Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Nov, 2022

Investors and analysts are starting to push beyond the hype about artificial intelligence and ask more questions about AI software companies' near-term growth prospects.

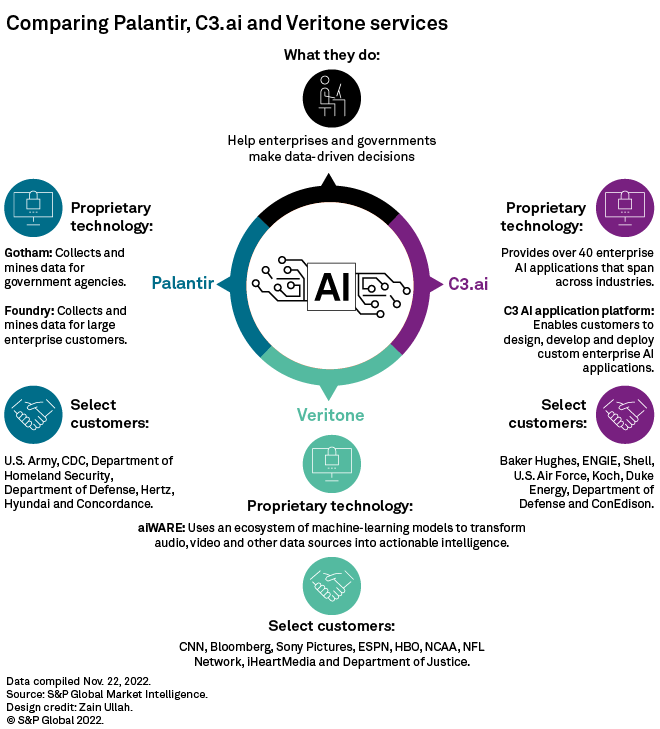

Professional service and software providers including Palantir Technologies Inc., C3.ai Inc. and Veritone Inc. market themselves as AI companies with high growth potential, offering services to enhance enterprise analytical capabilities in sectors like cybersecurity and telecommunications. But amid a tech market downturn, these companies are struggling to convince Wall Street they can withstand the pressures of a weakened macroeconomic environment.

"We believe chunky data analytics projects are more likely to be put on hold in a weaker growth environment," Goldman Sachs analysts said in a Nov. 8 note following Palantir's third-quarter 2022 earnings call.

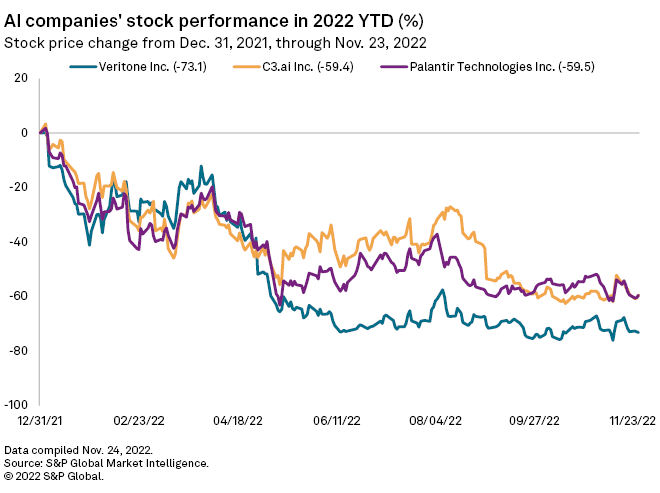

All three stocks have been hard-hit amid the broader sell-off in tech stocks in 2022, with Palantir and C3.ai both down about 59% year-to-date as of Nov. 23. Shares in Veritone were down about 73% over the same period.

Devil in the data

At their core, AI players are companies that provide a mix of professional services and software to achieve outcomes for clients across industries. Some analysts say that despite the near-term headwinds, AI companies have long-term potential as they continue to evolve and the demand for analytical insights grows.

"These are data companies today, that's the strategy," said Tejas Dessai, a disruptive technology analyst at Global X ETFs. "Tomorrow, they'll be able to deliver very specific AI applications on top of that."

Palantir, for instance, works with the U.S. government to provide services to its armed forces, such as military readiness and resource planning solutions. Outside of defense, the company provides other services, including hospital operation insights or anti-money laundering detection tools.

C3.ai provides enterprise AI applications across industries, while Veritone helps customers translate audio, video and other data sources into actionable intelligence.

Pullback in spending

C3 executives recently warned of the impact of a weaker economy, noting that the company is having to pursue more small contracts.

"I think trying to sell $10 million, $20 million, $30 million, $50 million, $60 million transactions in the next year could be pretty tough," C3 CEO and founder Thomas Siebel said during the September earnings call. "Large chemical companies, manufacturing companies, food companies — I mean these guys are all going to the bunkers. They're preparing for a recession."

C3 faces "massive headwinds" with heavy competition in a tough macroeconomic landscape for next year, Wedbush Securities analyst Dan Ives said in an email.

One upside for C3, however, is its diverse array of customers. If an AI services company provides offerings to enough sectors, it is bound to have exposure to poor macroeconomic conditions, noted Nick Patience, research director of the AI, big data and analytics channel at 451 Research.

Veritone is in a slightly different situation. Many of its customers are concentrated in the media industry, including a number of cable networks and Sony Pictures.

While Veritone has grown revenue substantially in recent years, it has struggled to turn a profit. It also carries a relatively heavy total debt load of $200.0 million as of the end of the third quarter, giving it a total debt-to-EBITDA ratio of 13.3x.

Intelligent ultimatum

Despite mixed perspectives on AI, analysts say there is still room for a growth story.

Dessai at Global X said AI services are a value-add to productivity and current economic conditions are a temporary obstacle. The analyst has a bullish outlook for the industry over the next two to three years, even with mixed earnings results.

451 Research's "Voice of the Enterprise: AI & Machine Learning, Use Cases 2022" found that among 772 surveyed IT end-user decision-makers, more than 95% expected their organization's AI initiatives to deliver a positive return on investment. The largest percentage, 26.2%, expected an ROI between 26% and 50%. Nearly 21% expected an ROI between 51% and 75%. Only 4.6% expected zero return or a negative return.

AI companies should focus on providing services that enable organizations to get up and running with software applications that address an ongoing organizational problem, a service that people are more willing to pay for even during periods of macroeconomic uncertainty, Patience said.

AI companies could also benefit by focusing on industries that have historically performed well in times of downturn, such as cybersecurity and defense, Dessai said, adding, "What really will be the differentiator [for growth] is in the type of clients these [AI] companies can share."

451 Research is part of S&P Global Market Intelligence.