Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — 21 Feb, 2024

Background

Note: This follows up from the earlier article: The informativeness of research reports – is all text content created equal? (January 2024) which indicated that:

We further illustrate this with a case study on real estate; and explore another potentially interesting content set called scores and factors, which include the entity’s Business Risk profile and the Financial Risk Profile (see Corporate Methodology, Jan. 7, 2024. Available on RatingsDirect® on CIQ Pro).

Tracing Text Sentiment on S&P Ratings Research Reports for a Property & Real Estate Entity

On Dec 6, 2023 Office Properties Income Trust (NASDAQGS:OPI) had its long term issuer credit rating downgraded to CCC+ (Watch Neg.); which was further downgraded to CCC (Outlook Neg.) on Feb. 7, 2024.

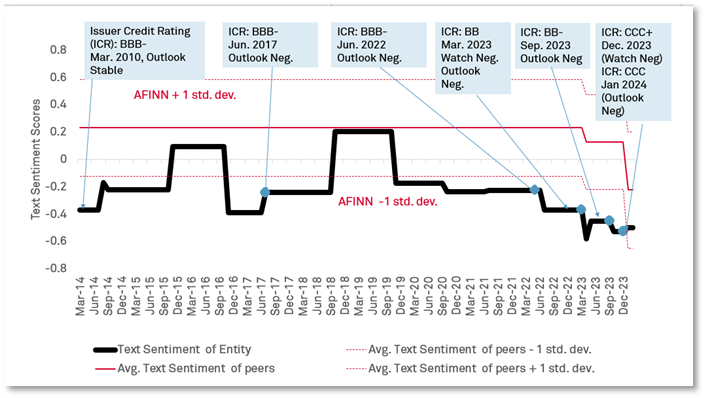

In Figure 1, we plot the S&P Global Ratings history, Outlook, and CreditWatch of this entity against the text sentiment scores. As described in the earlier article, these scores are derived from aggregating the text in the research report sections of this entity (thick black line in Figure 1 below) and matching these with an open-source AFINN sentiment lexicon, which maps words from a score of -5 negative to +5 positive, for illustrative purposes only. Clients can extend this to other sentiment lexicons of their choice.

We plotted the average text sentiment scores of entities with the same credit rating (solid red line); and marked its upper and lower 1 s.d. bounds of these scores (dotted red lines) for benchmarking purpose.

Figure 1: Credit Ratings & History for Office Properties Income Trust (NASDAQGS:OPI) vs. Text Sentiment Scores

Source: Credit ratings from RatingsXpress® Credit Ratings, which are also available on RatingsDirect® on CIQ Pro. Digitized research from RatingsXpress®: Research, both from from S&P Global Market Intelligence. The lexicon of Text Sentiment Scores are sourced from http://www2.imm.dtu.dk/pubdb/pubs/6010-full.html As of Feb. 2024. For illustrative purposes only.

The text sentiment score of the entity, which was eventually downgraded to CCC, was mostly below the average text sentiment benchmark in the years prior to the ratings downgrades. Furthermore, the text sentiment is at least 1 standard deviation worse than its rated peers for most of the last 10-year period.

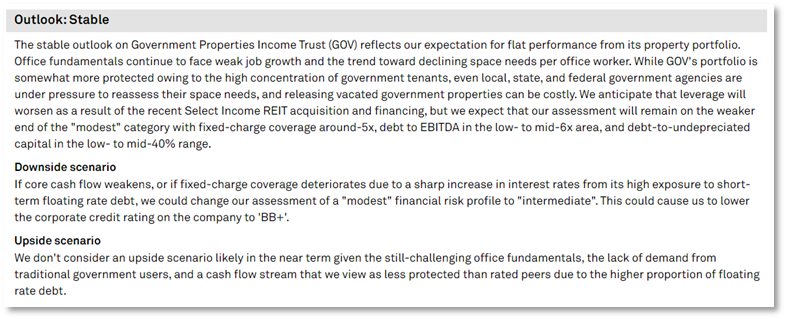

Here are examples of a section in a report that has text sentiment below the 1 standard deviation lower bound of peers. Figure 2 extracts from the Summary Analysis report for Government Properties Income Trust LLC published in Oct. 2016. (note: the entity which became Office Properties Income Trust in the merger announced in the year 2018 (see Research Update report published on Sept 17, 2018).

Figure 2: Outlook section from the Summary Analysis report of the Government Properties Income Trust LLC (which became Office Properties Income Trust) dated Oct. 2016.

Source: RatingsDirect® on CIQ Pro, as of Feb. 2024. A digitized version of this report is also available on RatingsXpress Research. For illustration Only.

Despite the moderate improvement in text sentiment post-merger, the research sentiment again turned negative over time. Figure 3 extracts from the Research Update report published on June 23, 2022.

Figure 3: Outlook section in the Research Update report on Office Properties Income Trust dated Jun. 2022

Source: RatingsDirect® on CIQ Pro, as of Feb. 2024. A digitized version of this report is also available on RatingsXpress Research. For illustration Only.

Signal from Text Sentiment confirmed by Changes in Business and Financial Risk Profiles

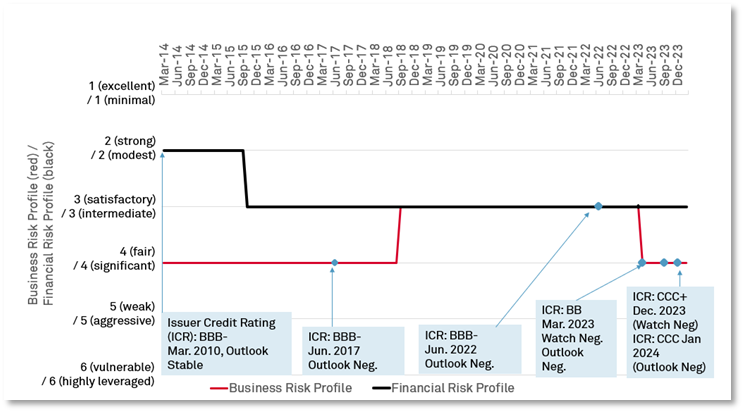

Business risk and financial risk profiles published in the research reports serve as a confirming signal on ratings downside before the merger in year 2018; and then subsequently in year 2023.

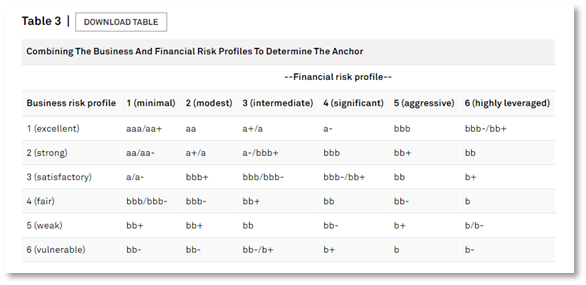

For real estate entities, the Business Risk Profile and Financial Risk Profiles range from 1 the best to 6 worst per S&P Global Ratings’ Criteria (see Figure 3 below)

Figure 3: Business And Financial Risk Profiles for Property & Real Estate

Source: Corporate Methodology | Jan 7, 2024, from RatingsDirect® on CIQ Pro, as of Feb. 2024.

With a business risk profile of 4 (fair) and a financial risk profile of 3 (intermediate) in the year 2015, the entity’s anchor before the merger is already below its rated peers and benchmarked at a “bb+” against the credit rating of BBB-. (see Research Update published October 20, 2015). The business risk profile was again moved to 4 (fair) on the back of cyclical headwinds affecting the sector, with the anchor moved to bb+ and notched down by -1 from the liquidity modifier (See Research Update here).

Figure 4: Business Risk Profiles and and Financial Risk Profiles of Office Properties Income Trust, March 2014 to present

Source: Extracted from Summary Analysis, Full Analysis and Research Update reports from RatingsDirect® on CIQ Pro, as of Feb. 2024.

Conclusion:

In this case study, we show an example of how negative research sentiment that is significantly below peer average can serve as an early warning of credit ratings downgrades, particularly when confirmed by a combination of shifts in the business risk profile, financial risk profile, CreditWatch, and Outlook in the same direction. Such insights prove valuable for monitoring potential downside risks within sectors grappling with industry headwinds. It also indicates the potential for an alpha factor by building a Z-score from text sentiment (subtracting the mean from the same rating category and dividing by its standard deviation).