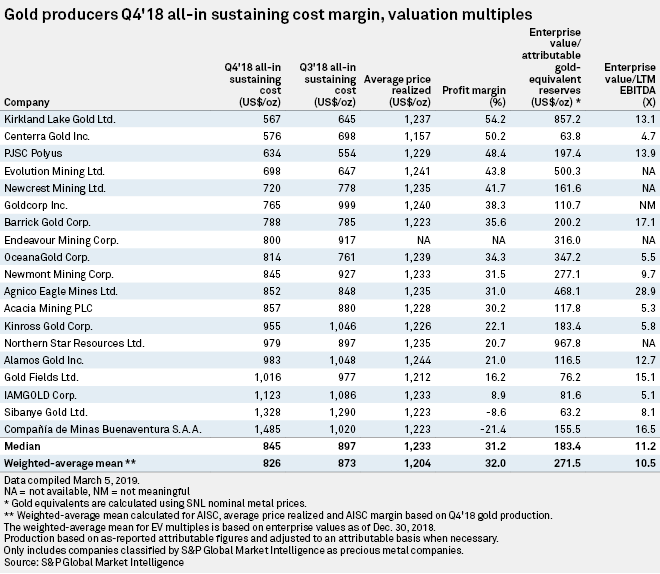

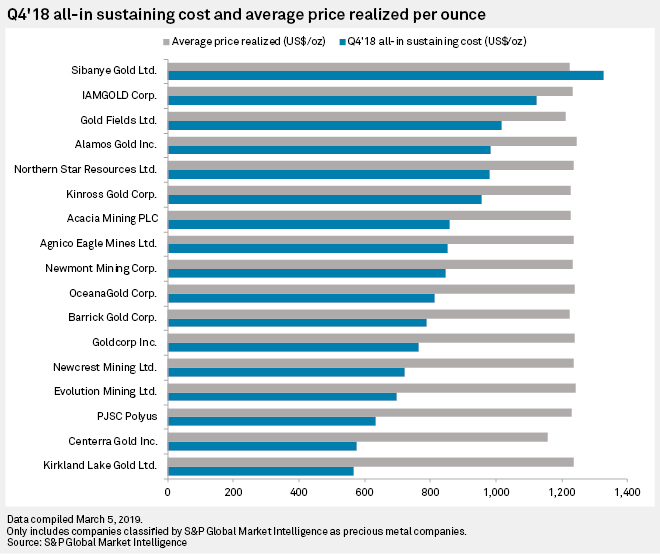

The reported all-in sustaining costs of the largest gold producers dropped to a weighted average of US$826/oz in the fourth quarter of 2018, a 5% decrease from the same companies' weighted average in the previous quarter. The drop came even as most of the companies included in the analysis saw quarter-over-quarter increases in all-in sustaining costs.

Kirkland Lake Gold Ltd. logged the lowest AISC for the fourth quarter of 2018, at US$567/oz. This reflected a 12% decrease from costs during the prior quarter. During the fourth quarter, the company increased production by 39% compared to the same quarter in 2017 and had the highest 2018 share price among gold producers at US$26.10.

Centerra Gold Inc. saw a 17% decline quarter over quarter, coming in at US$576/oz. The company exceeded its 2018 gold production guidance, with Kumtor surpassing its forecast and Mount Milligan achieving the upper end of its guidance.

PJSC Polyus reported the third-lowest AISC despite a 14% quarter-over-quarter increase to US$634/oz. The company's annual production increased from 2017 to 2018 due in part to the completed ramp-up of Natalka in Russia.

Goldcorp Inc. logged the largest quarter-over-quarter decline in AISC, dropping 23% to US$765/oz. The company expects to maintain a similar cost level during 2019 by producing between 2.2 million ounces and 2.4 Moz of gold at AISC of between US$750/oz and US$850/oz.

Alamos Gold Inc. had the highest average price realized for the fourth quarter of 2018, at US$1,244/oz. The company reported an AISC of US$983/oz, putting its profit margin at roughly 21%, below the weighted-average margin of 32%. In total, eight of the 19 companies achieved above-average margins. Kirkland Lake Gold and Centerra Gold topped the list at 54% and 50%, respectively.

Two companies had all-in sustaining costs that outstripped the average price realized per ounce. South Africa-based Sibanye Gold Ltd. had AISC of US$105/oz above its average price realized, yielding a profit margin of negative 8.6%. Compañía de Minas Buenaventura SAA also saw a negative profit margin at 21.4%, with reported AISC of US$262/oz above the average price realized.

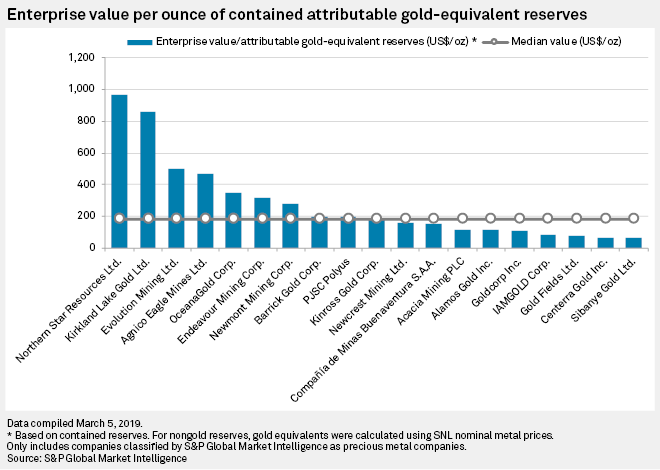

Looking at the enterprise value per ounce of attributable gold reserves, values varied from Sibanye's low of US$63/oz to Northern Star Resources Ltd.'s US$968/oz. The group's median value was US$183/oz.

Watch a recent webcast to learn how to leverage the AISC metric via the S&P Global Market Intelligence platform. S&P Global Market Intelligence's Base & Precious Metal Charting template allows users to analyze historical and forecast cash flows, production and costs associated with precious metals. The charts benchmark S&P Global Market Intelligence-covered properties and allow users to filter based on a specific region or country. The Company Two-Page Profile Template allows users to get a snapshot of a company's key data, including performance ratios, balance sheet and income statement. Find all company-level data, news, events and filings by accessing a Company Briefing Book. There are separate pages for financials, production and costs, and attributable reserves and resources. |