A busy Atlantic hurricane season and shrinking reinsurance capacity could further disrupt Florida's already unstable property insurance market.

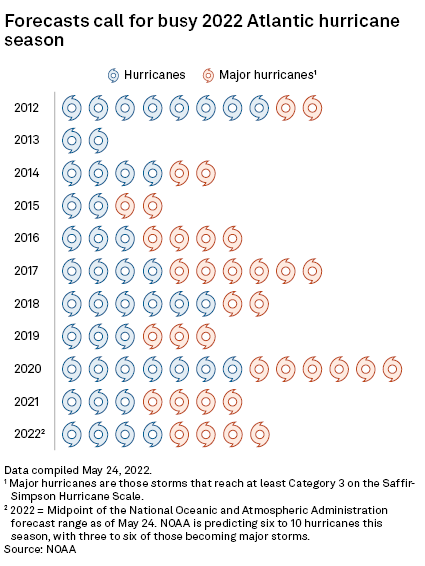

The 2022 season, which runs June 1-Nov. 30, is expected to produce an above-average amount of named storms, according to The National Oceanic and Atmospheric Administration, Colorado State's Department of Atmospheric Science and AccuWeather.

Colorado State University researchers predict that there is a 47% chance for a major hurricane to make landfall on the U.S. East Coast, including Florida, and a 46% chance of one striking the Gulf Coast from the Florida Panhandle west to Brownsville, Texas.

Most states in those regions have some catastrophic exposure that is largely underwritten by leading carriers. Florida, however, is "very much a unique situation," said Keefe Bruyette & Woods analyst Meyer Shields. Some major carriers, including The Allstate Corp., State Farm Mutual Automobile Insurance Co., The Progressive Corp. and United Services Automobile Association, have a presence in the Sunshine State, but small companies control much of the market, Shields said.

"The fragmentation itself is fine because it means that you don't have companies that have enormous proportionate risk," Shields said in an interview. "The burden is being carried by a lot of companies, but those companies are small and they don't necessarily have the wherewithal to absorb the worst that Mother Nature could throw at them."

Florida reinsurance woes

Already reeling from rampant social inflation and shrinking capacity, primary carriers in Florida are also in the grip of a reinsurance crisis.

Reinsurance carriers are either raising their rates or steering clear of the Florida market. Munich Re and Swiss Re AG have shrunk their capacity in the market by 50% to 80%, while RenaissanceRe Holdings Ltd. also is reducing its footprint.

Shields said reinsurers' underexposure in the state is an indication that Florida-focused property insurers are probably not in good shape, since they are having a difficult time obtaining all the reinsurance they need to protect their financial strength ratings.

"They're paying significantly more for the reinsurance that they are buying, and they've been performing poorly even in the absence of hurricanes hitting Florida," Shields said.

Even as the Florida Legislature sought to address the turmoil in the market by enacting insurance reforms, more companies recently announced pullbacks. Southern Fidelity Insurance Co. Inc. on May 25 announced it would temporarily suspend writing new homeowner policies and dwelling/fire policies until it can acquire adequate reinsurance. Progressive also said it would stop writing new business in Broward, Palm Beach, Miami-Dade, Lee, Collier and Brevard counties as of June 1.

A new $2 billion taxpayer-backed reinsurance fund may provide temporary help, but if a major storm hits a populated area of the state, that sum "will not come close to being enough," Shields said.

Another active season

The Atlantic basin can expect a hurricane season that looks a lot like last year's, said Dan Kottlowski, AccuWeather's lead hurricane expert. The 2021 season, the third-most active on record, had 21 named storms, seven of which became hurricanes. Four of those storms became major hurricanes with winds in excess of 111 mph.

"A lot of the parameters are in place," Kottlowski said in an interview. "We have a persistent La Niña and on top of that, we've got abnormally warm water across the Atlantic basin, which is helping to fuel not only tropical development but also enhancing the chance of rapid intensification."

But the number of storms in a season does not always correlate to insured losses, said Karen Clark, founder of risk modeler Karen Clark & Co. A record 30 named storms occurred in 2020, with 11 making landfall in the continental U.S. but none impacting a major metropolitan area.

Even with far more tropical activity, the 2020 season generated only $27.38 billion in insured losses, according to Aon PLC, compared to $39.69 billion a year earlier. In 2017, U.S. hurricanes caused $63.48 billion in insured losses, the highest total by far in the last decade.

When Hurricane Andrew ravaged southern Florida in 1992 and caused $27.3 billion in insured losses, there were just six named storms and four hurricanes all season.

While the accumulation of insured losses was "slightly above average" over the past couple of years, they were not bad years in terms of insured losses, according to Clark.

"Hurricanes are like real estate: it's 'location, location, location,'" Clark said in an interview. "Losses are going to be determined by where the hurricane makes landfall."