Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 27 Sep, 2022

By Sarah Cottle

Today is Tuesday, September 27, 2022, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we put a spotlight on the global slump in dealmaking. Only 14 U.S. bank M&A deals were announced in August compared with 17 deals in July. However, aggregate deal value jumped to $891.4 million from $457.5 million, according to S&P Global Market Intelligence. Due to tight monetary policy and increased regulatory scrutiny for large deals, some superregional banks are looking for nonbank M&A. In the European financial sector, 62 deals were recorded in August, the lowest monthly total year-to-date, according to Market Intelligence data. With the rise in the cost of financing, many companies in the tech space have suffered declines in valuations. In the oil and gas industry, the number of whole-company and minority stake deals declined to 21 in August from 32 a year ago.

Aggressive interest rate hikes to tame inflation have led to an 18.9% slump in gold prices since March, according to S&P Global Market Intelligence data. The price of gold fell $389 per ounce to $1,667.10/oz on Sept. 15 from a peak of $2,056.10/oz on March 8. Some analysts see the retreat as a blip and predict higher prices in the years ahead.

Transaction banking revenues have reached their highest levels since the global financial crisis, as the industry benefits from interest rate hikes and huge corporate demand for financing. The world’s 10 largest transaction banks reported combined revenue of $15.6 billion in the first half of 2022, according to data by Coalition Greenwich, an S&P Global-owned company. Supply chain disruptions resulting from Russia’s invasion of Ukraine in sectors such as agricultural commodities and energy have led to a greater corporate need for supply chain finance and commodity trade finance.

We also feature our author, Sarah Cottle, sharing three top research highlights in our Insight Monthly video.

Insight Monthly, September 2022

See a recap of the top three research highlights by S&P Global Market Intelligence for September 2022:

—Read the full article from S&P Global Market Intelligence

The Big Number

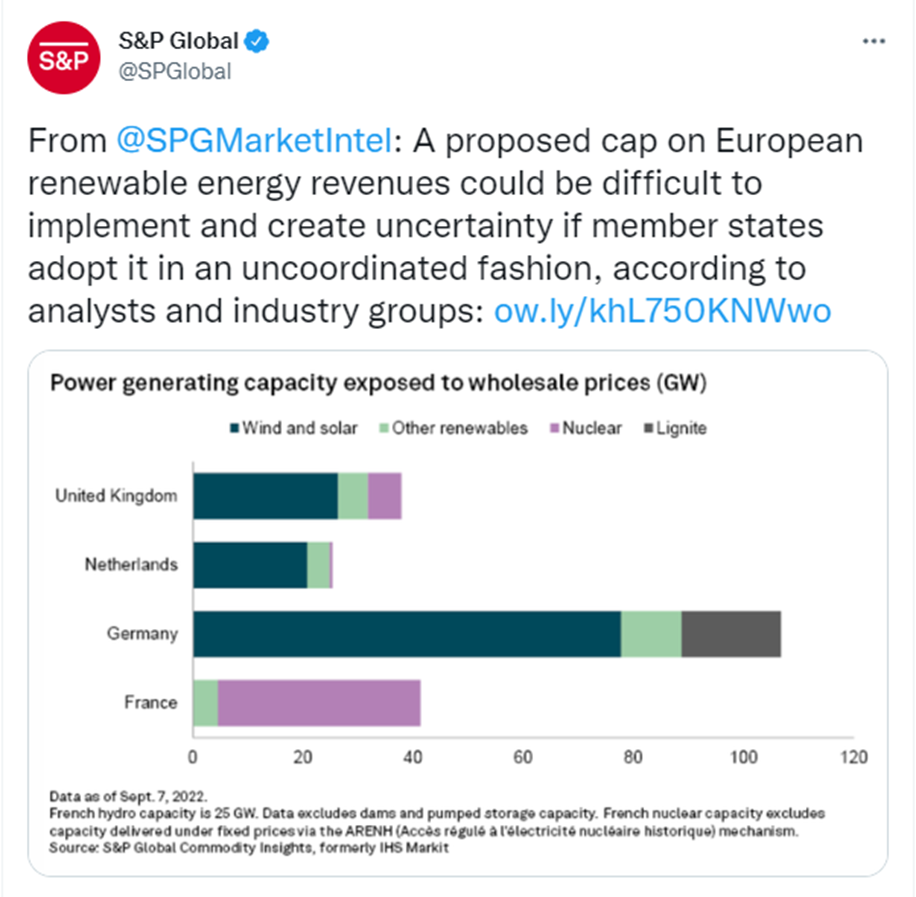

Trending

—Read more on S&P Global Market Intelligence and follow @SPGlobal and @SPGMarketIntel on Twitter

Seek & Prosper

Essential Intelligence from S&P Global — a powerful combination of data, technology, and expertise — helps you push past the expected and renders the status quo obsolete. Because a better, more prosperous future is yours for the seeking.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Louis Bacani

Theme