Among South Africa's banks, Absa Group Ltd.'s aggressive lending and Nedbank Ltd.'s reliance on retail borrowers have put them in a stronger position to navigate the lower-rate environment versus their peers.

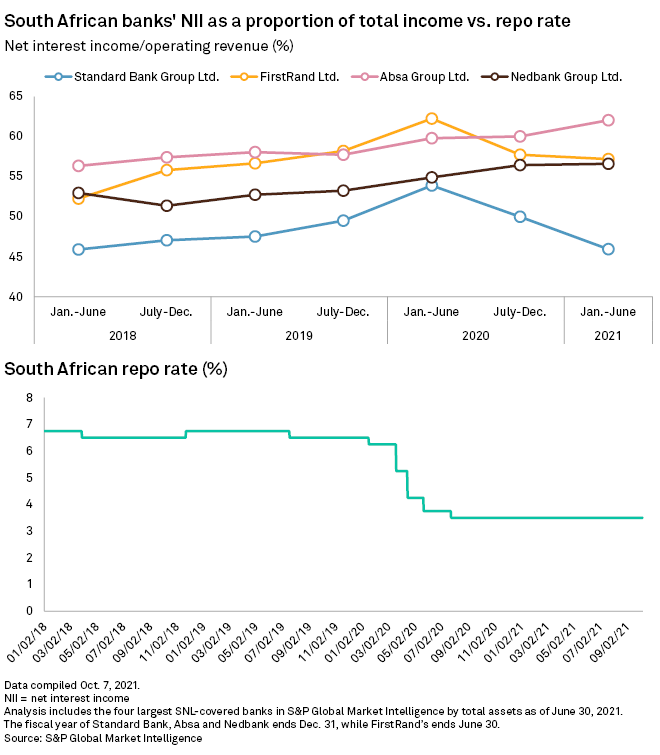

The South African Reserve Bank cut the benchmark repo rate several times in 2020 to stimulate the economy and to mitigate the economic effects of COVID-19. The rate currently stands at 3.5% and although a rate hike could be announced at the next policy meeting in November, lenders still face pressure on their net interest income, or NII, with the benchmark set to remain well below pre-pandemic levels. NII is a key driver of revenue, accounting for between 45% and 60% of lenders' total income.

"The rate cuts were so deep it has affected all banks. [T]he quantum of this differs between banks and depends on the structuring of their assets versus liabilities and how much of their deposits are retail versus corporate, also the makeup of their loan books," said Nolwandle Mthombeni, a senior banking analyst at Intellidex in Cape Town.

Nedbank has managed its NII in the lower rate environment "[t]hrough actions such as the selective origination of certain higher margin loan-types, supported by a favorable margin accretive tilt in asset mix — while continuing to operate within prudent credit risk appetite parameters — by replacing low margin wholesale funding with higher margin household and commercial deposits, and by lowering funding costs through a marginally shorter funding profile," Paul Bowes, the bank's executive head of balance sheet management, told S&P Global Market Intelligence.

Nedbank's NII in the first half of 2021 eclipsed its guidance. Full-year NII will be up 5% to 7% versus 2020, the bank said, which it attributes in part to a change in its asset mix as higher-yielding retail lending grew more than its less profitable corporate loan book.

"Nedbank has been lending, has been hedging somewhat, and has also switched out of some expensive funding given lower demand for some loans," said Ilan Stermer, an analyst at Renaissance Capital in London.

In its most recent half-year financial results, Nedbank highlighted how the rate cuts had boosted demand for secured lending such as home loans and vehicle finance. Applications for these increased 49% and 38%, respectively, year over year.

"Absa deploys a number of strategies to address interest rate risk, which include a governed interest rate risk management strategy — structural hedging program — through the interest rate cycle to reduce margin volatility associated with structural balances," a bank spokesperson said in an email.

Ex-Barclays PLC subsidiary Absa's half-year NII rose in the first at its fastest clip since at least 2018. This reflects a determination to win back the market share it lost during the latter stages of Barclays' control, while hedging also helped limit the negative impact of lower rates on NII.

"That made Absa stand out versus its peers, but it can't continue to grow this aggressively for much longer. At some point, competition will increase again," said Mthombeni.

"Now, Absa's strategy should be to cross-sell to its existing client base to get more transactional income. Absa doesn't want to take on too much risk because the economy remains fragile."

Winners and losers

The relative underperformance of Standard Bank, the country's largest bank by assets, was mostly due to its mortgage exposure relative to the rest of its loan portfolio, according to Mthombeni. Most mortgages in South Africa are floating-rate. NII among its consumer and high net worth division was flat, but for business and commercial clients and wholesale this fell 8% and 10%, respectively.

FirstRand expanded its unsecured lending "quite sharply" prior to the pandemic before reversing this approach, said Stermer, noting the bank had been reticent to lend "post-COVID until recently."

Standard Bank's net interest margin continued its downward trend in the first half of 2021.

"The expectation is that the interest rate environment will remain depressed for the foreseeable future, certainly through to the end of 2021," said Rivaan Roopnarain, a partner at consulting firm PwC in Johannesburg. "The key expectation is for muted loan growth for the next six to 12 months. That's a function of the heightened levels of uncertainty regarding the South African economy. We expect net interest income to continue to grow but probably at the same low single-digit levels of the past 12 months."