Finance sector M&A in Asia-Pacific will slow further after the total deal count fell in the quarter ended June 30, as market uncertainties force buyers to become more cautious and selective.

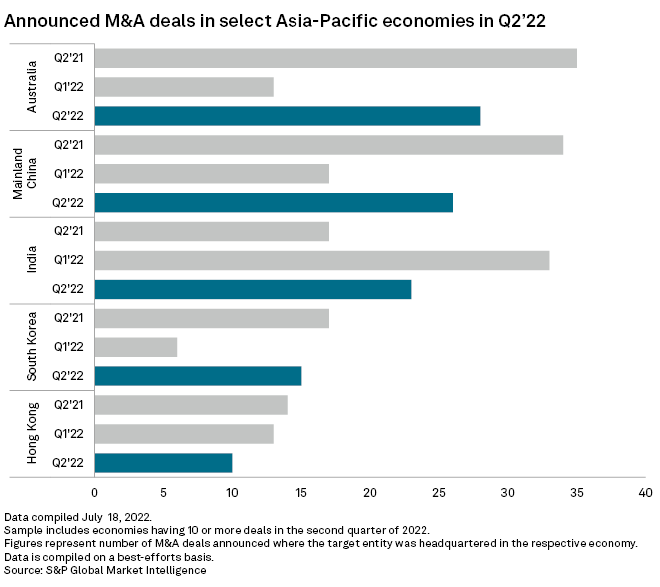

Finance sector M&A deals in the quarter fell to 154 from 165 in the prior-year period, dragged by a slowdown in activity in the banking and nonbanking financial institution sectors, S&P Global Market Intelligence data shows. The ongoing war in Ukraine, rising inflation, interest rate hikes and a bearish market environment will weigh on investors' appetite for deal making.

"Due to some unexpected volatilities, in the short term, some transactions which are signed but not yet closed could be impacted, and transactions currently underway may collapse," said Miranda Zhao, head of M&A for Asia-Pacific at Natixis Corporate & Investment Banking.

For incomplete transactions, parties may seek to rely on material adverse change provisions to walk away, Zhao said, referring to deal provisions to address unforeseen events, such as war, that could impact the target valuation. Some parties may even forgo money already deposited in escrow accounts as a transaction guarantee to avoid completing the transaction.

Russia's invasion of Ukraine in February and the following surge in inflation roiled global equity markets. The S&P 500 index shed more than 20% from the start of 2022 to June before recovering somewhat. The benchmark is still down 17% in 2022. Tesla Inc. CEO Elon Musk in early July filed to terminate a $44 billion deal to acquire Twitter Inc., claiming the social media platform failed to cooperate with requests for information about fake accounts run by bots. Twitter, in a counter filing, said Musk's termination was "invalid and wrongful" and the company did not breach any of its obligations.

Analysts expect continued market volatility and geopolitical tensions to force buyers to become cautious in their hunt for deals.

"M&A activity in [the financial] sector will continue but [deals] will be selective and localized and propelled by a variety of specific criteria," said Brian Chia, a partner at Wong & Partners in Malaysia and chair of Baker McKenzie's Asia-Pacific M&A practice.

Chia expects opportunistic M&A activity to continue. "Insurance companies, for example, continue to view large parts of Southeast Asia as underserved and underpenetrated," Chia said. "They will look to increase market share and reach out to underserved markets by developing new market segments."

In Asia-Pacific, 28 insurance deals were struck in the June quarter, up from 24 in the previous quarter and 25 in the prior-year quarter.

Prospective buyers will also push for more rigorous due diligence, especially around supply chains, potential sanction impacts and financial links to countries impacted by the war, Natixis' Zhao said. In addition, rising interest rates will impact funding feasibility and investors will become more cautious, Zhao added.

Most buyers in the second-quarter finance sector deals remained from within the Asia-Pacific region, according to the data.

Bright spots

A few bright spots for M&A remain though, experts said. Financial technology will remain popular following the COVID-19-driven rush to digitalization. Blockchain and cryptocurrency will be an area of interest for deals despite ongoing troubles in the market.

"The desire to move fast and go deep with tech is rising and this can only be achieved through acquisition of new technology enablers," Chia said. "This will be a key catalyst for tech M&A for financial sector players. In the mid to longer term, neither the pandemic nor the specter of stagflation will temper the inevitable pull to tech."

Investor interest in the region's fintech sector remained robust in the second quarter despite the market sell-off and rising rate environment, according to a July 21 Market Intelligence report. Venture dollars to privately held fintech companies stood at $3.53 billion in the quarter, up 6% from

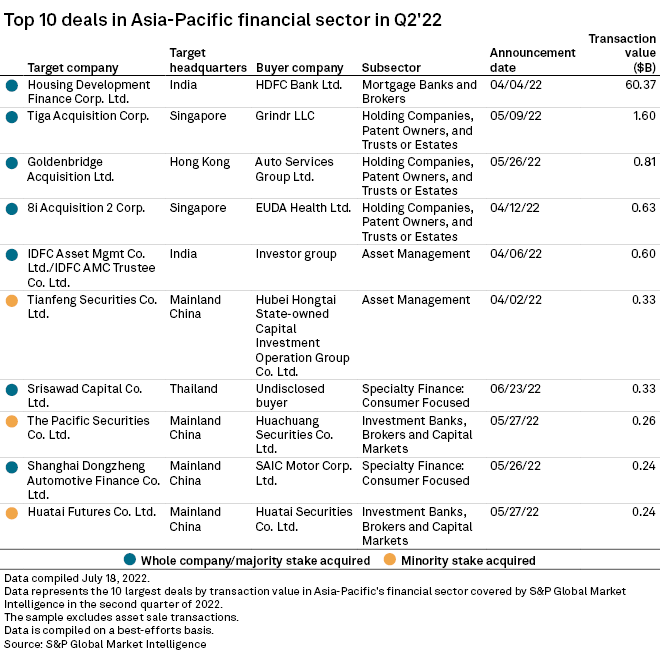

Companies that are in need of funding may also be pressured to sell out to players with deeper pockets, said Daryl Liew, chief investment officer at wealth and asset management firm Reyl Singapore. The market still has some buyers that are interested in acquiring companies, such as many U.S. special purpose acquisition companies that listed between 2021 and the first quarter of 2022, Liew said.

"There is still a lot of dry powder looking for acquisitions as a result of the SPAC listing wave," Liew said. "Current market conditions are extremely unfavorable for growth companies, especially those that are yet to turn a profit."

| *Click here to download a spreadsheet with data featured in this story. *Read more about banks's insurance divestments in Asia-Pacific. |