Cambodia's Garment Manufacturing Association has asked the government to suspend the industry's $190-per-month minimum wage, the Nikkei Asian Review reports, as the sector struggles with a loss of orders due to COVID-19. Bangladeshi exporters face a similar challenge, as outlined in Panjiva's research of June 10.

The apparel industry has been one of the worst-performing consumer discretionary sectors in terms of U.S. imports due to store closures being compounded by reduced spending and financial failures of several retailers.

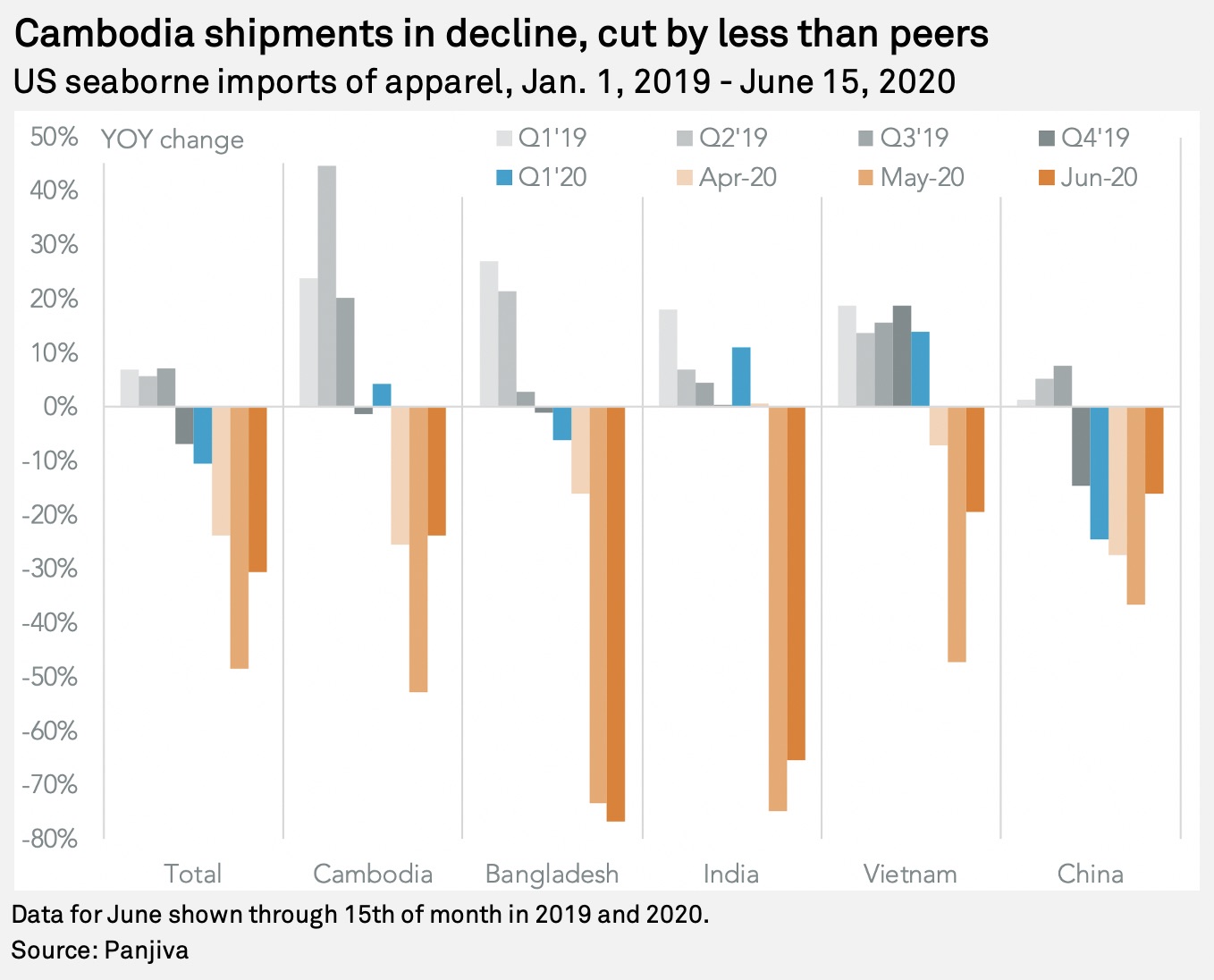

Panjiva's data shows that U.S. seaborne imports of apparel from Cambodia may be pulling out of their dive. Shipments in the first half of June dropped 23.8% year over year, while total U.S. imports of apparel fell by 30.5%. By comparison, imports from Bangladesh and India fell by 76.6% and 65.4%, respectively. Cambodia has nonetheless lagged Vietnam and China, which have seen imports fall by just 19.3% and 15.9%, respectively.

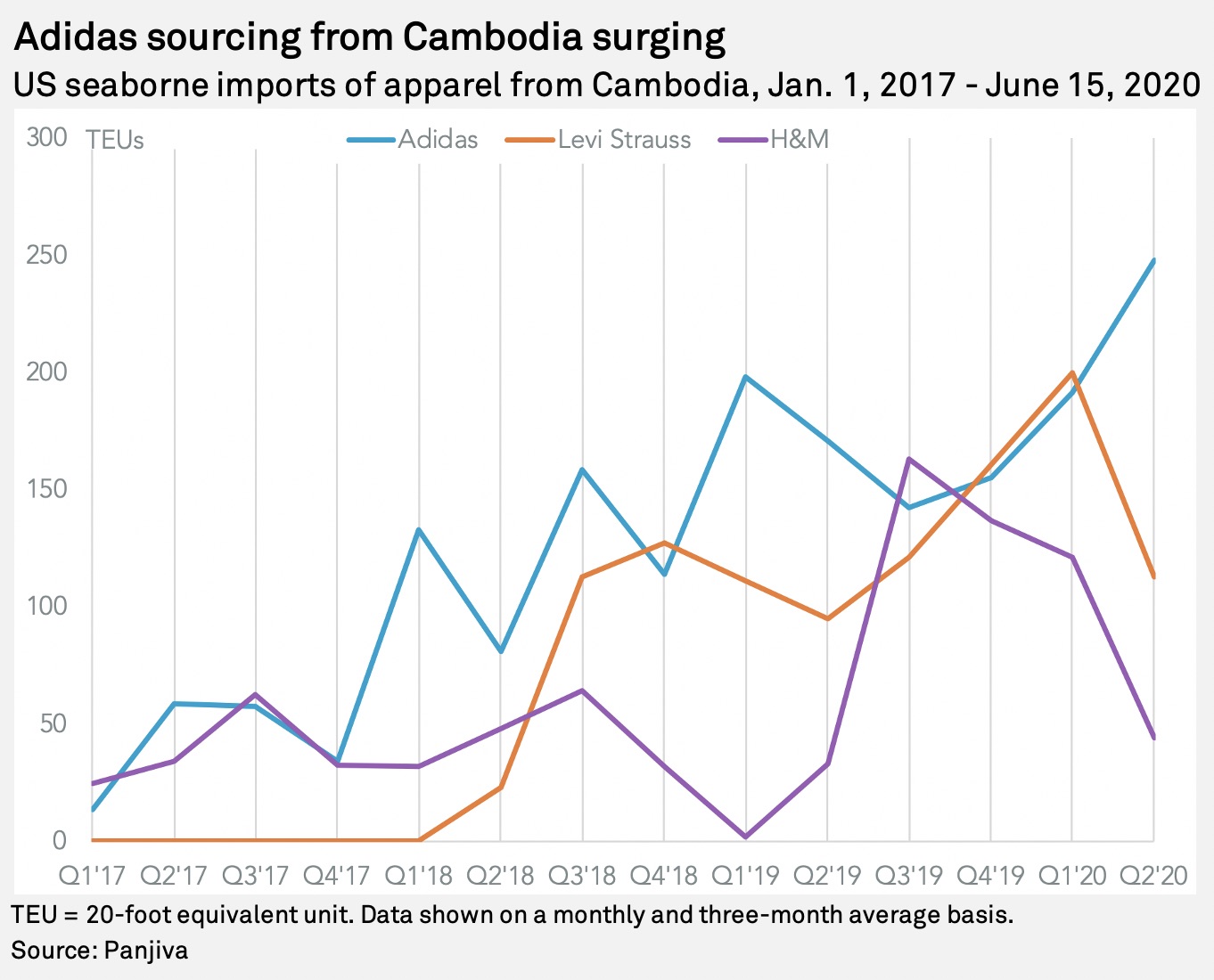

Cambodia's better performance versus its regional peers may be in part due to continued purchasing growth from three major buyers. U.S. seaborne imports linked to H & M Hennes & Mauritz AB (publ) surged 214% higher year over year in the second quarter through June 15, admittedly compared to minimal purchases a year earlier. Imports linked to Adidas AG, meanwhile, climbed 58.0% in the second quarter so far after a 3.5% dip in the first quarter. Levi Strauss & Co.-related shipments have grown more steadily, with a rise of 36.1% in the second quarter after an 80.2% rise in the first quarter.

On a sequential basis, though, the picture is less strong, with Levi Strauss and H&M imports down by 43.5% and 63.5%, respectively — admittedly with two weeks of the quarter remaining — while Adidas' rose by 29.5%. The latter supports prior comments from CEO Kasper Rorsted that the company has "a deep responsibility for the extended supply chain to ensure that they will be around when the crisis goes away."

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.