Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 19, 2022

By Akshat Goel, Ben Herzon, and Ken Matheny

The outlook for US GDP growth remains weak for the third quarter and beyond.

We lowered our forecast of third-quarter GDP growth to a scant 0.4% (annual rate), largely because new and revised data on retail sales through August suggested lower growth in personal consumption expenditures (PCE).

Total retail and food services sales rose 0.3% in August. This exceeded consensus expectations and followed a 0.4% decline in July that was revised down from no change. During August, core sales rose 0.2%, falling short of our expectations. Core sales were revised up for June and down for July.

These developments imply more second-quarter PCE and less growth of PCE and imports in the third quarter. In response, we raised our tracking estimate of second-quarter GDP growth and lowered our tracking forecast of third-quarter GDP growth.

We anticipate that PCE will rise at a 0.9% annual rate in the third quarter. Several other components of GDP are likely to post declines, including business and residential construction, government consumption and gross investment, and inventory investment. Weakness in those components will be offset by an increase in real net exports that we anticipate will add nearly 2 percentage points to GDP growth in the third quarter.

Inflation

Falling gasoline prices kept the lid on overall consumer price inflation in July and August.

Still, core inflation — which excludes some of the more volatile items within the Consumer Price Index, like gasoline — rebounded in August, boosted by large increases in rents and for health and automotive insurance. Rent inflation (owners' equivalent) on a 12-month basis rose to the highest in 36 years. That is a setback for policymakers at the Federal Reserve who are intent on lowering inflation.

Surveys point to some easing of consumers' inflation expectations in response to the drop in gasoline prices. The University of Michigan Consumer Sentiment Index rose 1.3 points to 59.5 in the preliminary September reading, up almost 10 points from the record low in June of 50.0.

Rate expectations

The Fed will keep both feet planted firmly on the brakes to lower inflation.

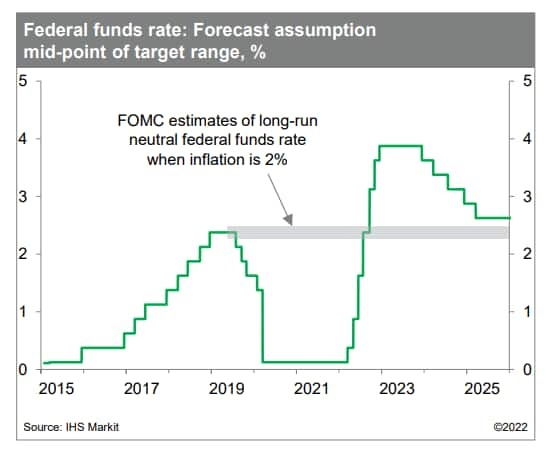

At this week's meeting, we expect the Federal Open Market Committee to raise the target for the federal funds rate by 75 basis points to a range of 3% to 3¼%, which would put the upper end of the target range on track to reach 4% later this year.

The balance of risks is tilted toward an even higher peak funds rate target unless inflation moderates substantially over the next several months. Trading in futures and overnight index swaps reflects investors' expectations that the federal funds rate could reach 4½% by next spring.

Fourth-quarter outlook

GDP growth is likely to improve modestly in coming quarters, even as tight financial conditions, the waning impacts of past fiscal stimulus, and a weak global backdrop restrain demand and limit real growth.

We expect GDP growth to inch up to 1.0% in the fourth quarter and to match that pace over the four quarters of next year. (On an annual-average basis, we expect GDP growth to fall from 1.7% this year to 0.9% in 2023.)

This week's US economic releases:

Housing starts: We estimate 1,474 thousand units. This would follow a cumulative decline over the prior three months of approximately 20%, leaving the pace of starts well below averages from earlier this year.

Existing home sales: We estimate 4,646 thousand units. This would continue a sharply weakening trend that began early this year and would leave the pace of sales at levels last seen in summer 2020. Prior to the COVID-19 recession, existing home sales had not been as low as 4,680 thousand in approximately 10 years.

Conference Board's Leading Economic Index: Prior to August, the index has declined for five consecutive months. Even a flat result for August would indicate risk for the economy over the next several months.

Posted 19 September 2022 by Akshat Goel, Senior Economist, US Macro and Consumer Economics, S&P Global Market Intelligence and

Ben Herzon, US Economist, Insights and Analysis, S&P Global Market Intelligence and

Ken Matheny, Executive Director, Research Advisory Specialty Solutions, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.