US and European investment banks are likely to see higher 2024 returns on equity as operating margins in advisory and underwriting recover, driven by rising revenues.

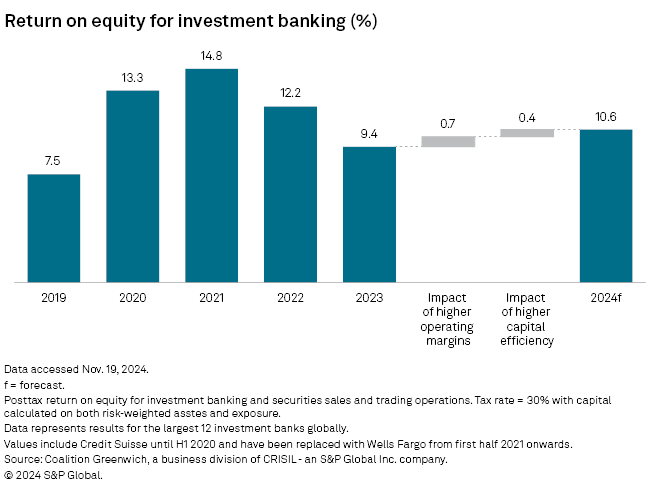

The average posttax return on equity (ROE) across equities and fixed-income sales and trading, as well as advisory and underwriting activities, at the 12 largest global investment banks is projected to reach 10.6% in 2024, up from 9.4% in 2023, according to research firm Coalition Greenwich.

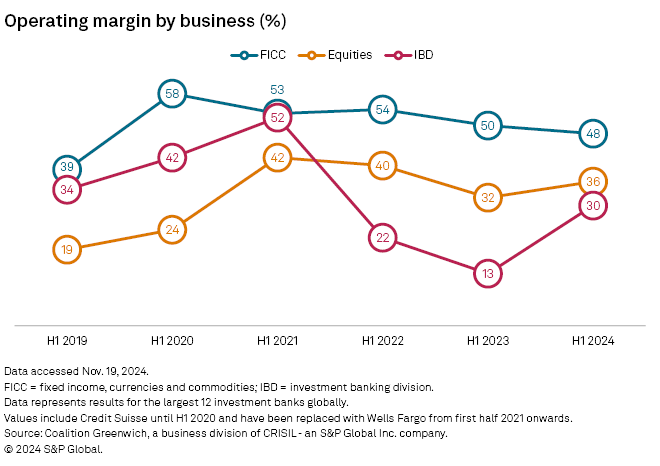

The rise in ROE will primarily stem from improved operating margins, particularly in investment banking divisions (IBD) that oversee deal advisory and capital markets underwriting, according to Coalition Greenwich's latest sector index report. Enhanced capital efficiency, driven by efforts to limit risk-weighted assets, is also expected to support the increase.

IBD operating margins, which compare revenues to costs, more than doubled to 30% in the first half, up from 13% in the same period a year earlier. This improvement followed a 31% jump in IBD revenues, which offset higher costs, notably bonus expenses, the report said.

IBD revenues are particularly accretive to ROE due to the segment's lower capital requirements compared with sales and trading, according to Gaurav Arora, global head of competitor analytics at Coalition Greenwich. "When the advisory side of IBD in particular starts growing again, naturally we expect the ROE numbers to increase too," he said.

Banks with larger IBD operations, particularly in M&A advisory, are likely to benefit the most from the recovery in revenues. This trend could favor large US banks over their European counterparts, Arora noted.

Coalition Greenwich, a division of CRISIL, an S&P Global company, monitors revenues at Bank of America Corp., Barclays PLC, BNP Paribas SA, Citigroup Inc., Deutsche Bank AG, Goldman Sachs Group Inc., HSBC Holdings PLC, JPMorgan Chase & Co., Morgan Stanley, Société Générale SA, UBS Group AG and Wells Fargo & Co.

IBD revenue outlook

Advisory and underwriting revenues in IBD are rebounding from 2023 lows, with most segments expected to post double-digit growth in 2024. Debt capital market revenues are projected to rise 40% to 45% for the year, Arora said.

Equity capital market revenues are up, driven by follow-on offerings as IPO activity remains weak, and are forecast to grow 30% to 35%, the analyst noted.

Advisory revenues, hit hardest in 2023 by rising interest rates, are recovering more gradually, with an 8% to 10% increase expected in 2024.

Looking ahead to 2025, M&A revenue growth estimates range from 15% to 25%, depending on US policy shifts. Deregulation could boost large-scale deals, while potential tariffs may hurt earnings and dampen cross-border activity, Arora added.

FICC, equities revenue outlook

Fixed income, currencies and commodities (FICC) revenues have remained high due to disruptions from events such as the COVID-19 pandemic, the Russia-Ukraine war and the Silicon Valley Bank collapse, Arora said.

In 2024, FICC revenues are expected to dip 2% as macro trading normalizes, while credit trading sees growth. A slight rebound is anticipated in 2025, driven by credit performance and robust debt issuance, with macro trading stabilizing or improving slightly.

Equities sales and trading revenues are set to rise 12% in 2024, boosted by equity derivatives and strong cash and prime broking. But a slight decline is expected in 2025 due to unsustainable valuations.

As equities stabilize and FICC posts modest gains, IBD growth will likely drive overall revenue expansion in 2025, Arora said.