Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Aug, 2021

By Anser Haider

After a late start converting to 5G, Apple Inc. is quickly making share gains among adopters of the next-generation wireless technology — a trend expected to continue with the company's upcoming fall device launches.

The selling point for the new iPhone this year is expected to be 5G, especially for Apple fans who are still holding on to aging 4G devices.

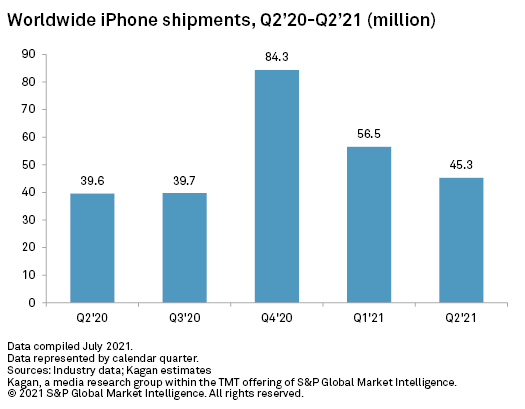

Last year's iPhone 12 was the first to offer 5G network support. Shipments of the device reached 84.3 million units after its debut, up more than 17% year over year from 71.8 million shipments, according to estimates from Kagan, a media research group within S&P Global Market Intelligence.

"With very strong sales of the iPhone 12 lineup from the past three quarters, Apple is very optimistic that there will be plenty of 5G upgrades expected in the future, given that cumulative 5G-enabled iPhone shipments so far represent less than 1% of the 1.09 billion iPhones installed globally," said Milan Ringol, a technology research associate at Kagan.

Apple typically unveils its new iPhones in the second week of September and launches them later in the month, although the iPhone 12 unveiling was delayed until October 2020 due to production issues caused by the COVID-19 pandemic. Apple did not respond to a request for comment about the upcoming fall release.

"Apple has dominated the 5G market with 29% market share and we expect this to spike when the new phones go on sale," said Ken Hyers, director for emerging device strategies at Strategy Analytics. "It won't come as a surprise if we see them take close to 40% of the 5G handset market share."

5G bump

Kagan estimates worldwide smartphone shipments will hit 1.30 billion units by year-end 2021, up 0.8% year over year. That represents a rebound after smartphone shipments fell 6.6% year over year in 2020 due to severe supply chain constraints as well as the pandemic's indirect influence on demand.

Ringol noted that many mature markets such as the U.S. and parts of Western Europe and East Asia are already saturated with smartphone ownership, with penetration rates at or above 90% over the past three years. These factors have contributed to consumers holding onto their devices longer before replacing them with new devices, lengthening replacement cycles and consequently dragging shipments down.

"The 5G rollouts have been a slight boon for manufacturers, including Apple, as they have revitalized some of those stagnating markets," Ringol said.

Wireless carriers are paying significant subsidies to move users to the newer standard, and the next iteration of the iPhone will help to usher in an array of development that spotlights 5G's upgraded capabilities, Tim Lesko, principal at Granite Investment Advisors, said.

"Developers cannot design apps to benefit from 5G until more people have 5G and the networks are more robust," Lesko said. "Apple will lead that trend as more iPhone users upgrade hardware and software at a faster pace than any other platform."

Design expectations

Analysts expect few design changes to what many are already calling the iPhone 13, in keeping with Apple's recent naming convention.

Aside from 5G functionality, the next iPhone is expected to include a new camera and video-recording features, a faster chip, larger batteries, and a smaller notch or display cutout. The phone is expected to retain the same size configurations as the iPhone 12, with a 6.1-inch regular model, 5.4-inch mini model and 6.1-inch and 6.7-inch pro models, based on online leaks by Apple insiders.

That would leave out some features that are already popular with Android phones, noted Strategy Analytics' Hyers.

"There doesn't seem to be an under-display fingerprint sensor or facial recognition camera, which is disappointing, as those solutions have been around a couple of years from Android vendors," Hyers said. "Apple isn't particularly fast when it comes to adopting new smartphone trends."

Hyers said Apple will likely tout the camera features as a major draw for the new iPhone.

While the smartphone industry has been recovering from the disruptive impacts of the pandemic, long-term effects from demand for semiconductors remain in multiple industries and continue to impact companies including Apple. The iPhone maker cautioned during its last earnings call that supply constraints will be worse in the current period than they were in the June quarter.

"We'll likely see the usual limited stock availability in the first few months as supply will struggle to catch up to demand," said Kagan's Ringol.

Apple's market power could help it to secure more supply, according to Strategy Analytics' Hyers.

"In the long-term perspective, suppliers who won Apple as a customer don't want to potentially hurt their relationship and will go out of their way to ensure Apple gets dibs over others," the analyst said.

Location

Segment