As the coronavirus pandemic continues to devastate the finances of U.S. hospitals and health systems, experts predict a short-term rise in strategic M&A dealmaking and interest from private equity to scoop up flagging physicians offices.

The pandemic "provides a potential war chest if you're thinking about going out and acquiring struggling providers," Christopher Whaley, a researcher at policy think tank the RAND Corp., said in an interview.

Hospitals and providers have deferred elective or nonessential care in an effort to stop the spread of the virus and conserve much-needed resources, cutting off a lucrative line of business that is expected to cost the industry over $161 billion by June. Some of the country's largest for-profit hospital companies — HCA Healthcare Inc., Universal Health Services Inc. and Tenet Healthcare Corp. — have reported substantial patient and procedure volume declines in the first quarter of 2020 with the trend expected to continue.

Larger hospitals and health systems may be well-positioned to weather the downturn and use strategic M&A to boost revenues, Whaley said.

Smaller systems, on the other hand, may be forced to sell or close their doors.

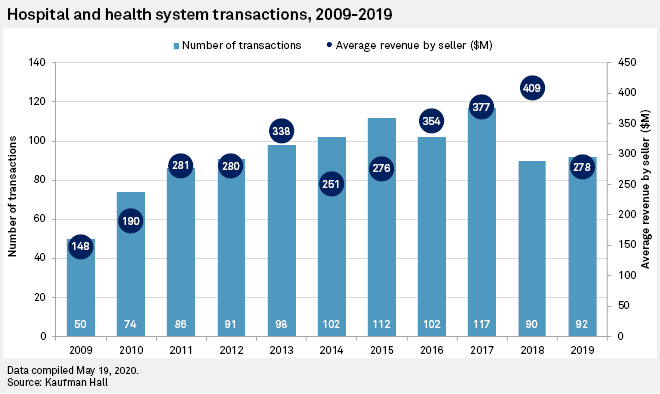

"For those who are facing those challenges, [distressed transactions] will be a part of the landscape of M&A transactions for a period of time, whether that's six, 12, 18 months, I don't know," said Anu Singh, managing director at Kaufman Hall, a consultant for healthcare companies and other institutions.

Distressed providers and facilities could offer an M&A opportunity for Nashville, Tenn.-based HCA, CFO William Rutherford said May 12 during the BofA Securities 2020 Health Care Conference. HCA plans to examine the environment over the next 12 to 24 months as the company gets a better read on volumes and revenue, Rutherford said.

Universal Health may also consider buying struggling facilities as a way to expand in the company's current markets, CFO Steve Filton said during an April 28 earnings call. However, Filton did not provide a timeline for when Universal Health would be active.

'Motivating events'

Some hospitals have put current deals on hold to address the crisis and manage day-to-day operations and liquidity needs, according to John Langenderfer, senior vice president and managing director of healthcare banking at Huntington Commercial Bank.

Michigan-based Beaumont Health in April delayed a merger with Summa Health, an Ohio-based health system. The delay was announced the same day Beaumont reported negative net income of $278.4 million for the first quarter, a $407.5 million decrease compared to the prior year, according to an April 21 statement. Beaumont did not return a request for comment as of publication regarding the length of the delay.

"These conversations have been going on with CEOs for many years," he said. "A lot of times it takes ... motivating events to create alignment for a possible sale, joint venture partnership."

Hospitals may be looking to grow their footprints in current markets or expand into geographies where they do not have a presence, according to Langenderfer. He said that hospitals and health systems may also look past traditional providers to newer industries that have grown during the crisis, like telemedicine.

Companies will ultimately revert back to strategic transactions based on factors like increasing a system's capabilities or geographic footprint, which has fueled M&A deals in the industry for the last several years, according to Kaufman Hall's Singh.

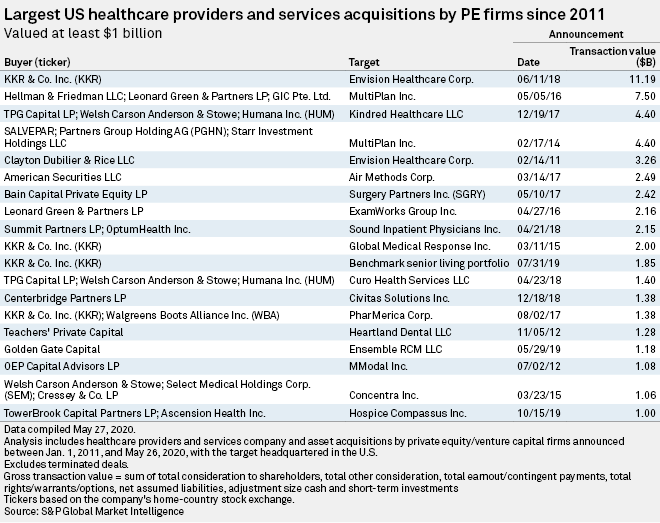

Starting around 2015 or 2016, private equity deals for healthcare took off and have steadily increased, Whaley said. Physician offices, which have been hard-hit by the crisis and attracted attention from firms before the pandemic, could be a primary target for private equity firms, he added.

Over the last several years, private equity has also been interested in specialized hospital services that can be replicated across a number of systems or organizations, according to Singh. Going forward, firms will likely value systems and services that are resilient to the pandemic, he added.

"The other x-factor that private equity always brings is, not only is it the strategic value of the investment being made, but it's also the capital structure that is deployed," Singh said.

How market participants like lenders and other entities holding capital perceive risk during this time will influence firms' investment strategies, according to Singh.

Impact on rural providers

Rural hospitals across the country are also under strain, primarily due to the decline in elective care, executives have said. One Wisconsin health system reported losses of $60 million in just a few weeks. These facilities were already facing thin operating margins and a heightened risk of closure before the crisis.

Some rural facilities may have to consider bankruptcy or "a hurry-up merger," Langenderfer said. Rural hospitals are "nice, easy tuck-ins" for larger systems, he added.

Smaller systems or hospitals may want to be part of a larger company after considering recent issues like supply and staffing shortages, increased costs from preparing for patient surges, and a potential resurgence of cases in the fall, Rick Gundling, senior vice president of healthcare financial practices for the Healthcare Financial Management Association, said in an interview.

Hospitals' and health systems' M&A strategy could be shaped by what operational gaps have been highlighted by the crisis and what will be needed to operate in a post-pandemic environment, Langenderfer said.

"Any crisis, whether this or any nature, exposes a company, an operation, to some of their weaknesses," he said. "This pushed all of our providers ... to learn that we're not really prepared for an epidemic like this."