Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Feb, 2021

|

| Plug Power CEO Andrew Marsh. The U.S. hydrogen technology company is eyeing further growth in the European market. Source: Plug Power |

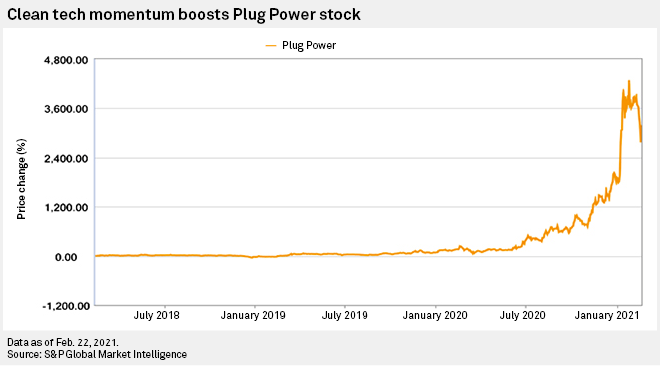

➤ Plug Power "in the right place at the right time" after more than tenfold stock growth in 2020, says CEO.

➤ U.S.-based company looking to expand further in Europe's hydrogen economy.

➤ Expects new partnerships like those with Acciona and Renault but does not see itself as M&A target.

Recent months have brought a surge of industry and investor enthusiasm for hydrogen technology companies such as Plug Power Inc. The Latham, N.Y.-headquartered fuel-cell and electrolyzer-maker recently entered into a €2 billion partnership with Spanish power company Acciona SA for producing green hydrogen. Korean conglomerate SK Group Ltd. has invested $1.5 billion in the company, and it is also developing fuel-cell vehicles with French automaker Renault SA. In a conversation with S&P Global Market Intelligence, CEO Andrew Marsh reflected on this momentum and outlined the company's plans for expansion. The following is an edited transcript of the conversation.

S&P Global Market Intelligence: Hydrogen companies such as Plug Power are seeing significant investment momentum, hype even. How have you experienced this in the past year?

Andrew Marsh: Plug has not been an overnight success. [It] has been in the right place at the right time after 25 years. ... We spend much more time with the [environmental, social and governance] investment community. When you think about how you invest out of COVID-19, people aren't looking to invest in old industries. ... As the world has moved to achieve net-zero carbon emissions, Plug Power has been in an ideal position to support that effort.

There's a hype, and there's companies like Plug Power [and others] that are working on real products and real applications, building the future world.

Europe is prioritizing heavy industry such as refining, steel and chemicals for the switch to green hydrogen, and road transport is further down the list. What does that mean for your European plans?

[The joint venture with Acciona] is targeting to have 20% of the Iberian market for the generation of green hydrogen [by 2030]. ... We have industry-leading electrolyzers [and] the ability to build hydrogen plants. ... Plug Power is a pure green hydrogen play. ... That's where the future is.

There are certain applications where fuel cells are far superior to batteries: when it comes to things like fleet vehicles, where asset utilization is really important, where fast fueling, versus charging time, and range are important. And we expect the joint venture [with Renault on hydrogen mobility] will have a 30% market share by 2030. We're putting hundreds of thousands of vehicles on the road in Europe by that time.

Are you planning a further expansion of your European footprint? And how do you assess M&A potential?

Yes. We've been working very closely with Banco Santander SA, who have been the facilitator for the deals with Renault and with Acciona. And we certainly are looking to expand with utilities beyond those two opportunities. We aren't done in Europe yet.

We have some large deployments, which will continue for our electrolyzer products in Europe as well as our fuel-cell products. We have a big footprint in the Bayerische Motoren Werke AG facility in Leipzig ... [and] we're involved in airport deployments throughout Europe. So Europe is a really exciting opportunity for us. Very soon, Plug will probably announce a location of a large European headquarters.

Plug Power will be looking to do additional acquisitions over the coming year as well as partnerships, both in Europe and around the world. It's clear to say we have not stopped. ... As far as being acquired, we're sold on the stock market, right? ... We're not planning to be sold, but somebody's buying us as we speak. ... I don't spend any time thinking about being acquired; I think about how to build out Plug Power.

How important is the policy environment for the fortunes of green hydrogen, both in Europe and in the U.S.?

In Europe, a lot of the initiatives are certainly government-driven. In the U.S. ... many of the initiatives [are] actually company driven. The younger generation especially is more sensitive to the social responsibilities companies must have, and I think that drives a great deal.

Where government policy really helps ... is to accelerate the adoption of this technology and to create a fair playing field. ... I think what the Biden administration hopes to do is to develop a tax code that incentivizes the future, [which] will be very beneficial to renewables across the board.

|

A Plug Power hydrogen truck. |

Some countries have ambitious hydrogen capacity targets, and there are regularly new project announcements. Is there a risk of overpromising, or "hydrogen by press release," and that not every project materializes?

We're in the luxury of having done this for many years and being in a strong financial position. I don't have to live by the next press release to get funding or get to the next level. We're really focused on building real industry, real applications. I told [investor SK Group] I didn't want their money until they could convince me that we could actually really build a business together. ... I'll tell you, I [expected] that kind of investment in Asia about two years from now; it happened faster. Other activities go slower.

Even if it's half [of what is projected], that's really a big industry. I'm not overwhelmed [by the targets]. I think those numbers are realistic. [Plug Power] is building a facility now that's 1.6 GW of capability; about 500 MW will be committed to electrolyzers. ... There are companies like ourselves who've been doing this for a long time, who know how to scale this activity.

How well-equipped will the hydrogen economy be to handle extreme weather and avoid disruption like in Texas?

It has everything to do with how the network and infrastructure was designed for the environment. ... You can design hydrogen generation plants and make them weatherproof. But if you don't design the products to be weatherproof, I don't care what the technology is, it won't work.

It's a clear statement of the criticality of recognizing how infrastructure has to change because of all the damage CO2 has done to the environment. People think about global warming, it's certainly global warming, but it's also great global variations, extreme temperature ranges.