S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

The message at SuperReturn North America was clear: If private equity wants to reach desired return targets, they have to get to work and add value to portfolio companies through operational improvements.

Firms can no longer count on multiple expansions fueled by steady economic growth and a free-flowing supply of labor, said Patrick Severson, a senior managing director at Vista Equity Partners Management LLC. Uncertain times create opportunity, but seizing that opportunity requires a greater degree of collaboration between management teams and investors, Severson added.

"It's a great time if you are the type of firm that rolls up your sleeves, is willing to navigate some complexity," Severson said during a panel discussion on the main stage of the annual conference, held Sept. 13-14 in New York City.

Another panelist, Adam Howarth, co-head of portfolio management for Partners Group Holding AG, shared Severson's view that private equity has to approach investments with a fine-tuned business transformation plan. That means growing companies and not just cutting costs, he added.

A key piece of the Partners Group strategy has been to hire talent for its investment team directly from the industries the firm invests in. "Which has been a great fit for us because there's a lot of alignment between what we're trying to do in terms of rolling up our sleeves and creating value in these businesses and what their skillsets are," Howarth said, echoing Severson's sartorial turn of phrase.

Still, the industry remains tentative amid record inflation, rising interest rates and geopolitical upheaval. Global private equity entries fell nearly 46% year over year in August.

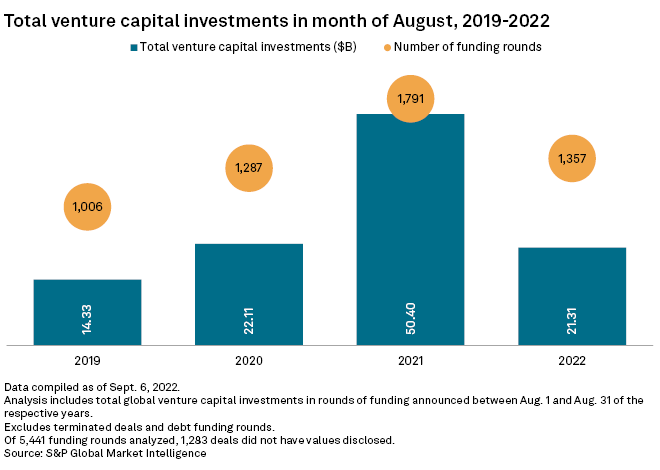

CHART OF THE WEEK: Venture capital funding rounds dry up in August

⮞ Global venture capital-backed funding rounds dropped 57.7% year over year in August to $21.31 billion.

⮞ The technology, media and telecommunications sector made up the biggest share of the capital raised during the month at 44.4%.

⮞ South Korean electric vehicle battery manufacturer SK on Co. Ltd. nabbed the largest funding round in August, raising about $1.51 billion.

DEALS AND FUNDRAISING

* Funds managed by The Carlyle Group Inc. closed the acquisition of ManTech International Corp., which provides technologies and solutions for mission-critical national security programs. The all-cash deal had an enterprise value of about $4.2 billion.

* Veritas Capital Fund Management agreed to acquire Sequa Corp. from Carlyle-managed funds in a deal expected to close during the fourth quarter. Sequa is the parent company of Chromalloy, which provides aftermarket services to the airline industry.

* Baring Private Equity Asia raised $11.2 billion for its Baring Private Equity Asia Fund VIII, against an $8.5 billion target. The fund will invest in the Asia-Pacific region, with a focus on the core sectors of healthcare, technology services, business services, education, financial services, consumer and advanced manufacturing.

* EQT AB's EQT Growth AB fund secured total commitments of €2.4 billion at final close, with €2.2 billion in fee-generating assets under management. The fund focuses on technology companies, particularly in Europe and Israel.

ELSEWHERE IN THE INDUSTRY

* FTV Capital invested $146 million in Patra Corp. The growth investment was part of a move to recapitalize the insurance industry service provider.

* Odyssey Aviation LLC, a fixed-based operator serving private aviation customers and air cargo operators, received a capital injection from Granite Creek Capital Partners. The investment is part of a larger recapitalization in which Odyssey CEO Salvatore Calvino's investment arm, Equivu Capital LLC, becomes the majority shareholder of the business.

* Kinderhook Industries LLC sold National Truck Protection Co. Inc. to JM Family Enterprises Inc. National Truck provides the commercial truck industry with aftermarket warranty programs.

* Blue Point Capital Partners LLC and The Riverside Co. jointly invested in siffron Inc., a retail merchandising fixtures and product display solutions company.

FOCUS ON: HEALTHCARE

* Everstone Capital Asia Pte Ltd. acquired a controlling stake in Softgel Healthcare. The India-based company offers outsourcing solutions for pharmaceutical and nutraceutical companies.

* Riverside invested in Jupiter Life Science Consulting, an add-on acquisition for its pharmaceutical services platform Red Nucleus Solutions LLC. Jupiter offers commercial and market-access strategies for pharmaceutical, biotechnology and medical device companies.

* An affiliate of H.I.G. Capital LLC recapitalized technology-enabled clinical research organization Navitas Life Sciences Inc.

* Renal Care 360, a nephrology practice and chronic care management company, received a capital injection from Pharos Capital Group LLC.