Agriculture loans 30 days or more past due or in nonaccrual status hit 2.4% of total agriculture loans at U.S. banks and thrifts as of June 30, up from 2.1% in the same quarter in 2019, but down from 2.7% in the first quarter.

Delinquencies for agricultural production loans, which finance things like equipment and seeds, stood at 2.1%, down from 2.4% in March but up compared to 1.8% in June 2019. Meanwhile, delinquencies for farm loans, which finance land, stood at 2.6%. This was 26 basis points less than the previous quarter but 25 basis points higher than the same period last year.

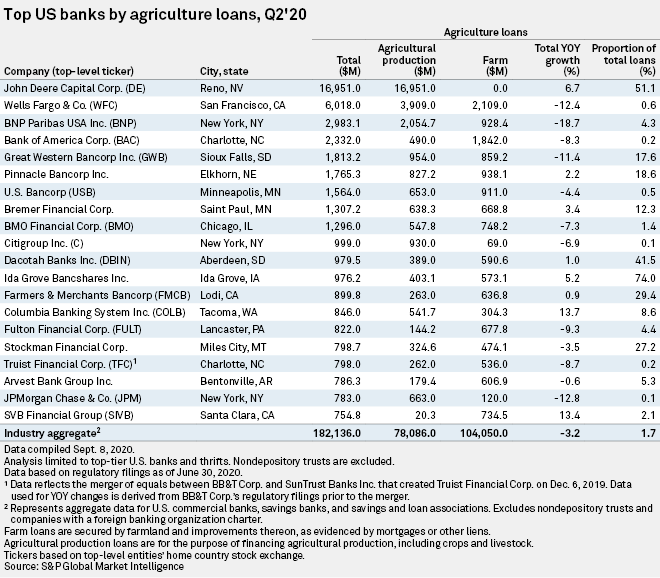

Combined agricultural production and farm loans grew in the second quarter to $182.14 billion, up 1.5% from March, but down 3.2% year over year.

Olney, Texas-based Olney Bancshares of Texas Inc. saw the delinquency ratio on its farm loans jump to 25.9% in June, 24.4 percentage points higher than in June 2019. This marked the largest year-over-year change in delinquencies on loans of this type. First Bank & Trust of Sioux Falls, S.D., reported the biggest change in agricultural production loan delinquencies: 25.8% of the bank's agricultural production loans were delinquent in the second quarter, up 25.1 percentage points year over year. Olney Bancshares and First Bank & Trust did not respond to a request for comment.

John Deere Capital Corp. remained the largest holder of agricultural production and farm loans among U.S. banks and thrifts at $16.95 billion as of June 30. Its agricultural loan portfolio grew 6.7%, compared to the same period last year.