Webinar Rewind - February 21, 2023

In the past few years, hundreds of companies have announced intentions to become net zero or carbon neutral by 2050. However, this is no easy task for Scope 3 emissions, defined by the Greenhouse Gas Protocol as emissions in a company’s value chain that it does not produce.

In this webinar, Brian Werner, Head of Sustainability Sales for S&P Global Market Intelligence, moderates a panel sat by Vandana Gaur, Senior Manager, Corporate Analytics, at S&P Global Sustainable1, alongside Sharon Vidal, Senior Director, Head of Corporate Social Responsibility at Illumina; and Athanasia Xeros, Vice President of Environmental Sustainability at Mastercard.

What Are Scope 3 Emissions?

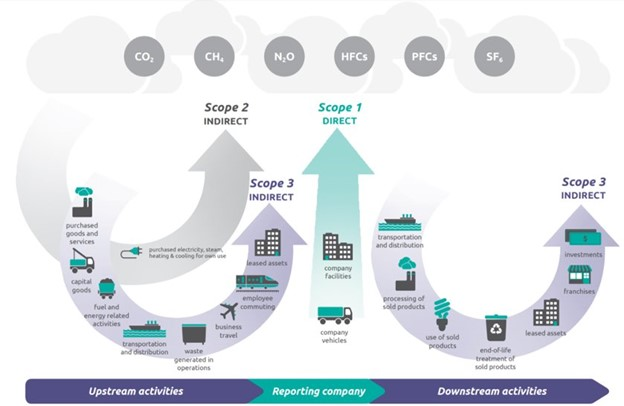

Scope 3 emissions are greenhouse gas (GHG) emissions throughout a company’s value chain, including upstream and downstream activities (Figure 1). These emissions occur due to the company’s business activities but are produced outside the company’s direct control.

Scope 3 emissions can include a wide range of activities, such as emissions from purchased goods and services, transportation of goods and services, waste disposal, and the use of products sold by the company. They are often considered the most difficult and complex emissions to measure and manage because they involve multiple entities along the value chain, including suppliers, customers, and other stakeholders.

Figure 1 - Source: WRI (2015) GHG Protocol: Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

As Scope 3 emissions become a greater focus of ESG reporting and regulatory frameworks, companies are faced with new challenges in measuring and disclosing their environmental impact.

Vandana Gaur highlights the increasing pressure on companies to disclose their emissions, citing a range of regulations and reporting requirements that are becoming more stringent. “As of February 2023, ESG reporting is required as a listing rule for 34[1] stock exchanges covering market capitalization of 25 trillion$. Additionally, there are SEC guidelines and a proposed SEC guideline[2], which talks about disclosing scope 1, 2, and 3 emissions.” She goes on to say, “Then we have TCFD reporting recommendations[3], which again talks about disclosing scope 1, 2 and 3 emissions. And as of today, we have around 70[4] global carbon tax regimes – so as you can see regulations are getting more and more stringent. And companies are asked to disclose their scope 1, 2 and 3 emissions.”

Why Scope 3 Emissions Matter

In addition to mitigating the effects of climate change and reducing global GHG emissions, addressing Scope 3 emissions is equally important to the sustainability strategy of individual companies. By taking action to understand and reduce Scope 3 emissions, companies can make dramatic progress towards their net zero goal. They can also build resilience in their supply chains and demonstrate their commitment to sustainability and environmental stewardship.

Fortunately, an increasing amount of data and guidance is available to help companies accurately measure their Scope 3 emissions and effectively integrate them into their sustainability strategies. In real-world terms, Sharon Vidal of Illumina explains, When we launched our first official sustainability targets in 2020, we started off with just scopes 1 and 2. And while we based them on the science-based target initiative methodology, we couldn’t officially go for verification at the time because we didn’t have any data on scope 3 or any idea how even to start.

Vidal continues, “Fast forward to today we now have science-based target verification for scopes 1, 2, 3; as well as verification on our net zero targets by 2050. And we know we won’t get there without addressing our scope 3 emissions. And we couldn’t have done that without access to this data and a guide helping us like S&P Global through the process.”

How to Compute Scope 3 Emissions

Computing Scope 3 emissions can be a complex process that requires detailed information about a company’s value chain and business operations. In other words, “Sustainability doesn’t just sit within one group in an organization. That’s actually one great thing about scopes 1, 2 and 3 - they probably hit everyone, from the people who are in charge of your business travel to the facility managers running your building, to your leasing and real estate team,” says Athanasia Xeros of Mastercard.

Some general steps are as follows but are by no means exhaustive:

- Identify relevant emission sources/activities: The first step in computing Scope 3 emissions is identifying all relevant emission sources throughout the value chain. This may include emissions sources such as suppliers of purchased goods and services, transportation, employee commuting, waste disposal, and company product use.

- Categorize emissions: After identifying relevant activities, these activities must be categorized according to the GHG Protocol’s Scope 3 categories. These categories include upstream emissions from purchased goods and services, upstream and downstream emissions from transportation and distribution, emissions from use of sold products, and many more.

- Collect data: Once the relevant emission sources have been identified and mapped to scope 3 categories, data must be collected on the activities associated with each source. This may require working with suppliers and other partners to obtain the necessary data.

- Calculate emissions: Once data has been gathered, emissions can be quantified using appropriate emissions factors. Emissions factors are specific to each type of emission source and are used to convert the data collected in step 3 into emissions data.

- Report emissions: Emissions data must be reported transparently and consistently. Many companies report Scope 3 emissions in annual sustainability reports or other public disclosures.

Luckily, companies are not alone in their effort to understand and manage Scope 3 emissions. As Brian Werner observes, “your scope 3 emissions are somebody else’s scope 1 and 2 emissions. And your suppliers are probably somebody else’s suppliers, so there’s a huge community working together to achieve these lofty goals and reduce scope 3 emissions.”