A weakening economy, rising bank provisions and tumbling property prices are heightening fears that Dubai could face a repeat of 2009 when the government and government-owned companies restructured multibillion-dollar debts, plunging the emirate into recession.

Those fears may be unfounded, analysts say, with reforms instituted following that crisis having positioned banks to better deal with increased defaults, whether by the government, businesses or consumers. But banks' exposure to real estate may still leave them vulnerable.

Ostensibly, Dubai's economy seems steady, with GDP forecast to expand 2.1% this year, up from 1.9% in 2018, according to official data. Yet other indicators paint a markedly gloomier picture, with the IHS Markit Dubai Purchasing Managers' Index slumping to a 3.5-year low in August as three major sectors — travel and tourism, wholesale and retail, and construction — all weakened.

Property prices, meanwhile, have fallen 31% from a mid-2014 peak, according to consultants ValuStrat, echoing the crash of 2009 to 2011, when prices plunged by more than half. The Arab Spring subsequently sparked a rebound as money and people fled conflict-hit countries such as Egypt and Syria, and the 2013 award of hosting rights for Expo 2020 propelled house valuations to record highs.

Since then, however, an oil price slump, the Qatar blockade and heightened tensions with Iran have constrained Dubai's economic growth, with overly ambitious tourism targets quietly revised and reduced government spending across the UAE prompting job losses and a markedly weaker consumer sector.

Ehsan Khoman, head of MENA research and strategy at Japan's Mitsubishi UFJ Financial Group in Dubai, said a lack of frequently reported data meant it is challenging to fully comprehend how Dubai's economy is performing. But the figures that are publicly available do suggest that economic activity remains tepid, he said.

"Whilst the real estate sector may continue to correct, our expectation is that this will not result in any major strains on [bank] balance sheets with less leverage in the space vis-à-vis the previous downturn which was broadly fueled by credit," he said.

Real estate exposure

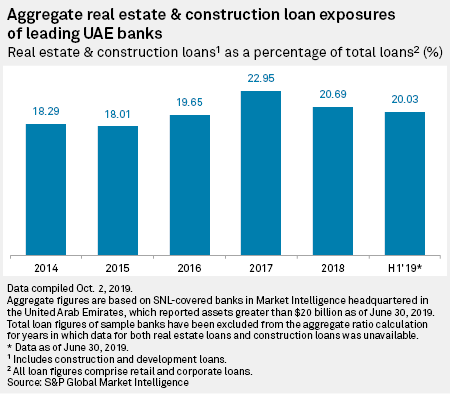

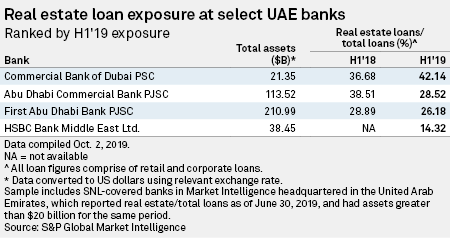

In 2015, lending to real estate and construction constituted about 18% of leading UAE banks' total lending, while in the second quarter of 2019, this figure had climbed to 20%, according to S&P Global Market Intelligence data.

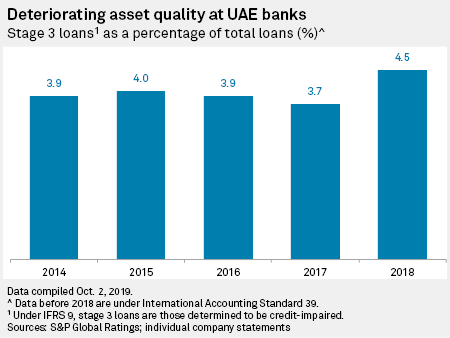

Asset quality at UAE banks has deteriorated, with credit-impaired "stage 3" loans ticking up to 4.5% of total loans at the end of 2018, from 4.0% in 2015.

"Over the last four years while the real estate market has been deteriorating, banks' real estate exposure has also increased, so the quality of their loan portfolios is unlikely to be robust as it was in 2015," said Asad Ahmed, managing director of Alvarez & Marsal Middle East, predicting that some banks' 2019 full-year impairments will be double-digit percentage points higher than in 2018.

Despite weak demand, Dubai residential supply will increase to 659,000 units at 2021-end versus 536,000 in mid-2019, consultants JLL forecast. House prices fell a further 9% year over year in the second quarter, JLL estimates, while commercial real estate occupancy rates and rental values also extended declines. S&P Global Ratings forecasts Dubai's real estate prices will fall by 5% to 10% in 2019.

"Banks have exposure on both sides of real estate — as providers of capital to real estate developers and as providers of mortgage financing," said Ahmed, noting that the sustained drop in property prices since 2014 means that many Dubai property buyers would have seen their equity wiped out.

"The buffer that this equity provided to banks may also have disappeared," he said.

In a September note, Fitch Ratings warned that UAE banks have not fully recovered from the earlier property crash.

"Banks' stage 2 and stage 3 loans are already high, averaging 15% to 20% of gross loans together, and are likely to increase," the rating agency warned. Fitch said smaller banks are more vulnerable to deterioration in credit conditions due to thinner capital buffers and lower revenue generation.

Contractors hit

The slump has also hurt Dubai's listed contractors.

Shares in Arabtec have plunged 90% over the past five years as the builder posted combined losses totaling 5.7 billion dirhams in 2015 and 2016. It made a net profit of 256 million dirhams last year.

Contractor Drake & Scull is under investigation by the UAE market regulator, after the company reported a loss of 4.5 billion dirhams in 2018. The company's shares have been suspended since November 2018, while it owed 5.4 billion dirhams in bank borrowings and other debts at the end of 2018.

"The banking sector has concentrated exposure to the real estate and related sectors," Fitch notes. "The default of one large single borrower could cause fast deterioration of asset quality at one or more banks."

UAE banks' aggregate lending portfolio totaled 1.7 trillion dirhams at 2018-end, of which 65% was wholesale corporate loans, according to a July report by the central bank. Retail loans (21%), lending to government entities (12%) and lending to non-bank financial institutions (2%) constituted the remainder.

Dubai government and government-related entities have combined debts of around $124 billion, which is more than 100% of 2018 GDP, S&P Global Ratings estimates, while in September Fitch warned that a "significant portion" of the $23 billion owed by the Dubai government and due to mature by the end of 2021 may be restructured.

Much rests on whether the 40 billion dirham Expo 2020 can achieve its target of attracting 25 million visitors — or 144,500 per day — during its six-month run.

"There's risk that once the Expo is over, revenues in the real estate, construction, hotel and retail sectors turn out to be weaker than expected, causing some firms to struggle to service their debts," said James Swanston, Middle East and North Africa Economist at London's Capital Economics.

"Many [government-related entities] must service high levels of debt over the next few years. If they struggle to make these repayments, we suspect that Abu Dhabi would come to the rescue again."