High-flying meme stock AMC Entertainment Holdings Inc. has fallen back to earth amid a bumpy theater recovery and a more sober equity market.

Historically, the largest theater company in the world has seen its stock correlate closely to rival Cinemark Holdings Inc. However, that changed during the retail trader boom of early 2021, when AMC shares soared triple digits despite a high debt load and risk of bankruptcy. In 2022, AMC's stock has remained decoupled from its peers, but with sentiment moving in the opposite direction.

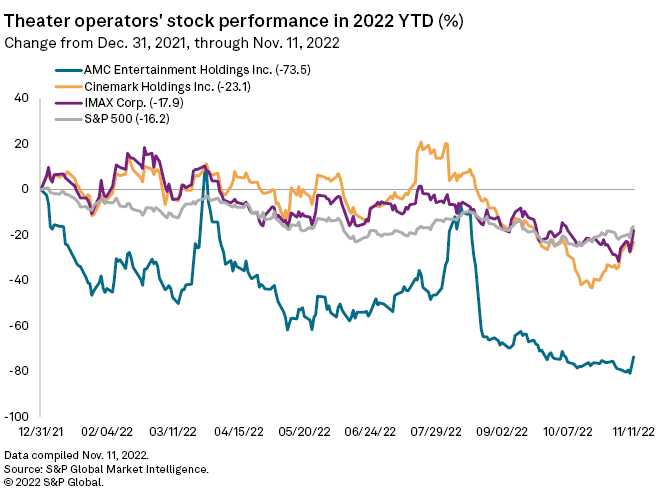

Year-to-date through Nov. 11, AMC was trading off by 73.5% while Cinemark was down 23.1% and theater technology company IMAX Corp. was down 17.9%.

Prior to the broad market rally on Nov. 10, the third-quarter earnings season was punishing for AMC. IMAX and Cinemark both benefited from better-than-expected U.S. attendance trends in reporting earnings in the first week of November. But despite AMC beating Wall Street forecasts in its Nov. 8 earnings report, the company's stock fell sharply on Nov. 9.

In an interview with S&P Global Market Intelligence, Wedbush Securities analyst Alicia Reese said she believes investor sentiment toward AMC has turned negative because of over-diversification in its business strategies.

"AMC is trying to dip their hands into everything under the sun," Reese said. "They're burning through cash to set up these investments, and I think they're doing too many."

Recovery revenue

AMC reported third-quarter revenue of $968.4 million, above third-quarter 2021 revenue of $763.2 million and Wall Street forecasts of $961.0 million, according to S&P Capital IQ consensus revenue estimates. The company also beat consensus estimates on EBITDA, reporting a loss of $12.9 million compared to expectations for a loss of $22.2 million.

However, that represents a wider loss than the prior year against higher revenue.

Meanwhile, Cinemark has managed to not only generate positive EBITDA on smaller revenue but more than double it year over year. The company reported EBITDA of $99.5 million for the third quarter, up from $44.3 million a year earlier.

B. Riley Securities analyst Eric Wold said in a research note that the firm remains optimistic about Cinemark's ability to over-index the industry box office recovery and keep per-patron spending levels elevated.

Much of Cinemark's success was driven by consumer demand for premium experiences, like those offered by IMAX. In turn, both Wold and Reese are bullish on IMAX.

Wold wrote in a separate note that IMAX has seen its share of domestic box office increase since the start of the pandemic.

"Heading into an impressive 2023 film slate with a product that has been dubbed an affordable luxury during tougher times, we believe IMAX is well positioned to approach prior box office records before the rest of the exhibition industry," Wold said.

At the same time, both analysts are much more cautious on AMC, with Wold maintaining a "hold" rating on the stock and Reese an "underperform" rating.

"Their debt balance is so bloated. I think they squandered a golden opportunity to pay down that debt load," Reese said.

Screening strategies

That golden opportunity came in August when the company issued shares it dubbed "AMC Preferred Equity." Reese and other analysts were compelled by the strategy, which would provide much-needed liquidity for AMC to pay down an 11-figure debt load, much of it accrued and refinanced at high rates through the pandemic period.

Instead, AMC forged new investments in theater upgrades, a popcorn business, an AMC-branded credit card, an exploration of branded blockchain products and other ventures. The company has seen its enterprise value collapse by more than $5 billion since the AMC Preferred Equity issuance. And then on Oct. 14, the company issued $400.0 million in new bonds at a 12.75% interest rate, Reese pointed out.

By comparison, Cinemark ended the third quarter with $3.81 billion in debt. And its most recent issuance, $460.0 million in senior unsecured notes printed in August 2021, carried a 4.5% interest rate.

"It feels like [AMC's] throwing stuff against the wall and seeing what sticks," said Wade Holden, a box office analyst with Kagan, a media research group within S&P Global Market Intelligence.

However, AMC has been in a difficult position, Holden said. It entered the pandemic period already with a massively swollen balance sheet after an M&A spree that consolidated the industry both domestically and globally. While Reese and other analysts are dubious of an investment strategy that has led the company to far-flung ventures like gold mining, Holden argued that AMC must explore atypical opportunities because typical revenue sources remain scant.

Holden said the third quarter was difficult across the industry as studios released very little content. The box office will not likely recover to pre-pandemic levels until 2024, according to the Kagan analyst, and that will likely include fewer feature films in theaters offset by more expensive, premium tickets.

"There's still a slowdown in new productions. The film slate hasn't ramped up to where it was before the pandemic," Holden said. "I'm not sure you can really fault AMC for trying to find ways to utilize their brand and find revenue rather than waiting for the next big film to give them a bump, and then waiting on the next one."