Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Feb, 2022

By Hassan Javed

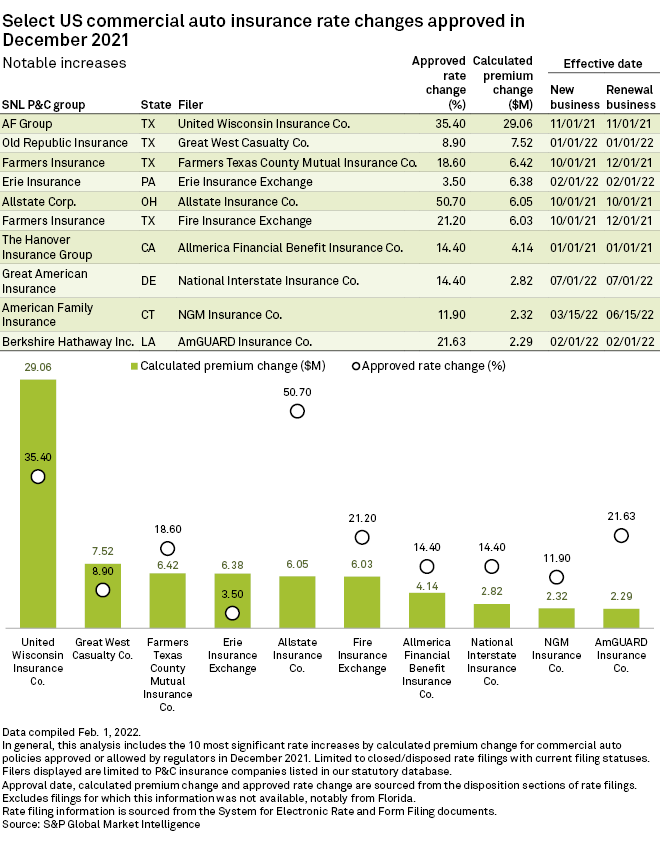

AF Group could see the biggest increase in aggregate premiums out of any insurance group from new commercial auto rates approved in December 2021, according to an S&P Global Market Intelligence analysis.

Subsidiaries of AF Group received approvals for two rate hikes, which could increase the group's aggregate premiums by $29.1 million.

Texas drives increases for AF Group, others

A huge portion of the cumulative positive premium impact for AF Group comes from a single rate hike approved in Texas. The 35.4% rate increase took effect Nov. 1, 2021, for both new and renewal businesses. The rate change will impact more than 2,500 policyholders, according to the filing.

In total, Lone Star State regulators approved 15 rate increases that could boost premiums by $52.2 million, the highest of any state.

Farmers Insurance Group of Cos. is expected to experience the second-largest cumulative increase in commercial auto premiums after securing approvals for five rate hikes from Texas regulators. The approved rate increases could increase the company's total premiums by about $14.9 million.

Old Republic dominates rate cut chart

Old Republic General Insurance Group Inc. secured approvals for the top three most-significant rate decreases of the month in terms of premium impact. A 21.5% rate decrease in Pennsylvania may be the most significant as it could lower the group's total premiums by about $1.8 million.