Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — 14 May, 2024

By Paul Vinzani

Highlights

The Client: Asset servicer

Internal Users: Client reporting solutions

Redistribution End Clients: Insurance and banking firms

In a world of ever-changing and developing regulatory requirements, firms who support reporting capabilities need to develop sustainable automation that can be updated and enhanced to meet customer needs.

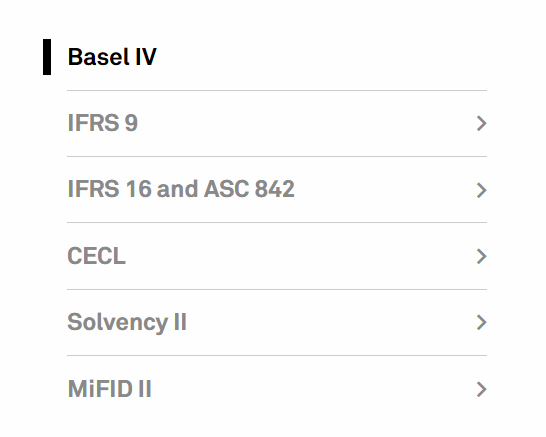

Asset servicers have begun offering enhanced regulatory reporting to their end customers. Among these customers, insurance and banking firms are under increased regulatory scrutiny to disclose their investments and debt structures to determine risk thresholds and capital adequacy, as they serve public markets. Basel II and solvency regimes are two examples where credit quality assessments must be reported consistently and accurately. Feed solutions from S&P Global Market Intelligence ("Market Intelligence") can help automate this reporting by offering reliable and flexible delivery of one of the industry’s largest databases of current and historical credit ratings. This coverage from S&P Global Ratings includes corporate, sovereign, U.S. public finance and structured asset classes globally.

This asset servicer requested the use of credit ratings from S&P Global Ratings to automate its regulatory reporting to reduce the time it takes to manually create credit quality reports on behalf of its customers. RatingsXpress feed delivery enables the seamless linking of regulatory models to underlying credit ratings across thousands of entities. The automation has helped this asset servicer create a sustainable business model that can scale to accommodate more clients and changing regulatory requirements.

Service providers need to accommodate diverse client reporting needs to help their clients meet regulatory requirements. This firm wanted to automate its reporting processes to:

The team reached out to "Market Intelligence" to see what was possible.

Specialists from Market Intelligence discussed RatingsXpress delivered via XpressfeedTM, a powerful data feed management solution. This would provide the company with:

|

Access to trusted credit ratings |

RatingsXpress offers one of the industry’s largest databases of current and historical credit ratings from S&P Global Ratings with entity- and security-level data in one schema. The credit ratings cover nearly one million securities:

|

|

A reliable and flexible delivery mechanism |

Xpressfeed offers streamlined delivery of credit ratings from S&P Global Ratings. The solution enables wealth managers to ensure accurate, timely delivery of critical information while helping to automate client statement reporting processes. |

Figure 1: Sample Regulatory Reporting Regimes

Source: S&P Global. For illustrative purposes only

This firm is now able to ingest one of the industry’s largest databases of current and historical credit ratings in a way that:

Click here for more information on the solution mentioned in this Case Study.

Theme

Products & Offerings