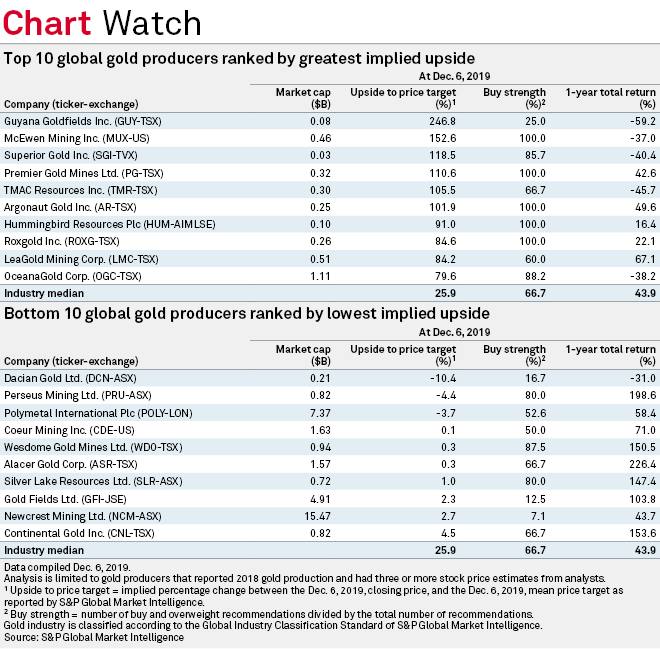

The stocks of global gold mining companies are generally trading lower than analysts' mean target prices, implying a median upside potential to investors of 25.9% across the sector, an S&P Global Market Intelligence analysis found.

The gold companies with the greatest implied percentage of upside to analysts' price targets are generally companies with total market capitalization under US$1.0 billion, according to an analysis of data compiled Dec. 6. OceanaGold Corp. was the only top 10 global gold producer by percentage of potential upside to its stock price with a market capitalization greater than US$1.0 billion.

Guyana Goldfields Inc. was trading 246.8% below analysts' price targets, implying the most percentage upside available through any global gold mining company stock analyzed. The company generated a one-year total loss of 59.2%. Guyana Goldfield's buy strength, which is determined by dividing the total number of buy and overweight analyst recommendations by the number of recommendations available, was 25.0%.

Other gold mining stocks with an upside to analysts' price targets exceeding 100% were McEwen Mining Inc., Superior Gold Inc., Premier Gold Mines Ltd., TMAC Resources Inc. and Argonaut Gold Inc.

Only three of the global gold mining stocks analyzed were trading above analysts' expectations, implying downside. Shares of Dacian Gold Ltd., with a buy strength of 16.7%, had a downside to analysts' price targets of about 10.4%, the highest potential downside of any of the gold companies analyzed. Other gold miners with an implied downside based on analysts' expectations were Perseus Mining Ltd. and Polymetal International PLC.

The data analysis included only gold producers with three or more stock price estimates from analysts that reported gold production in 2018.