Dominion Energy Virginia often says that its electric retail rates for residential customers are "well below state, regional and national averages." But Dominion Energy Virginia, known legally as Virginia Electric and Power Co., has also tacked a number of riders — also known as rate adjustment clauses — onto its base rates in recent years.

Those RACs now make up a significant and growing portion of the company's overall revenues, and many consumer advocates and commercial customers consider them hidden surcharges.

This has driven efforts by major companies like Walmart Inc. and Costco Wholesale Corp. to "escape" from Dominion's monopoly electricity supply and sign contracts with independent power producers. Although it has denied those requests, the Virginia State Corporation Commission acknowledged a "decade of rising rates" and advised the companies to take their fight to the state legislature.

"Dominion often likes to talk about its rates being the lowest in the region, but consumers don't pay rates, they pay bills," said Brennan Gilmore, executive director of Clean Virginia. "[Dominion has] been able to create a system where they can stack on a lot of additional fees into bills by the time that they get to the consumer."

Dominion Energy Inc. executives in a March 2019 investor day presentation said the typical monthly residential bill for Dominion Energy Virginia customers is 18% to 22% lower than the U.S. average and is expected to increase "less than or equal to U.S. inflation" through 2028. This was based on the Edison Electric Institute's analysis of typical bills and average rates for the summer of 2018.

An EEI report that analyzed typical bills and average rates in effect on Jan. 1, 2019, showed that Dominion Energy Virginia's bills were slightly below the average in its region, though much higher than some of its peers in other states.

A controversial freeze on rate reviews by regulators in 2015 was replaced with a system that establishes reviews every three years, rather than every other year.

Ahead of their next rate reviews, the SCC showed in a late August report that Dominion Energy Virginia and American Electric Power Co. Inc.'s Virginia utility Appalachian Power Co. earned millions in excess revenues for the second year in a row.

Dominion Energy has said the additional revenues it earns will be earmarked for SCC-approved investments, such as its 12-MW Coastal Virginia Offshore Wind project and grid enhancements.

"Reinvesting the revenue ... will enable us to give our customers what they want while also keeping rates low," Dominion Energy spokeswoman Audrey Cannon told S&P Global Market Intelligence.

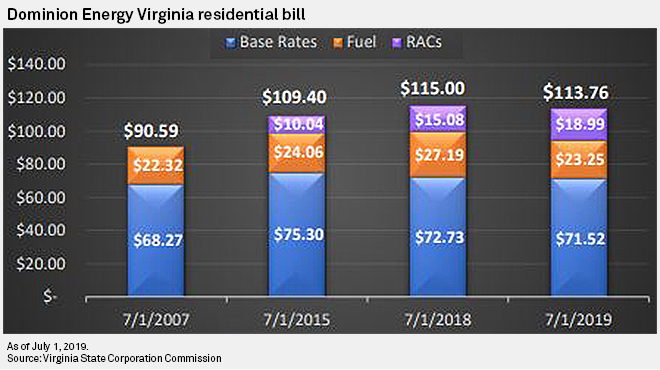

Still, the SCC's August 2018 report noted that Dominion's residential bill has increased nearly 27% since Virginia ended its experimentation with retail choice in 2007.

Dominion's average monthly residential bill was $90.59 on July 1, 2007. By the time the Grid Transformation and Security Act took effect July 1, 2018, the residential bill had hit $115.

As part of this increase, Dominion Energy Virginia has more than a dozen RACs that it charges customers on top of its base rates, according to the SCC. The majority of these charges are tied to electricity supply, with four attached to combined-cycle natural gas plants.

By comparison, customer bills from Appalachian Power include six rate riders, with one tied to its 625-MW combined-cycle Dresden Energy Facility.

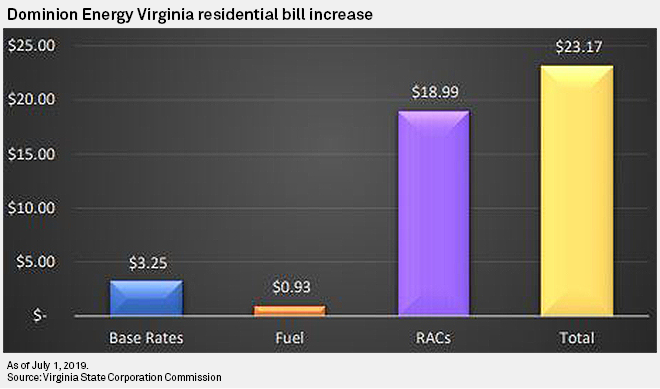

As of July 1, 2019, the typical residential bill for Dominion Energy Virginia customers was $113.76 with $18.99 tied to RACs, according to the SCC.

Base rates grew by only $3.25, the SCC found.

Dominion Energy executives told investors in late March that Dominion Energy Virginia's rate base is expected to grow to $32 billion to $34 billion in 2023 from $23 billion in 2018. The utility said that about 17% of its 2018 overall rate base came from generation riders.

In its 2018 integrated resource plan, the utility calls for $12.1 billion in capital investments, including eight new gas-fired peaker units, additional solar generation capacity and grid transformation programs. Most of those costs will be recoverable through RACs.