Many Amazon.com Inc. third-party sellers are struggling with pandemic-induced supply chain delays that have raised freight costs and kept popular items out of stock, retail experts say.

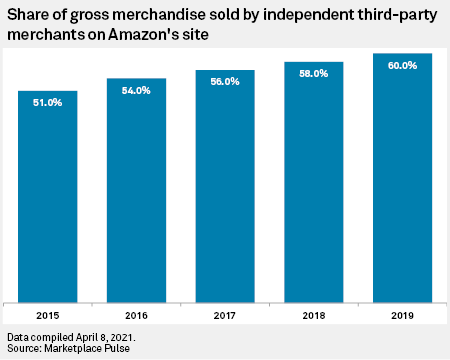

Strong consumer demand, worldwide equipment shortages and insufficient staff to haul goods from U.S. ports are making it more expensive to ship products from Asia. The likely result, according to retail experts, is higher prices for Amazon customers in the coming months as the extra costs are passed on. Independent third-party merchants account for a majority of physical gross merchandise sales on Amazon's site, at 60% as of 2019, according to data from Marketplace Pulse, a firm that collects data on e-commerce companies including Amazon.

"I would say it's affecting a number of clients," said Steve Yates, CEO of management consultancy Prime Guidance, which advises Amazon sellers. "Freight costs have gone up, and our clients have had challenges getting inventory."

Amazon did not respond to inquiries for this story, but Marketplace Pulse estimates there are about 2 million active Amazon sellers.

Most sellers ship through Amazon's Fulfillment By Amazon program, which handles packing and shipping for products and makes those goods eligible for Prime one- and two-day shipping options. But Amazon, too, is facing supply chain constraints, making it imperative for sellers to find alternative shipping services, Yates said.

"We've been advising clients that they really need to have operational independence, not necessarily to bypass FBA [Fulfillment By Amazon] but to augment it," he said.

It's not surprising that small Amazon sellers are facing these challenges, given that the global logistics industry as a whole is congested, said Chris Rogers, supply chain analyst with Panjiva, a unit of S&P Global Market Intelligence.

Consumer demand remains the main driver of growth, Rogers said, with U.S. seaborne imports of leisure products climbing 168.3% in March 2021 versus March 2020 and home furnishings imports rising 136.5% during that period.

Unlike larger retailers that can more easily absorb extra shipping expenses, Amazon sellers face a "witch's brew" of logistics and fulfillment issues that "hits them harder from a cost perspective," said Nick Shields, a senior analyst with Third Bridge who covers the retail sector.

Just ask Chuck Gregorich, an Amazon seller whose business Net Health Shops LLC sells items such as fountains, patio furniture, firepits and hammocks.

Workers unload a container of goods for Amazon seller Net Health Shops LLC. |

Last year, Gregorich began ordering 2021 spring inventory earlier than usual due to pandemic-induced supply chain constraints that he knew could cause delays. Even so, only 150 of 350 containers filled with goods were shipped, leaving Net Health Shops' inventory mostly sold out by early April. The company continues to ship in products from overseas, but Gregorich is waiting on a backlog of items that should have been sent months ago.

The delivery delays mean higher costs for consumers and a smaller selection of goods online, Gregorich said. "We're having to increase our price, and a lot of times we don't increase our price enough to cover the additional cost," he said.

In many instances, Gregorich had to pay thousands of dollars more to rush shipments from overseas, an expense that bites into already thin margins eaten up in part by the advertising costs needed to boost search results on Amazon's site.

"On Amazon, there's so much competition, you've got to spend 5% to 15% of your sales on advertising," Gregorich said. Still, Amazon is his largest and most important online venue. "A ton of the volume is on Amazon, so you have to be on Amazon so you can scale," he said.

The shipping issues have also added a cost and time burden on Plugable, an electronics company that sells items such as laptop docking stations and USB ports on Amazon.

A shortage of semiconductors has only exacerbated the situation and left some of the company's best-selling items out of stock, said Plugable CEO Bernie Thompson.

"We are leaving millions of dollars of revenue on the table because we can't get the product in time," Thompson said.