Remediation work continued at Lloyd's of London in 2020, with some businesses paring back their books and others even exiting the market altogether. But Lloyd's also welcomed some new businesses; several managing agents are growing strongly amid much improved pricing.

Cuts continue

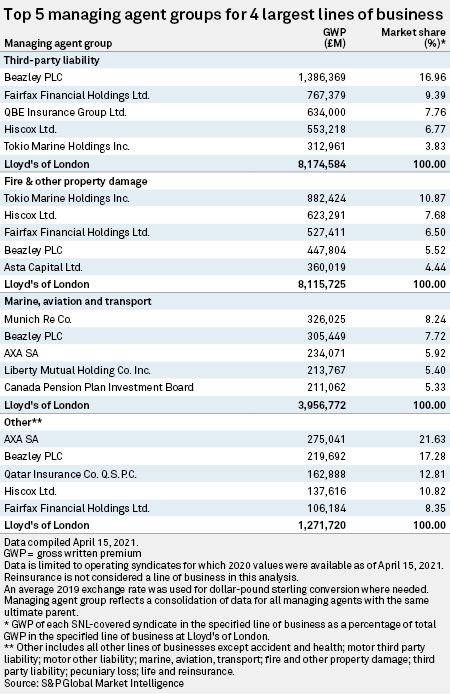

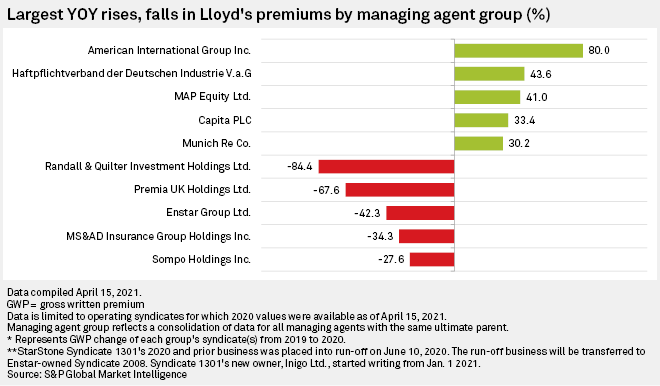

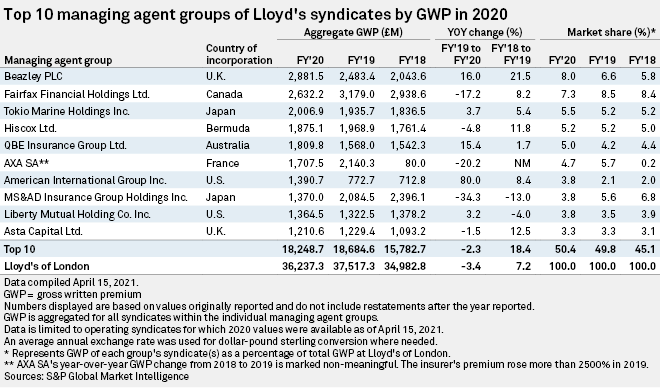

S&P Global Market Intelligence data shows some steep reductions in gross written premiums in 2020 at the managing agent level.

The biggest declines were related to syndicates that had closed in previous years such as Syndicate 5678, which is now managed by Randall & Quilter Investment Holdings Ltd. Enstar Group Ltd.'s 42.3% reduction was driven in part by the decision to put Syndicate 1301 into runoff on June 10, 2020, and because Syndicate 2008 is a dedicated run-off syndicate.

Some of the large drops reflected cutbacks, such as the 34.3% decline at MS&AD Insurance Group Holdings Inc.'s Syndicate 2001. The syndicate in its annual report said the decline was mainly due to underwriting action taken in 2019 and 2020. That included exits from aviation, domestic U.K. property and casualty, pro rata and international casualty, where underwriting had largely stopped on or before Jan. 31, 2021.

There were also a number of full exits last year. Sompo Holdings Inc.'s 27.6% drop in Lloyd's premium came after the company decided in April 2020 to put Syndicate 5151 into runoff as of the end of that year. Other exits included Syndicate 1991, which went into runoff on Nov. 6, 2020, because, according to its annual report, it had "not been able to access sufficient profitable business." Patria Re's special purpose Syndicate 6125 also went into runoff in November "due to concerns that it was unlikely that the syndicate would produce an adequate return on capital."

Overall, Lloyd's said it pruned 19.8% of its gross written premium between 2018 and 2020 in the push for improved profitability. Much of the heaviest lifting may be done as Ekaterina Ishchenko, a director covering Europe, the Middle East and Africa Insurance at Fitch Ratings, said in an interview that a "majority of the work" of exiting unprofitable business was over.

Prices are increasing particularly sharply in many specialty lines Lloyd's writes, creating ideal conditions for growth. Lloyd's said it put through price increases of 10.8% in 2020 compared with a planned increase of 4.6%. While CEO John Neal has said Lloyd's will not drop its guard, he also made it clear that the market is open to growth in the right business and for the right syndicates. He told journalists following the publication of the market's results March 31 that Lloyd's had signed off on business plans to support 7% growth in 2021 and would consider mid-year increases to premium.

On the up

Some Lloyd's insurers are in expansion mode. The fastest-growing managing agency in 2020, according to S&P Global Market Intelligence data, was American International Group Inc.'s Talbot Underwriting Ltd., which posted an 80% increase in gross written premium. That was primarily due to a new syndicate that started writing in 2020 and added $724.7 million of gross premium in its first year.

Some of the restructuring resulted in new beginnings. Startup insurer and reinsurer Inigo Ltd. bought Enstar's Syndicate 1301 and the StarStone managing agency to use as a platform to begin underwriting at the start of 2021. Syndicate 1301's capacity for this year under its new owner is £270 million.

Other new Lloyd's entrants for 2021 include Mosaic Syndicate 1609, managed by Asta, and Brit's Ki Syndicate, which uses algorithms to underwrite business. It also includes a new syndicate-in-a-box, Parsyl Syndicate 1796, set up to insure the transportation of COVID-19 vaccines.

Cost control

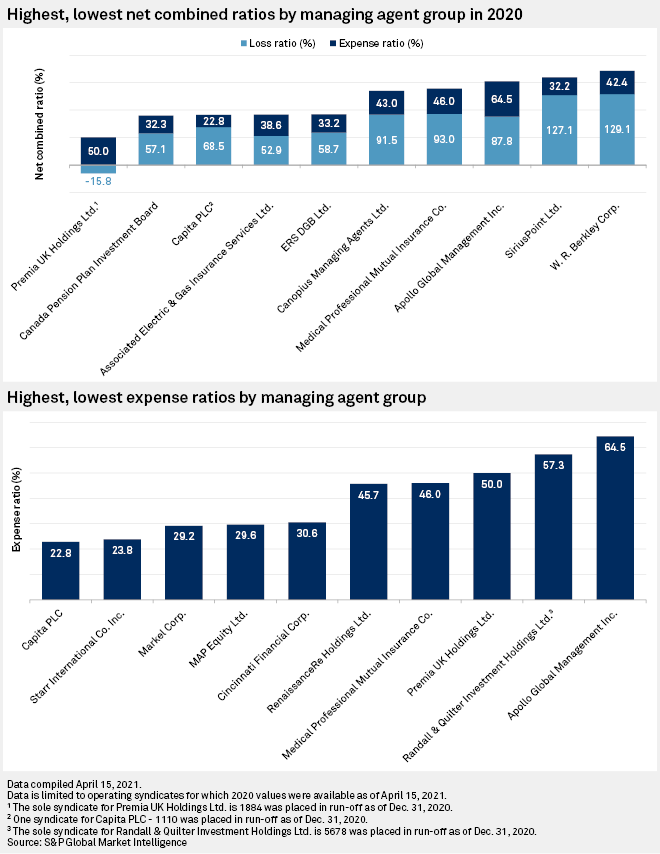

The remedial work is not over, however. Although the market's collective expense ratio fell by 1.5 percentage points to 37.2% in 2020, Neal seemed dissatisfied. S&P Global Market Intelligence data shows that some managing agencies' expense ratios are far above the market average.

The Lloyd's cost base could continue to be stubborn for some time. Ishchenko noted that the progress seen was mainly on administrative expenses and that acquisition costs are largely out of syndicates' control. Though Fitch expects further reductions, Ishchenko said Lloyd's expense ratio would remain higher than that of its competitors.

The efficiency savings promised by the Future at Lloyd's modernization drive will take time to materialize. Robert Greensted, associate director of insurance ratings at S&P Global Ratings, said in an interview that it will likely be a "couple of years" before the improvements started to show up in results. That said, support for modernization efforts, despite previous market reluctance to embrace technology, as well as the coronavirus pandemic boosting digital trading, meant Lloyd's has "a few following winds to help them along," he added.