Total U.S. bank deal value surged to a 15-year high in 2021, and the pace is unlikely to slow in 2022 despite an uptick in anti-merger rhetoric from top policymakers.

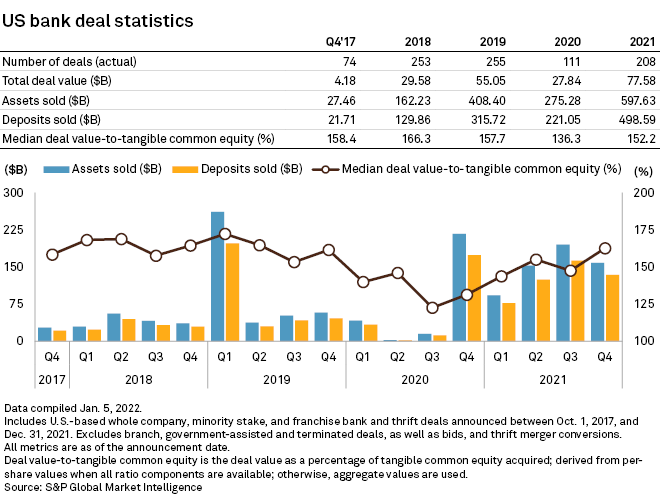

U.S. banks struck 208 deals with an aggregate deal value of $77.58 billion in 2021, the highest level since 2006. While the number of deal announcements last year lagged pre-pandemic levels, the increase in deal value came as banks sought larger, transformational tie-ups. Over the last month, policymakers have said that they intend to crack down on bank M&A of size. Still, deal advisers said they expect to see more mergers of equals and other large-scale deals in the year ahead.

Several banks sought large-scale deals in recent years to gain scale in the face of intensifying operational pressures such as tepid loan growth, low interest rates and the increasing digitization of banking.

"It's still kind of uncertain what organic growth looks like [in 2022]," said Sean Enright, a director with the investment banking firm Hovde Group, in an interview. "[For] a lot of banks, especially your larger, more experienced buyers, one of the best ways they'll be able to grow EPS or have meaningful EPS growth, may only be through acquisitions."

Closing window for big deals

Thirteen deals with values above $1 billion were announced in 2021, the most since 1998 when 14 such deals were announced. But with the wave of transformational M&A came greater scrutiny of bank deals under a new administration.

U.S. President Joe Biden in July 2021 issued an executive order calling for increased scrutiny of M&A, and a backlog of applications at the Federal Reserve delayed a handful of the largest pending bank deals. In December 2021, Federal Deposit Insurance Corp. Chairman Jelena McWilliams announced intentions to step down from her position following a clash among board members regarding the agency's review of bank deals. And Maxine Waters, chair of the House Financial Services Committee, in December 2021 called for a moratorium on deals that resulted in a bank having over $100 billion in total assets.

But those moves could have a paradoxical effect, said Richard Weiss, a managing director at PNC Financial Institutions Advisory Group.

"It's going to be ironic, because I think it's going to cause more banks to consider M&A," Weiss said in an interview.

With no new rules in place, some bankers could see an opportunity to strike a deal in the first half of the year before the D.C. rhetoric turns into action, said John Gorman, partner at Luse Gorman PC.

"You may see some people thinking that they still have a window now," he said in an interview. "What they're thinking is 'I should do it now if I'm ever going to do it because we could be told something different.'"

Gorman also expects the trend of transformational tie-ups and mergers of equals to continue in 2022, particularly among community banks. Facing pressure to invest in digital initiatives from both fintech startups and national banks with immense tech budgets, community banks are seeing MOEs as a way to gain scale that will better enable fintech investment.

"There are going to be a lot of those types of transactions where community banking is coming together to try to preserve community banking," Gorman said.

Focus on efficiency

M&A helped offset some of the earnings pressures banks faced in 2021 as weak loan demand hampered asset growth and excess deposits in a low-rate environment weighed on margins.

Total bank deal value will remain strong in 2022 because "acquisitions can present a fix for both the seller and the buyer" as they continue to "wrestle with [net interest margin] pressure and loan growth," wrote Compass Point analyst Laurie Hunsicker in a Jan. 4 note.

Competition from neobanks and the investments needed to keep up with the increasing digitization of banking will also continue to be a main driver of M&A among banks of all sizes in 2022, said Jay Jung, founder and managing partner of Embarc Advisors, a strategic financial advisory company.

"There's a lot of competition. For a lot of these old-school banks, the path to survival is through operational efficiency," Jung said in an interview. "This is an industry that needs scale and efficiency to compete with the new entrants."