challenge

However, though analysts expect the bank to continue to diversify by building up its fee-based income operations and reducing its dependency on the net interest income provided by traditional banking, the speed at which it is able to do so is likely to be reduced, said Fahed Kunwar, an analyst at equity research company Redburn.

"The plan would have been to continue with an acquisition-led strategy to build up the wealth management operations, but COVID-19 has made a massive dent in profits and that raises questions over how acquisitions would be funded, even though banks can pick up loan books quite cheaply at the moment," he told S&P Global Market Intelligence.

Lloyds' profit fell sharply in the first quarter of this year after it took £1.43 billion of impairment charges to cover expected credit losses. The Bank of England's decision to cut interest rates to a record low of 0.1% from 0.75% in March will hit banks' earnings hard and the central bank has said it is reviewing the possibility of moving to negative interest rates.

The coronavirus crisis has increased the need for the bank to find other sources of income as concerns mount about the banking sector's profitability in the wake of the crisis, said Jefferies analyst Benjie Creelan-Sandford.

"Its recent focus has been on bancassurance and wealth management and that is not surprising, given where interest rates have got to and the pressure on the top line as a result. If the Bank of England follows the ECB into negative rates that would put even more pressure on net interest income," he said in an interview.

The appointment of Budenberg raises the possibility that the bank might be preparing for mergers and acquisitions activity.

He formerly worked at UBS Group AG and was heavily involved in assisting the U.K. government when it bailed out key banks, including Lloyds, during the global financial crisis. He later led U.K. Financial Investments, the group which handled the government's stakes in banks.

Lloyds' CFO William Chalmers is also a former investment banker who joined from Morgan Stanley.

"Budenberg and Chalmers together could point to an increased interest in M&A, but the CEO going now probably indicates that the plan is going to take bit longer to achieve than they thought before the coronavirus crisis," said Kunwar.

Potential successor

Horta-Osório's replacement is likely to be an internal candidate, said Kunwar, not least because U.K. bank bosses tend to be under greater public scrutiny than their European counterparts.

"The consequences for U.K. bank bosses when things go wrong are much worse than for their European peers. I think that was part of the reason for the protracted search for a CEO at HSBC and RBS, both of which ended by appointing an internal candidate," he said.

"Also, an external candidate would have to join the bank and trust the loan book in a recession."

John Cronin, an analyst at stockbrokers Goodbody, said Lloyds' "forward-looking" board might take a different direction with Horta-Osório's successor.

"We would posit that a traditional banker might not be the right fit given the way the board seems to be thinking about strategic evolution. There is a strong prospect that Lloyds will plump for a seasoned executive with deep experience of banking as well as, ideally, insurance and wealth," he said in a note to investors.

Among potential internal candidates are Vim Maru, Lloyds' head of retail banking or the head of commercial banking, David Oldfield, said Kunwar, both of whom have been key in handling the bank's response to the coronavirus crisis. Alison Brittain, CEO of Whitbread but also a former Lloyds head of retail banking, is also likely to be a candidate, said Kunwar.

Cronin suggested Jean-Paul Mustier, head of UniCredit SpA, could be a candidate to replace Horta-Osório or the former RBS boss Stephen Hester.

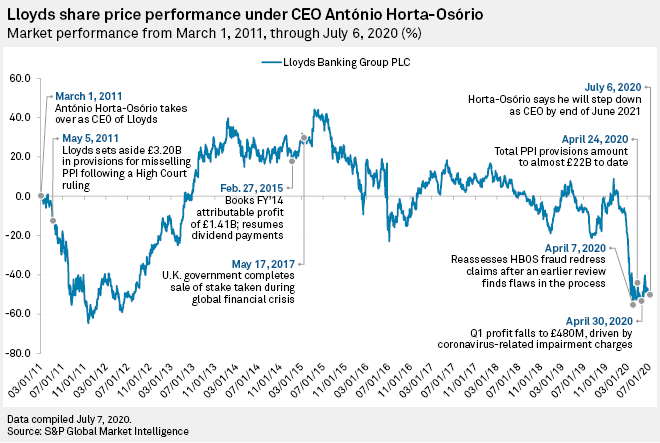

Horta-Osório took over at Lloyds in March 2011 in the wake of the financial crisis when it was a state-backed lender that had been rescued from the brink of collapse by a £21 billion government bailout. He oversaw the sale of the government's 43% stake at a profit of nearly £900 million as well as meeting a list of state-aid-related penalties imposed following the bailout, including divesting 631 branches.

The bank also grappled with the payment protection insurance scandal which weighed heavily on profitability. It was Horta-Osório's decision to start compensating customers over the issue, putting aside £3.2 billion to do so, which led to other banks following suit. The PPI scandal eventually cost Lloyds more than £22 billion in penalties and customer compensation over the misselling scandal — about the same as its present market capitalization.