S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity firms working on year-end portfolio valuations have their work cut out for them after a tumultuous 2022.

Portfolio company valuations lean on comparisons to the revenue or profitability of similar, publicly traded businesses. But soaring inflation, rising interest rates and geopolitical turmoil scrambled the earnings trajectories and outlooks of companies across wide swaths of the global economy, making it difficult to get a clear read on performance.

Another key source of valuations data — the M&A market — has been relatively quiet this year. M&A deal value declined for five consecutive quarters in the U.S.

Craig Ter Boss, a partner in the valuation service group of accounting firm EisnerAmper LLP, recently offered some advice to valuations teams: Get out the pencil sharpener.

Not literally, of course. "Sharpening the pencil" is accountant-speak for a more rigorous, fine-grained analysis of corporate performance.

Ter Boss recently shared some ideas on what private equity valuations teams should look for this year to make sure their comps are truly apples to apples, or as close as they can get.

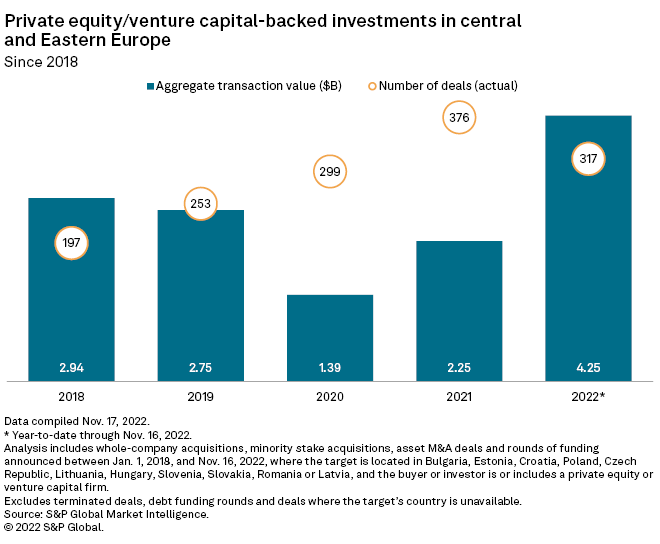

CHART OF THE WEEK: Central and Eastern Europe draw more private equity interest

⮞ The value of private equity and venture capital dealmaking in central and Eastern Europe zoomed past prior year totals in 2022, with $4.25 billion worth of deals recorded through Nov. 16, representing an increase of 88% over the 2021 full-year total.

⮞ Estonia led the way on the strength of mobility platform Bolt Technology O's $711.3 million funding round in January.

⮞ Private equity dealmaking in the region is expected to continue to trend upward, according to a report from Bain & Co., the Polish Private Equity and Venture Capital Association and private equity firm PFR Ventures Ltd. The report argues that the region "has all the pieces in place to embark on sustained acceleration."

DEALS AND FUNDRAISING

* Blackstone Inc. and Rivean Capital BV closed their acquisition of Esdec Solar Group BV, a Dutch provider of rooftop solar mounting systems.

* EQT AB is considering acquiring a majority stake in calibration services company Trescal from OMERS Private Equity. In the potential deal, OMERS will reinvest for a 25% stake in the company.

* The Carlyle Group Inc. brought in roughly $3.12 billion for CETP V, the latest iteration in the firm's pan-European technology fund series, Reuters reported, citing the co-heads of Carlyle Europe Technology Partners.

* Adams Street Partners LLC closed its Adams Street 2020 Global Fund program with roughly $1.1 billion in capital commitments.

ELSEWHERE IN THE INDUSTRY

* CVC agreed to sell French insurance broker April Group to KKR & Co. Inc. The deal is subject to legal and regulatory approvals.

* Private equity firms Clayton Dubilier & Rice LLC and Greenbriar Equity Group LP are investing in the merger of aerospace companies Dynamic Precision Group Inc., or Paradigm Precision, and Whitcraft LLC. Paradigm is majority owned by Carlyle-managed funds, and Whitcraft is a portfolio company of Greenbriar.

* The Riverside Co. completed the acquisition of Canuti Tradizione Italiana, which produces frozen pasta.

* Novacap will acquire All West Communications Inc., a fiber-based provider of data, video and voice services, in a transaction expected to close during the first half of 2023.

FOCUS ON: HEALTHCARE

* Audax acquired wellness clinic operator Medi-Weightloss Franchising USA LLC, with Buzz Franchise Brands LLC coinvesting as a minority partner.

* Amulet Capital Partners LP closed on United Vein & Vascular Centers.

* AGIC Capital acquired a majority interest in Atec Pharmatechnik GmbH, a German manufacturer of aseptic processing solutions.