Fallout from the Aug. 4 explosion at Beirut's port will put further strain on Lebanon's troubled financial system, with a large-scale sector restructuring appearing likely and depositors set to lose billions of dollars.

The blast has claimed at least 200 lives, according to BBC News, and caused widespread property damage. Public anger led the government to resign Aug. 10 as outgoing Prime Minister Hassan Diab, who was appointed in December 2019, said the blast was the result of endemic corruption.

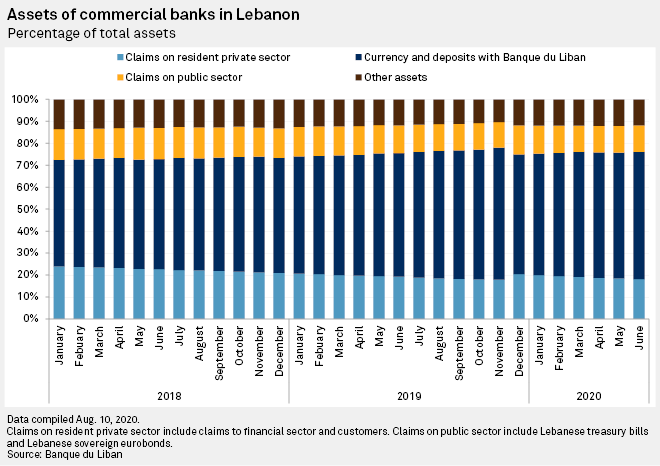

The fortunes of the country's banks are tightly intertwined with the government's finances, with most of their assets residing with the central bank. Lebanon defaulted on its debts in March and requires international aid; an IMF rescue package is likely to be tied to financial sector reforms.

"Lebanon doesn't have the fiscal space to fund the reconstruction of the public sector infrastructure destroyed in the explosion, and has no ability to borrow either because no one will lend to the country," former vice-governor of the Lebanese central bank Nasser Saidi told S&P Global Market Intelligence.

He said the banks will need to restructure, sell assets and consolidate.

Such reshaping is likely to be spurred by Lebanon's ongoing negotiations with the IMF for rescue funding. Managing Director Kristalina Georgieva said Aug. 9 that debt sustainability and financial system solvency are conditions for lending. She also called for formal capital controls and the elimination of Lebanon's multiple currency exchange rates.

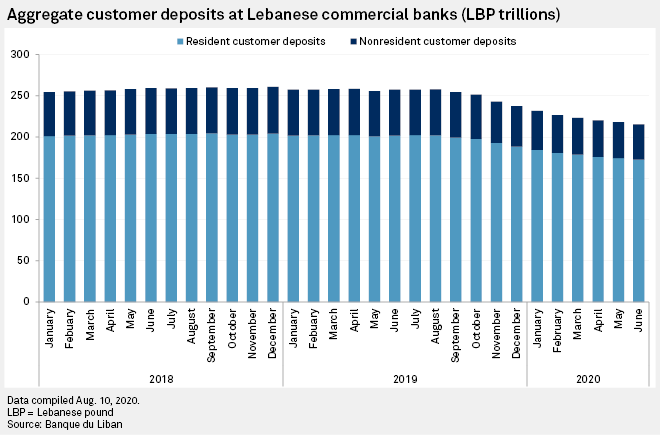

To service these debts and defend the Lebanese pound's dollar peg, the central bank — the Banque Du Liban — simply issued more debt at higher interest rates. Banks increased rates on local- and foreign-currency accounts to woo more depositors, and have been lending relatively little to the real economy. BLOM Bank SAL, Lebanon's second-largest lender by assets, had a loan-to-deposit ratio of just 23.7% as of June 30, 2019.

Debt restructuring

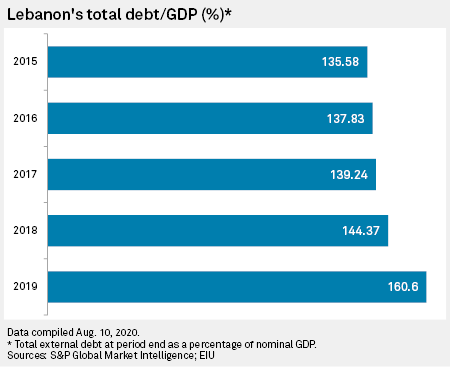

Meanwhile, mismanagement, a tourism downturn and falling remittances from the Lebanese diaspora reduced state income and roiled the economy. S&P Global Ratings estimates that Lebanon's GDP will shrink 15% in 2020, its third consecutive annual decline. Public debt amounts to more than 150% of GDP and is among the highest worldwide.

For a debt restructuring, the government wants the banking system to absorb $83 billion of losses, including $12 billion from loan books and $71 billion in losses on government securities — $54 billion of which is held by the central bank and $17 billion by commercial banks, according to a note from emerging markets research firm Tellimer.

In all, depositors stand to lose $44 billion, which is one-third of all deposits, the Carnegie Middle East Center estimates.

"Effectively, banks' capital will be wiped out and large deposit holders will have to absorb losses," Jaap Meijer, managing director of research at Dubai's Arqaam Capital, told S&P Global Market Intelligence.

Banks have imposed weekly cash withdrawal limits. Depositors' losses will depend on negotiations to write off state and central bank debts and the extent to which shareholders are willing to recapitalize banks.

"The bankers and the central bank are trying to resist that and push the burden of adjustment on to the government and depositors," said Saidi, who has also held the positions of Lebanon's minister of economy and trade, and of industry, and is president of consultancy Nasser Saidi & Associates.

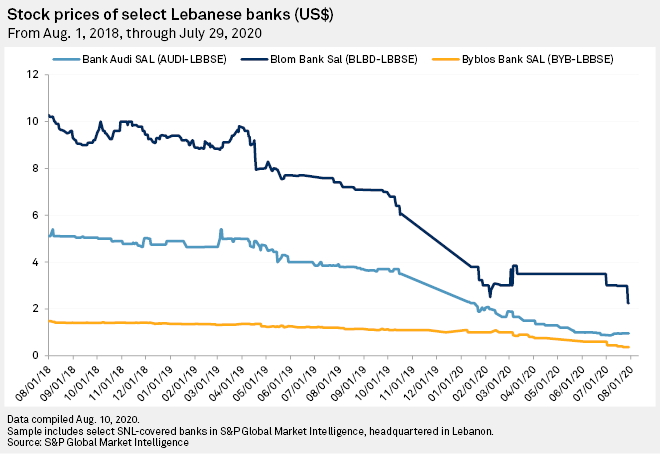

The crisis has led to greater opacity among Lebanon's big four banks. The most recently published financials published by Byblos Bank SAL, Bank Audi SAL and Bank of Beirut SAL only cover the first half of 2019. They show the trio reporting year-over-year net profit declines of 12%, 2.4% and 16.1%, respectively.

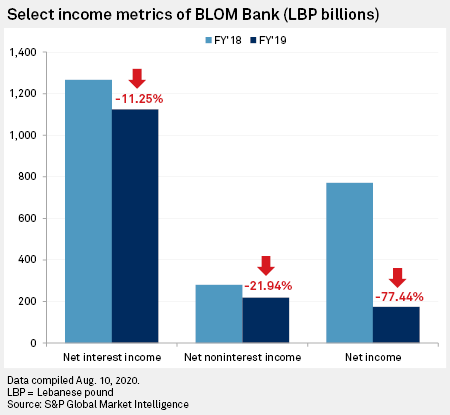

BLOM Bank's 2019 full-year results better reflect the worsening economic crisis. Its annual profit declined 77% year-over-year as it took impairments of 493 billion pounds to cover losses on financial assets. BLOM also said its Lebanese branches generated zero profit last year. All the major banks' share prices have declined sharply over the last two years.

"The banking system will have to be restructured," said Saidi. "Banks will have to downsize, sell the assets they hold abroad and repatriate the proceeds, sell their real estate holdings, and rebuild their balance sheets if they want to stay in business ... there will be M&A."

BLOM Bank is looking to sell African unit BLOM Bank Egypt SAE, according to an Aug. 11 Reuters report.

"Lebanon's banking sector is completely uninvestible," said Meijer, predicting that banks will be nationalized to absorb their losses on central bank debt. His firm, Arqaam, has a target price of "effectively zero" on Bank Audi and BLOM.

"All Lebanon's banks are technically insolvent — if customers can't withdraw their deposits, then the bank is in a selective default," he said.

International aid

French President Emmanuel Macron, who organized a group of international donors that have agreed €252.7 million in emergency aid, has also demanded reforms to the banking sector and the wider political system, the Financial Times reported.

The plunging value of the pound has sent living costs soaring, with annual inflation hitting 89.7% in June. Saidi estimates that about 60% of Lebanon's debts are due to interest rate increases designed to protect the pound, and criticized the central bank for failing to officially devalue the currency.

So far, a larger tranche of money from the IMF and other countries and institutions has not come through because Lebanon has balked at implementing the austerity plan and the debt restructuring, Meijer said.

"The banks would like more fiscal austerity in order to better protect their government and central bank exposures, but the government can't implement more austerity when the economy is in a freefall made even worse by COVID-19."

Saidi said Lebanon could solve the crisis by enacting capital controls, unifying the pound-to-dollar exchange rate, restructuring state-related debts and removing general subsidies. Up to $30 billion is needed to restructure the public sector, and a further $25 billion to restructure and recapitalize the banking sector, he said.

As of Aug. 11, US$1 was equivalent to 1.51 Lebanese pounds.