Investors' search for better yields could bolster Africa's nascent secondary market in nonperforming loans, with surging defaults across the continent due to the pandemic creating more opportunities to buy distressed debt.

For an NPL market to develop, three key aspects are required: An adequate regulatory and legal framework; sufficient capital from investors; and specialist companies to rehabilitate the loans acquired.

A lack of supportive laws and regulations, and difficulties in agreeing on prices for NPL portfolios, have so far stymied growth in Africa — and support from the likes of the World Bank's International Finance Corp., or IFC, will be critical to creating a functioning secondary market.

'More advanced' market

South African companies are leading the way on the continent, according to industry insiders.

IFC in 2019 invested in South Africa's Nimble Group Pty. Ltd., jointly establishing a special purpose vehicle with about $90 million in capital that is being deployed across sub-Saharan Africa's underdeveloped secondary market.

This contrasts with Europe, where large private equity firms such as Cerberus Capital Management LP, Blackstone Group Inc. and Lone Star Americas Acquisitions Inc. completed more than €160 billion in NPL deals between them in Europe from 2015 to 2019, according to law firm White & Case.

Greenpoint Capital, based in Cape Town, has invested around 3 billion rand across 62 private credit investments in South Africa.

"Institutional investors are allocating more towards private credit in the same way they did in the U.K. and U.S. decades ago and Asia more recently. Now South Africa is showing signs of following that same trend," said CEO Ryan Wood-Collier. "It's part of the general shift towards alternative investments spurred by a search for yield.

"It's a nascent sector, with a huge opportunity," added Wood-Collier, noting that, for now, NPL purchases in Africa occur on an ad hoc basis. "Buying and selling of credit will become more formalized, but it will take a while."

As government measures to cushion against the economic impact of the COVID-19 health crisis are gradually lifted, asset quality across Africa is likely to deteriorate. NPLs in Africa will double in 2021 versus 2019 levels as payment holidays, which were introduced to help borrowers during the pandemic, expire, according to Moody's forecasts.

A secondary market in bad debt would allow "banks to better manage and strengthen their balance sheets, freeing up capital that was locked up to cover the NPLs. It's a more cost-efficient means of NPL management, because banks can focus on their core business of lending," said Mainz.

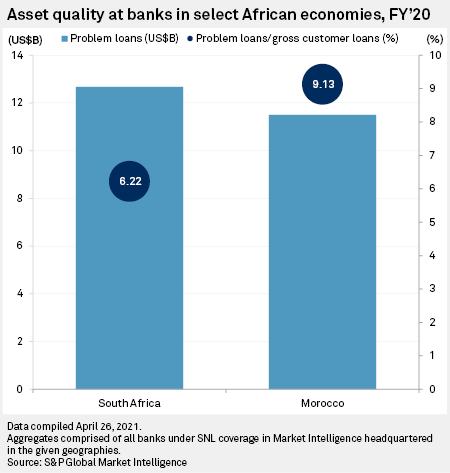

Banks in South Africa, the largest banking market by assets in Africa, had about $12.6 billion of problem loans on their books as of Dec. 31, 2020, according to S&P Global Market Intelligence data, constituting 6.22% of their total loans. Moroccan banks recorded a higher NPL ratio at 9.13%.

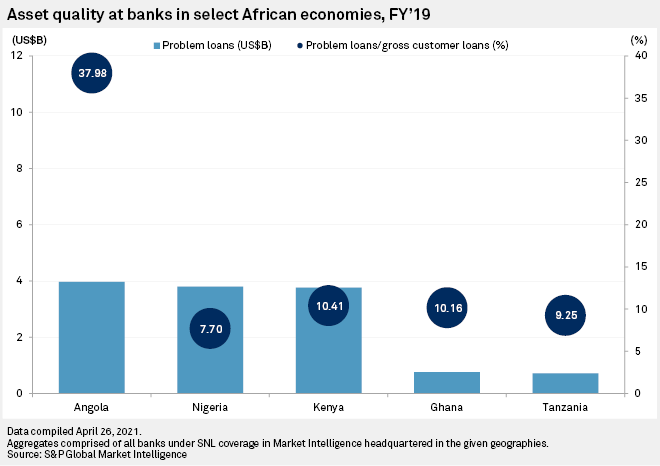

Nigeria's NPL ratio for the 2019 full year, the latest available data, stood at 7.70% while in Kenya and Ghana it was just over 10%.

So far, the special purpose vehicle with Nimble — the IFC's first of its kind in Africa — has acquired NPL portfolios in South Africa, Namibia, Botswana, Lesotho and Eswatini. As well as buying NPLs from banks, which are mostly unsecured retail loans, it can also invest in stressed companies in South Africa. Nimble has established operations in Kenya, with the special purpose vehicle planning to acquire NPLs from banks there too.

"When we look at NPL investments in emerging markets, we typically find two main challenges," said Mainz. "One is the servicing capacity, so we provide equity and capital to local companies to expand their operations, and the other one is capital available to acquire the NPLs."

Challenges for 'embryonic' market

However, many African countries lack insolvency courts with the power to resolve cases involving loan defaults in a timely manner.

"There are difficulties in enforcing contracts because many jurisdictions have pro-debtor legal regimes that may prevent creditors from realizing their claims swiftly. This could significantly affect loan recovery outcomes and values," said Jim Ho, partner at global law firm Cleary Gottlieb Steen & Hamilton in London.

Agreeing on a price between sellers and particularly buyers can be difficult.

Mainz said: "The price gap is always there. There are many factors specific to each portfolio's composition, such as provisioning levels, vintage loans, collateral valuation, recovery rate but in general banks will likely have a higher recovery estimate than investors."

As of May 4, US$1 was equivalent to 14.49 South African rand.