Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Oct, 2022

|

The nearly 1-GW Traverse Wind Energy Center in Oklahoma began commercial operations in March. |

American Electric Power Co. Inc.'s transmission business continues to serve as the company's crown jewel, with management Oct. 4 unveiling a plan to heavily invest in its regulated wires and renewables business as it steps up emissions reduction goals.

During an investor presentation, American Electric Power, or AEP, outlined a $40 billion capital plan for 2023 through 2027 with nearly $26 billion funneled to transmission and distribution investments, while $8.6 billion has been earmarked for regulated renewables. The company will add 16 GW of renewables from 2021 through 2030 and in March brought online the 999-MW Traverse Wind Energy Center, the final piece of its 1,484-MW North Central wind energy complex in Oklahoma.

AEP plans to spend $15 billion on transmission over the next five years with an investment runway of $35 billion over the next 10 years.

The transmission business has a compound annual growth rate of about 10% from 2018 through 2027, management told analysts and investors. AEP also receives more than 50% of its earnings from its transmission business.

Still, AEP President and CFO Julie Sloat said AEP's transmission business is undervalued compared to its peers and the valuations of recent transactions, specifically FirstEnergy Corp.'s ability to fetch a 40x price-to-earnings multiple in its $2.38 billion deal for a nearly 20% stake in FirstEnergy Transmission LLC.

"This suggests that we have a materially undervalued earnings stream," Sloat said at the company's analyst day in New York. Sloat will take over as AEP's next CEO on Jan. 1, 2023, succeeding Nicholas Akins, who will become executive chairman.

While the transmission business is trading at a 19.8x earnings multiple, the company has no plans to sell a slice of its AEP Transmission Holding Co. business or overall transmission assets.

"The reality is this is core to our business," Sloat said. "We have no interest in necessarily monetizing any of this piece of business."

Wall Street also sees transmission as a valuable part of AEP's business mix and energy transition.

"We appreciate how management framed up the importance of transmission to any decarbonization plan," Scotia Capital (USA) Inc. analyst Andrew Weisel wrote in an Oct. 5 research report. "We've long believed that investors undervalue AEP's transmission exposure, and are hopeful that investor confidence and bullishness grow from here."

Guggenheim Securities LLC expects further AEP asset sales to come from the company's generation and marketing segment.

Competitive asset sale

AEP is in the process of selling its competitive contracted renewables portfolio, which consists of 1,200 MW of wind capacity and 165 MW of solar capacity in 11 states. The investor-owned utility is separately pursuing a sale of AEP Renewables' 50% interest in the Flat Ridge 2 Wind Farm in Kansas.

AEP executives were optimistic but tight-lipped on how the sale of Consolidated Edison Inc.'s clean energy business could affect the valuation of the company's competitive renewable assets. Con Edison on Oct. 1 agreed to sell its unregulated Con Edison Clean Energy Businesses Inc. subsidiary to RWE AG unit RWE Renewables Americas LLC for $6.8 billion.

"We have high expectations, but the market will tell us here very soon," said Greg Hall, executive vice president and chief commercial officer for AEP. "Our portfolio is very well accepted in the market, so I'm expecting good things."

Hall added that the assets AEP is selling are primarily operating wind projects compared to Con Edison's pipeline of primarily solar assets. "So, it's tough to draw a direct line in comparison," Hall said. "But I would say, overall, I think it looks like we should be expecting a good print."

AEP management said they could use proceeds from the competitive asset sale to reduce equity needs and pay down debt. AEP outlined equity needs of $100 million and $600 million in 2023 and 2024, respectively, with $700 million of equity issuances expected annually in 2025 through 2027.

Guggenheim analyst Shahriar Pourreza said the contracted renewables sale could net proceeds of $830 million to $1.1 billion.

"While other utilities are selling/spinning their gencos, midstream and individual fossil plants at weak valuations, AEP is selling renewables into a red hot market in order to fund [capital expenditures] on a very credit friendly transmission business," CreditSights analyst Andrew DeVries wrote in an Oct. 4 research report.

The company expects to complete the sale of the unregulated renewable assets in the second quarter of 2023.

AEP also has initiated a strategic review of its retail electricity and natural gas business, which Pourreza said "represents management's commitment to continuous monitoring and evaluation of opportunities to fund growth in the company's core segments at a lower cost compared to issuing incremental equity or debt."

Kentucky update

AEP on Sept. 29 agreed to a $200 million reduction in the sale price of its Kentucky assets to keep the transaction on track. AEP and Liberty Utilities Co., a unit of Canada's Algonquin Power & Utilities Corp., entered into an amended agreement through which Liberty will acquire Kentucky Power Co. and AEP Kentucky Transmission Co Inc. for about $2.65 billion, including the assumption of about $1.22 billion in debt.

The companies expect to close the deal in January 2023 following approval by the Federal Energy Regulatory Commission.

AEP also narrowed its 2022 operating EPS guidance to a range of $4.97 to $5.07. Guidance for 2023 is $5.19 to $5.39 per share, with annual operating earnings expected to grow by 6% to 7%.

AEP's shares closed up nearly 3% on Oct. 4 at $90.66.

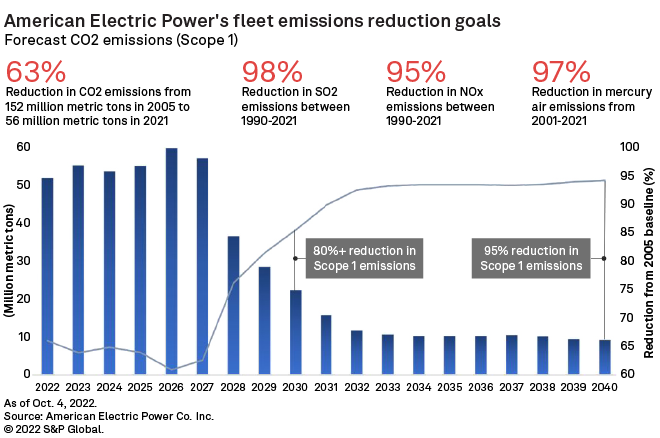

AEP adjusted its near-term carbon dioxide emission reduction target to a 2005 baseline from a 2000 baseline, upgraded its 80% emissions reduction target to include full Scope 1 emissions, and accelerated its net-zero goal to 2045, up from a previous aspirational goal of 2050.

AEP plans to retire more than 4.7 GW of coal-fired capacity from 2023 through 2028, including its Pirkey, Northeastern 3, Rockport and Welsh units. The company in August completed the sale of the 595-MW Cardinal unit 1 to Buckeye Power Inc.

Coal generation is expected to represent less than 5% of AEP's fleet by year-end 2028.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.