Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 2 May, 2023

By Sarah Cottle

Today is Tuesday, May 02, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we take a close look at the earnings forecasts for global utilities in the first quarter of 2023. Analysts expect few US multi-utilities to report year-over-year earnings growth as the sector grapples with the strongest headwinds in years, including warmer-than-normal first-quarter weather, higher interest expense and inflationary pressure. In Europe, utilities' earnings are expected to come in strong in the first quarter but stay below the 2022 records. Electricity and gas prices have declined as industrial shutdowns and a mild heating season lowered demand during the quarter, ultimately reducing power production in Europe's five largest markets — Germany, France, the UK, Italy and Spain, according to S&P Global Commodity Insights.

Dozens of S&P 500 companies will raise their regular dividend payments in the coming months, according to S&P Global Market Intelligence forecasts. Companies took advantage of near-zero interest rates during the COVID-19 pandemic to keep financing costs manageable, said Ryan Boyd, Market Intelligence head of business development for the Americas.

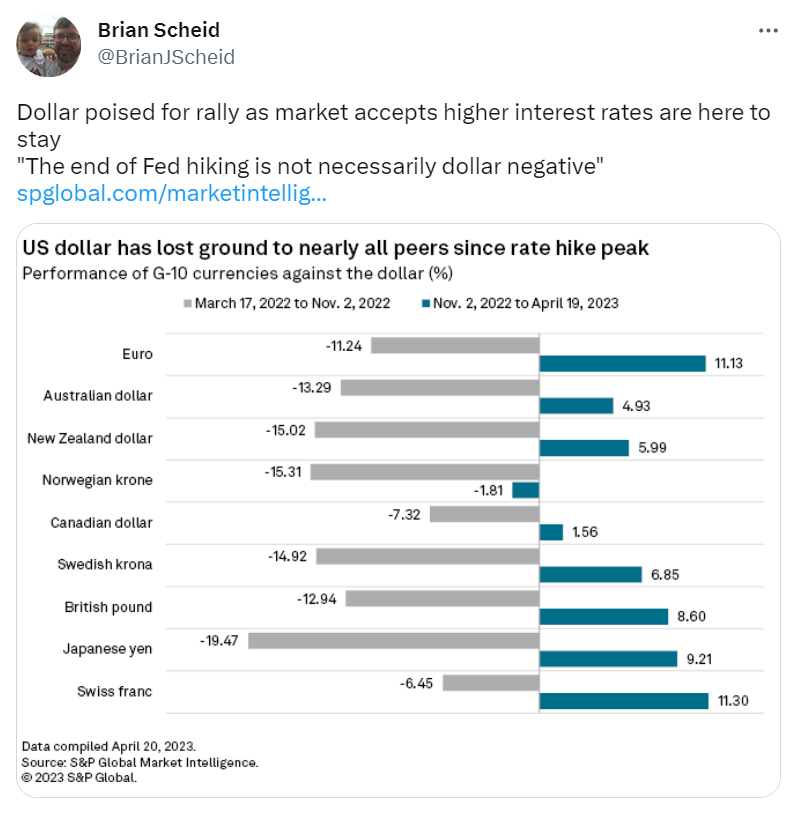

The US dollar is primed for new strength after largely falling over the past several months. As inflation remains well above the Federal Reserve's 2% target, the central bank is increasingly expected to keep rates high for much longer than previously anticipated, a shift that will likely boost the dollar in the coming weeks.

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter.

Don’t just make sustainability progress. Measure it.

Make decisions about tomorrow without losing sight of today’s opportunities. A clear understanding of credit and risk helps you see your workflow through a sustainability lens.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Waqas Azeem

Theme