America's pure-play shale gas drillers uniformly kept their message simple in fourth-quarter earnings calls over the past month: hold spending flat and generate extra cash as commodity gas prices recover from near-record lows in 2020.

The producers said they will first use extra cash to pay down debt. The exception was Pennsylvania dry gas driller Cabot Oil & Gas Corp., which said it will consider adding an extra dividend at the end of the year to keep paying out 50% of its free cash flow to shareholders.

While Haynesville Shale producer Comstock Resources Inc. said it was able to capture some of the skyrocketing price of gas during Texas' winter crisis, the Appalachian drillers shrugged off their sales into Texas as the state struggled when its infrastructure froze.

Investors are growing more comfortable that the historical shale overspenders might now be shale misers, analysts said, but the sector needs to keep showing Wall Street continued restraint. "While earnings season messaging was favorable regarding producer capital discipline, this will remain a key area of focus into next earnings season as well," Goldman Sachs analyst Brian Singer said.

After over a year of reiterating the low-cost message, the shale gas sector chose the start of 2021 to roll out environmental goals designed to help maintain the fuel's public image as "clean burning" while satisfying demands for emissions reductions.

At the end of 2019, only two companies mentioned environmental, social and governance goals; at the start of 2021's earnings season that number nearly tripled to five, more than half of the reporting companies, according to S&P Global Market Intelligence data.

Marcellus Shale pioneer Range Resources Corp. set the most ambitious marker of all the gas exploration and production, or E&P, companies when it said it planned to have net-zero direct greenhouse gas emissions by 2025, although it will have to purchase forestry and other offsets to cancel out its own emissions.

Range is realigning its executive compensation to include ESG goals, converting its fracking operations to "e-frack" equipment that uses gas from the well pad instead of diesel, and recycling 100% of its water to eliminate pollution, according to the company's fourth-quarter earnings presentation. "We're focused on being an environmental leader amongst E&P companies, and our compensation framework is aligned with shareholders and our strategic objectives," President and CEO Jeffrey Ventura told analysts.

S&P Global Ratings recently downgraded several fossil fuel producers and increased its risk rating for the oil and gas industry, citing "concerns about the greenhouse gas emissions and the energy transition to renewable energy."

"We expect demand for fossil fuel products to decrease, given the increasing adoption and transition of renewable energy alternatives to address climate change," Ratings said Feb. 24.

At the same time "Wall Street is sending a clear message that ESG performance will be a fundamental input into its investment process," energy analysts at Enverus said. "The investor community is pushing operators to disclose details related to greenhouse gas emissions, diversity and inclusion, and other corporate governance initiatives in a more responsible way."

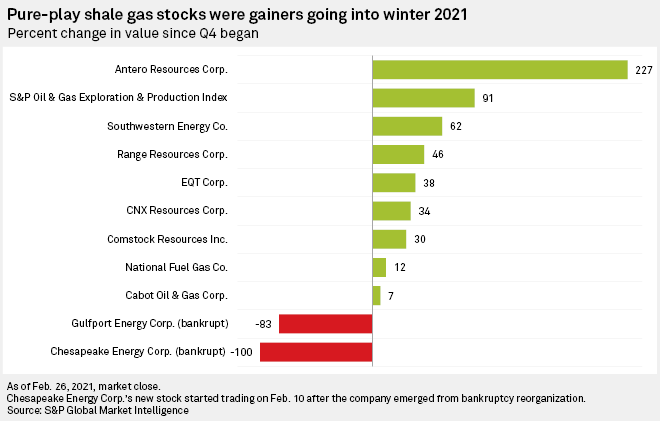

The stock market's reaction to shale gas during and after the quarter continued to be warm after a year that saw the stock prices of several Appalachian shale producers soar as energy investors looked for value and safety in the midst of an oil demand crisis.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.