North American electric utilities could flood the M&A market with contracted renewables portfolios in 2022 as those assets fetch attractive prices and the trend toward pure-play, investor-owned and regulated rate bases persists.

While there may be some corporate-level and whole-subsidiary transactions, minority stake transactions and contracted renewable power asset recycling will likely dominate deal-making in the coming calendar year, industry equity analysts said.

Heavyweights like Duke Energy Corp. and American Electric Power Co. Inc. which have non-regulated renewables businesses, as well as companies like Consolidated Edison Inc. that acquired them from other utilities, will look to shed those portfolios that have not integrated into their rate bases, according to Barclays power and utility research director Eric Beaumont.

"They've all learned how to do renewables now ... so it wouldn't surprise me if they shed those businesses simply because it's hard to come by risk-adjusted returns as good or better in the utility within those businesses," Beaumont explained in an interview. "There's a good chance you see utilities start divesting their non-regulated commercial renewable books."

Recycling investments

Neil Kalton, managing director of utility equity research at Wells Fargo Securities, agreed that such transactions could be enticing alternatives to tapping equity capital markets.

"The multiples being paid for those assets is really attractive," Kalton said. At the same time, utilities face compressed returns on contracted renewables "because in many cases, they are not developing or originating their own projects, they're buying them in early stages from small developers."

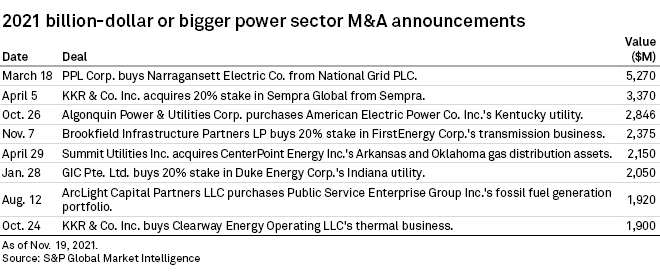

Algonquin Power & Utilities Corp. plans to pursue that strategy to help fund its recently announced $2.85 billion purchase of American Electric Power Co. Inc.'s Kentucky utility and transmission businesses.

"Whatever we do in terms of asset recycling probably will be more on the renewable side of the business where we believe it could be ... orphan assets that we perhaps developed or acquired many years ago that may not be a good strategic fit anymore," Algonquin Power President and CEO Arun Banskota said Nov. 12 during the company's third-quarter earnings conference call.

While management neither confirmed nor denied that Algonquin's 44% stake in Atlantica Sustainable Infrastructure PLC, formerly known as Atlantica Yield, could be part of the sale process, they did acknowledge that dropping down renewable assets into the yieldco could be an option.

Kalton also expects more minority stake deals in 2022 as another substitute for traditional capital raises. Private equity-backed transactions like Duke's sale of a 19.9% interest in its Indiana utility to GIC Pte. Ltd. and Brookfield Asset Management Inc.'s acquisition of a 19.9% ownership in FirstEnergy Corp.'s transmission business through its infrastructure investment arm can attract "companies that need equity and that trade at pretty steep discounts," Kalton said.

Financing the energy transition

For both privately backed and publicly listed buyers, Morningstar analyst Travis Miller noted that natural gas LDCs' solid three- to five-year growth trajectories may justify investments like Summit Utilities Inc.'s $2.15 billion acquisition of CenterPoint Energy Inc.'s Arkansas and Oklahoma gas distribution assets.

Gas-fired plants could also be in the M&A crosshairs for some utilities.

Southern Co. Chairman, President and CEO Tom Fanning told investors Nov. 4 that adding units with 10 to 15 operating years left "fits in with retirement schedules ... so those assets look like bridging assets and [are] very attractive economically and important to our strategy of replacing it with renewables."

Regulated utility holding companies may also be interested in buying specific assets that smaller and mid-sized companies cannot afford to retrofit for the energy transition.

"If we go back five, six, seven years, some of the smaller names sold coal assets because they didn't have the balance sheets to do big upgrades," Mizuho Securities USA LLC's Anthony Crowdell said in an interview, citing Missouri utility Empire District Electric Co.'s 2017 acquisition by Algonquin.

Private equity, however, will continue to drive the market for power company fossil fuel assets as valuations like Public Service Enterprise Group Inc.'s $1.92 billion sale of its thermal portfolio to ArcLight Capital Partners LLC trend more conservative due to terminal value concerns.

Limited corporate M&A appetite?

While Kalton expects one or two corporate-level transactions in 2022 based on the last five to 10 years, Barclays' Beaumont emphasized that only NextEra Energy Inc. and WEC Energy Group Inc. "have the balance sheet ability to back-leverage finance" — or issue holdco loans for — such deals.

Crowdell, however, noted that the lack of load growth in many jurisdictions could increase opportunities for corporate mergers.

"It wouldn't surprise me if ... consolidation continues at a steady pace," Crowdell said, given "anemic" service territory growth in some places and the potential for cost savings and synergies.

For NextEra, though, water utilities could be an even more attractive consolidation proposition. The renewables giant told investors Oct. 20 it plans to actively buy additional private and municipal systems after agreeing to acquire a $45 million "portfolio of rate-regulated water and wastewater utility assets in eight counties near Houston, Texas."

Guggenheim Securities LLC analysts wrote that "the fragmentation of the water utility space, sustainability upsides and regulated nature of investments make sense ... for [NextEra's] overall strategy."